In a recent development, Jones Trading has initiated coverage on Dyne Therapeutics (DYN, Financial) with a positive outlook. The coverage was led by analyst Catherine Novack, who announced a 'Buy' rating for the company. This marks a significant step for Dyne Therapeutics as it seeks to strengthen its position in the market.

The announcement includes a current price target of USD 30.00 for Dyne Therapeutics (DYN, Financial), indicating confidence in the company's potential to reach this valuation. The move by Jones Trading comes without any previous price target, providing a fresh perspective on the stock's future performance.

Dyne Therapeutics (DYN, Financial), known for its focus on muscle-related diseases, is anticipated to attract investor interest following this new coverage. The suggested price target and rating by a reputed analyst firm like Jones Trading could influence the stock's trajectory positively in the coming months.

As of June 26, 2025, the company's stock is listed on the NASDAQ, and the new coverage has contributed to stirring interest among market participants looking for opportunities in the biotech sector.

Wall Street Analysts Forecast

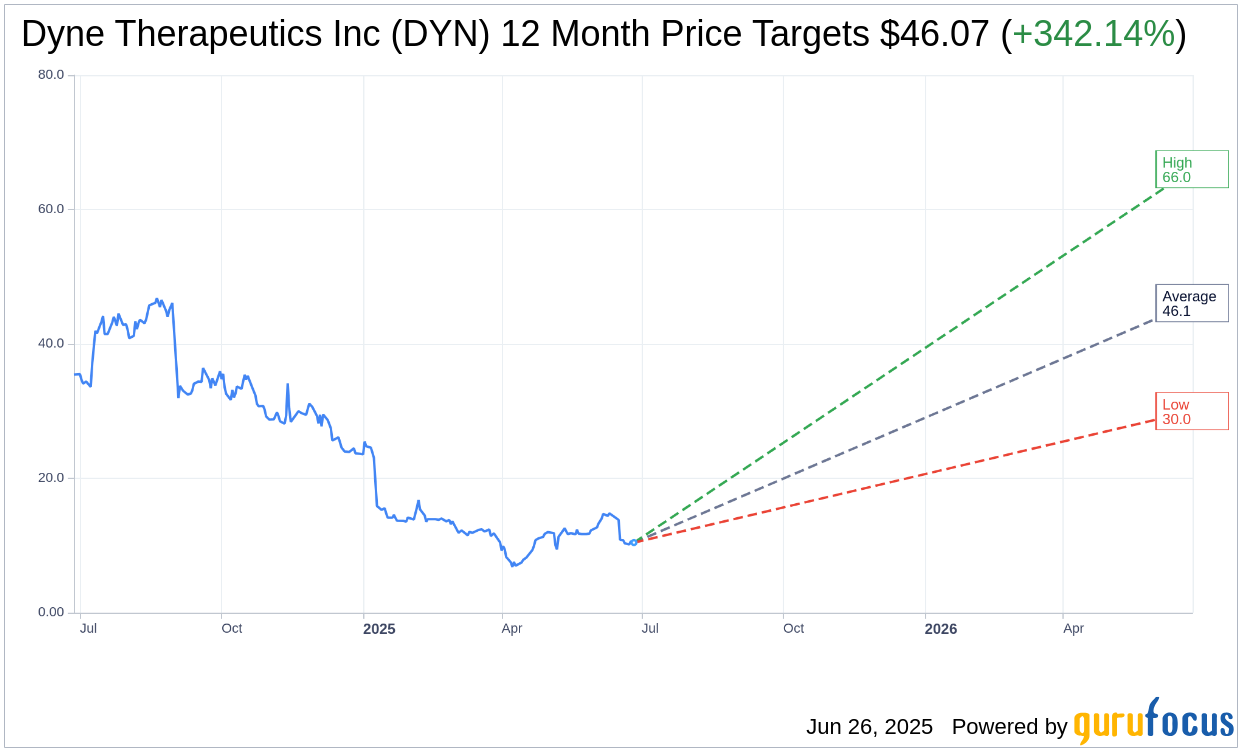

Based on the one-year price targets offered by 14 analysts, the average target price for Dyne Therapeutics Inc (DYN, Financial) is $46.07 with a high estimate of $66.00 and a low estimate of $30.00. The average target implies an upside of 342.14% from the current price of $10.42. More detailed estimate data can be found on the Dyne Therapeutics Inc (DYN) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Dyne Therapeutics Inc's (DYN, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.