Super Micro Computer (SMCI, Financial), a prominent player in the computing solutions industry, has recently been the subject of new analyst coverage. Keybanc, represented by analyst Brandon Nispel, has initiated coverage on SMCI with a "Sector Weight" rating. This newly assigned rating reflects the company's position within its sector, without a specific price target at this time.

The announcement, dated June 26, 2025, places SMCI under the scrutiny of Keybanc's analysis, though without any immediate projections for price movements in the USD currency. It emphasizes the importance of monitoring SMCI within the broader context of market sector performance.

Investors interested in Super Micro Computer (SMCI, Financial) should note that the company's recent analyst rating does not include any prior ratings for comparison nor does it provide a specific price target, suggesting a neutral stance on future stock price movement at this moment.

Wall Street Analysts Forecast

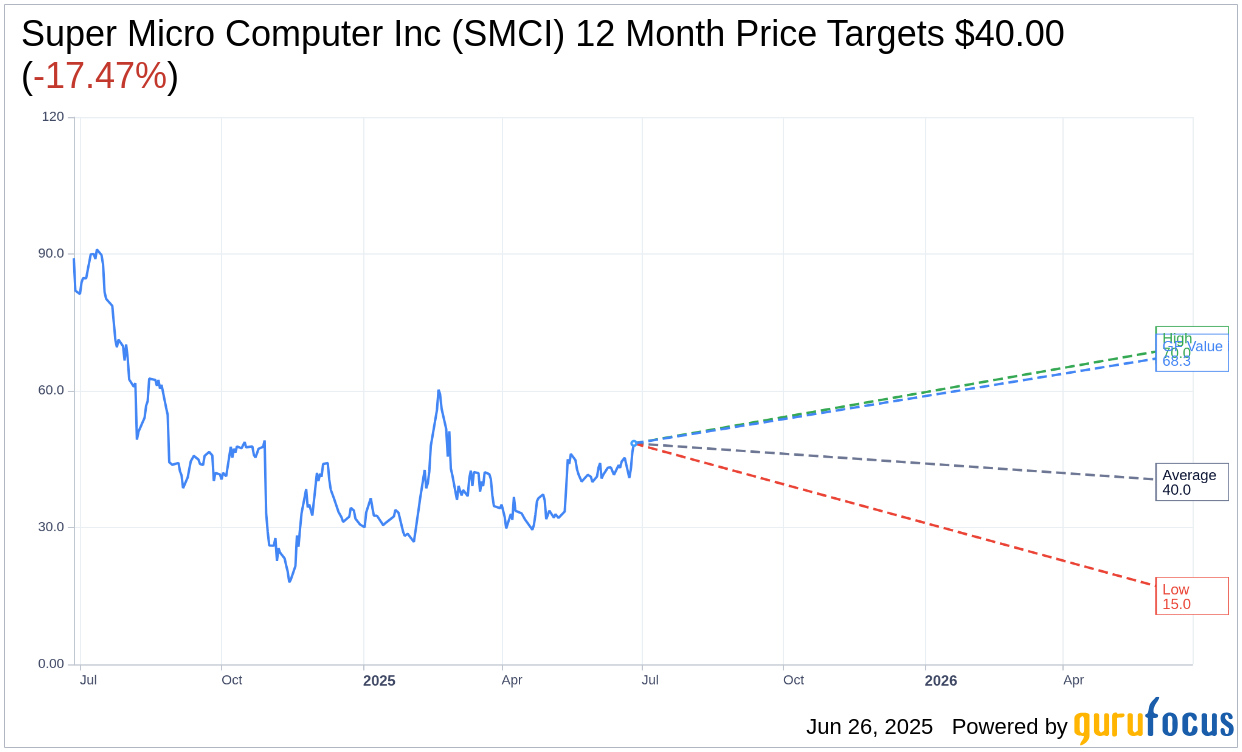

Based on the one-year price targets offered by 15 analysts, the average target price for Super Micro Computer Inc (SMCI, Financial) is $40.00 with a high estimate of $70.00 and a low estimate of $15.00. The average target implies an downside of 17.47% from the current price of $48.46. More detailed estimate data can be found on the Super Micro Computer Inc (SMCI) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Super Micro Computer Inc's (SMCI, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Super Micro Computer Inc (SMCI, Financial) in one year is $68.35, suggesting a upside of 41.04% from the current price of $48.46. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Super Micro Computer Inc (SMCI) Summary page.