- PayPal (PYPL, Financial) shares dropped 0.66% to $72.59 amid increased competition from Kraken's new payment app, Krak.

- Analysts provide an average stock price target for PayPal at $81.10, indicating potential growth of 11.33%.

- GuruFocus projects a GF Value of $88.63 for PayPal, suggesting a 21.67% upside from its current valuation.

Shares of PayPal (PYPL) saw a modest decline of 0.66%, settling at $72.59. This movement comes in the wake of Kraken unveiling its latest peer-to-peer payment application, Krak, marking a new entrant in the competitive payment space against PayPal's Venmo. Kraken looks to enhance transaction ease in both cryptocurrencies and fiat currencies, thereby pressing existing platforms to innovate.

Wall Street Analysts Forecast

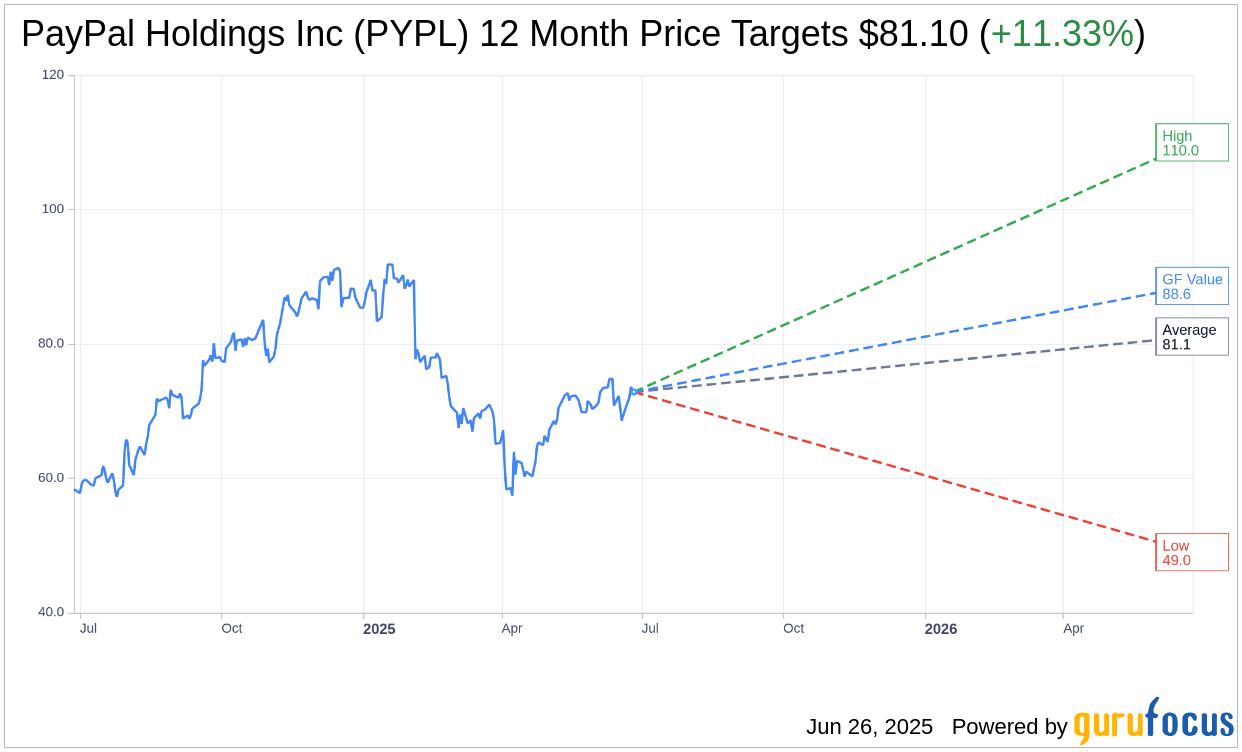

Insights from 37 analysts indicate that the average one-year price target for PayPal Holdings Inc (PYPL, Financial) stands at $81.10, with possible estimates spanning a high of $110.00 to a low of $49.00. The average target suggests an upside potential of 11.33% from the current price level of $72.85. Investors seeking more granular data can explore the detailed forecasts on the PayPal Holdings Inc (PYPL) Forecast page.

In terms of analyst consensus, 46 brokerage firms collectively rate PayPal Holdings Inc's (PYPL, Financial) with an average recommendation of 2.4. This "Outperform" status is on a scale where 1 represents a Strong Buy and 5 indicates a Sell.

According to GuruFocus estimates, the projected GF Value for PayPal Holdings Inc (PYPL, Financial) in a year is $88.63. This projection suggests a 21.67% upside from the current market price of $72.85. The GF Value reflects GuruFocus's fair value assessment of the stock based on historical trading multiples, prior business growth, and anticipated future performance. Additional insights and data can be accessed on the PayPal Holdings Inc (PYPL) Summary page.