Key Takeaways:

- Concentrix Corporation (CNXC, Financial) achieved a notable 1.5% revenue increase in Q2 2025, amounting to approximately $2.4 billion.

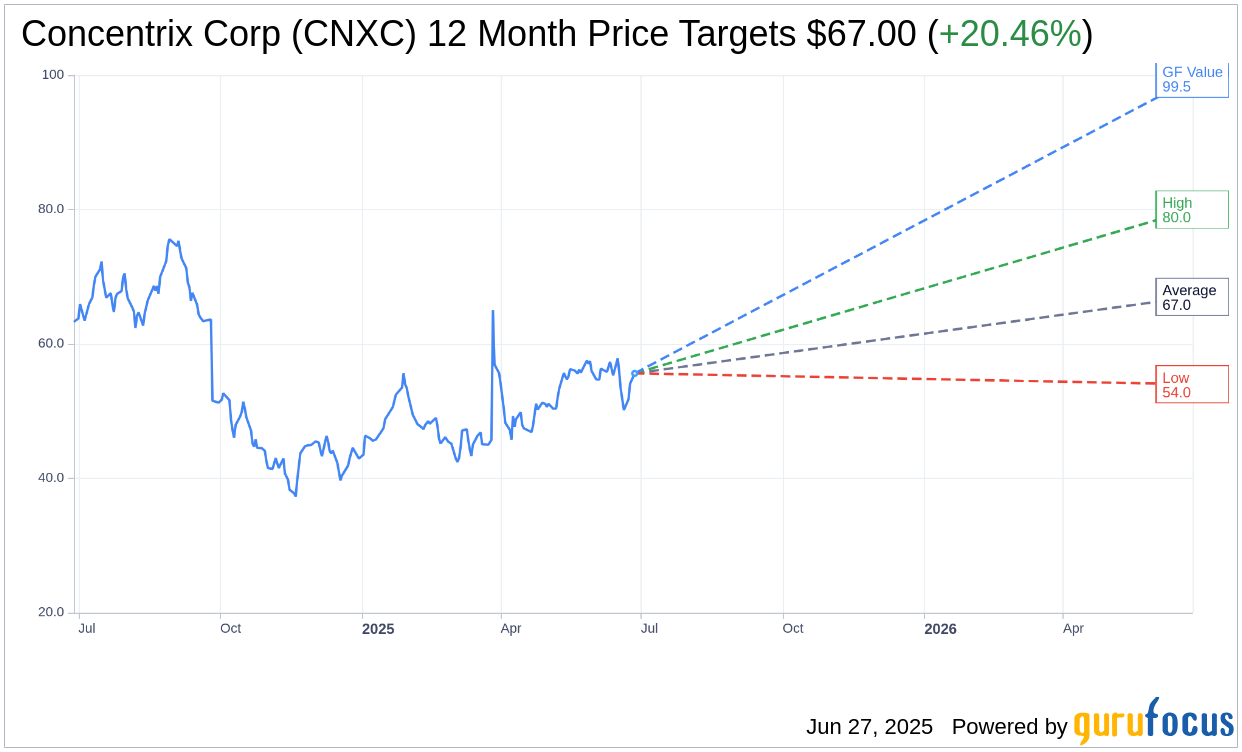

- Wall Street analysts predict a potential upside of over 21% for CNXC, with multiple recommendations to "Outperform."

- GuruFocus estimates suggest an impressive 80.41% upside potential based on the GF Value metric.

Concentrix Corporation's Q2 2025 Performance

Concentrix Corporation (CNXC) demonstrated robust financial performance in Q2 2025, exceeding revenue projections by reaching around $2.4 billion. This performance signifies a growth rate of 1.5% when compared to the same quarter last year. The company has shown remarkable progress in AI-driven customer solutions, particularly advancing in the retail and travel sectors. Notably, Concentrix reported an adjusted free cash flow of $200 million, underscoring its strong cash management capabilities.

Analyst Insights and Forecasts

Wall Street analysts offer valuable insights into Concentrix Corp's future prospects. Based on the analysis from 6 experts, the average one-year target price for Concentrix stands at $67.00, with a high estimate reaching $80.00 and a low estimate at $54.00. This indicates a potential upside of 21.53% from the current market price of $55.13. For more comprehensive forecast data, visit the Concentrix Corp (CNXC, Financial) Forecast page.

Brokerage Recommendations

The consensus among 6 brokerage firms places Concentrix Corp (CNXC, Financial) at an average recommendation of 2.0, categorizing it as "Outperform." This rating, which falls on a scale from 1 (Strong Buy) to 5 (Sell), reflects investor confidence in the stock's potential to exceed market expectations.

GuruFocus GF Value Analysis

According to GuruFocus estimates, Concentrix Corp's (CNXC, Financial) GF Value stands at $99.46 for the next year. This suggests an impressive upside potential of 80.41% from the current price of $55.13. The GF Value is derived from historical trading multiples, business growth, and projected future performance, offering investors a comprehensive view of the stock's fair market value. Detailed analysis and metrics can be accessed on the Concentrix Corp (CNXC) Summary page.