Raymond James has begun coverage on Republic Bancorp (RBCAA, Financial), giving it a Market Perform rating but refraining from setting a price target. Republic Bancorp, based in Louisville, Kentucky, has carved a niche as a business-oriented community bank, catering to both corporate and retail clients. The firm anticipates gradual growth for RBCAA in the upcoming years, though it notes potential short-term challenges. These include lower revenue from the bank's Tax Refund Solutions segment and slight pressure on its net interest margin. Consequently, Raymond James perceives the current risk and reward dynamics for RBCAA as evenly balanced.

Wall Street Analysts Forecast

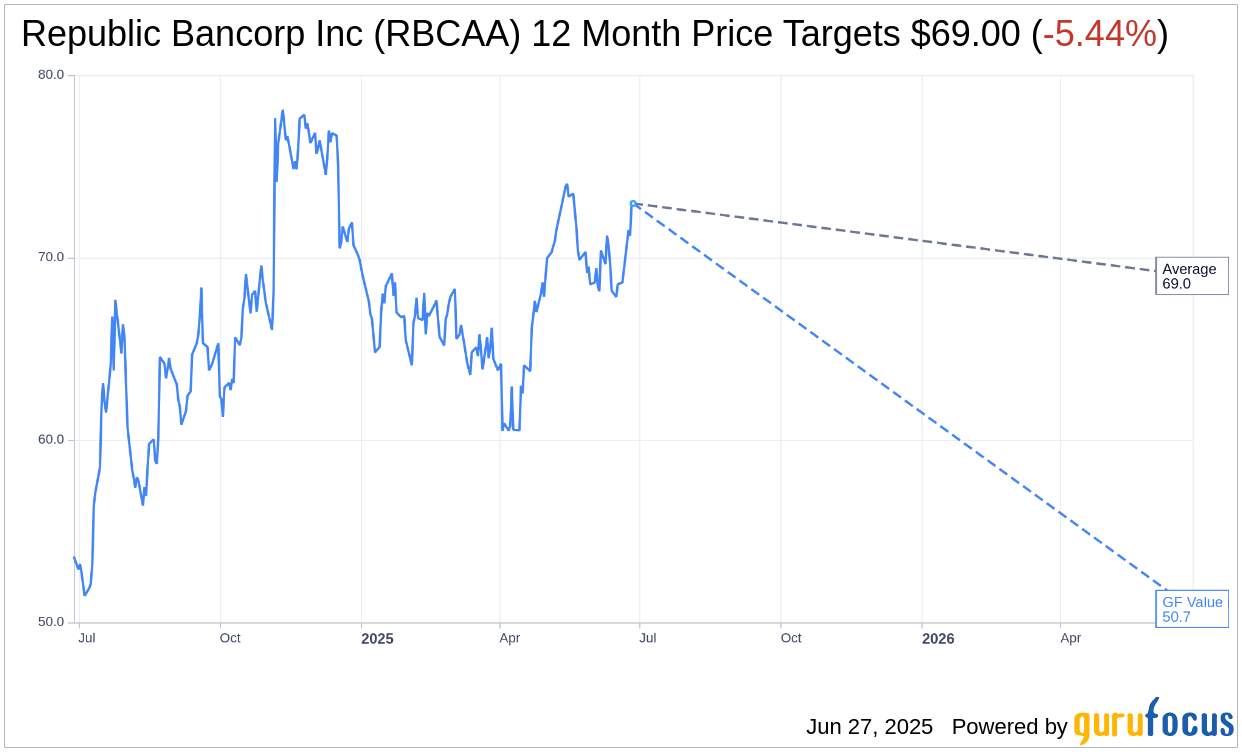

Based on the one-year price targets offered by 1 analysts, the average target price for Republic Bancorp Inc (RBCAA, Financial) is $69.00 with a high estimate of $69.00 and a low estimate of $69.00. The average target implies an downside of 5.44% from the current price of $72.97. More detailed estimate data can be found on the Republic Bancorp Inc (RBCAA) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Republic Bancorp Inc's (RBCAA, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Republic Bancorp Inc (RBCAA, Financial) in one year is $50.74, suggesting a downside of 30.46% from the current price of $72.97. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Republic Bancorp Inc (RBCAA) Summary page.