- Recent shifts in China's rare earth export policy impact MP Materials shares.

- Analyst projections suggest a potential decline despite "Outperform" recommendations.

- GuruFocus estimates a notable downside based on historical trading patterns.

Shares of MP Materials (MP) experienced a significant drop of 7.3% following China's approval of certain rare earth export applications to the United States. This strategic move aims to alleviate trade tensions, impacting the stock price that had previously risen due to export concerns.

Analyst Price Targets and Forecasts

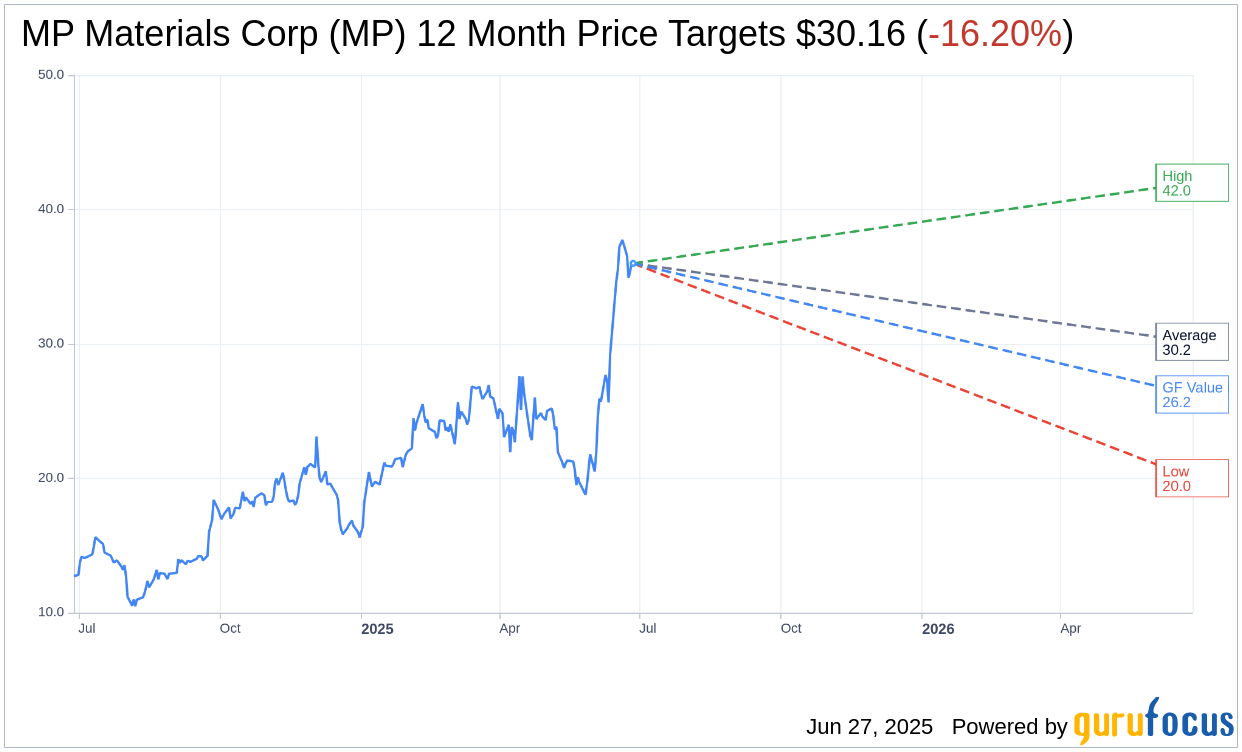

According to data gathered from 10 analysts, the average one-year price target for MP Materials Corp (MP) stands at $30.16. The targets range from a high of $42.00 to a low of $20.00. This average estimate suggests a potential downside of 8.66% from the current trading price of $33.02. For further detailed estimates, please visit the MP Materials Corp (MP, Financial) Forecast page.

Brokerage and GuruFocus Ratings

The consensus recommendation from 12 brokerage firms rates MP Materials Corp (MP) at an average of 1.8. This rating reflects an "Outperform" status, with the scale ranging from 1 (Strong Buy) to 5 (Sell).

Furthermore, the GF Value estimates provided by GuruFocus project a value of $26.24 for MP Materials Corp (MP) in one year. This projection indicates a downside of 20.53% from the current price of $33.02. The GF Value is derived from historical trading multiples, past business growth, and future performance estimates. For additional data, visit the MP Materials Corp (MP, Financial) Summary page.