Highlights:

- TransDigm Group (TDG, Financial) acquires Simmonds Precision Products for $765 million, enhancing its aerospace and defense portfolio.

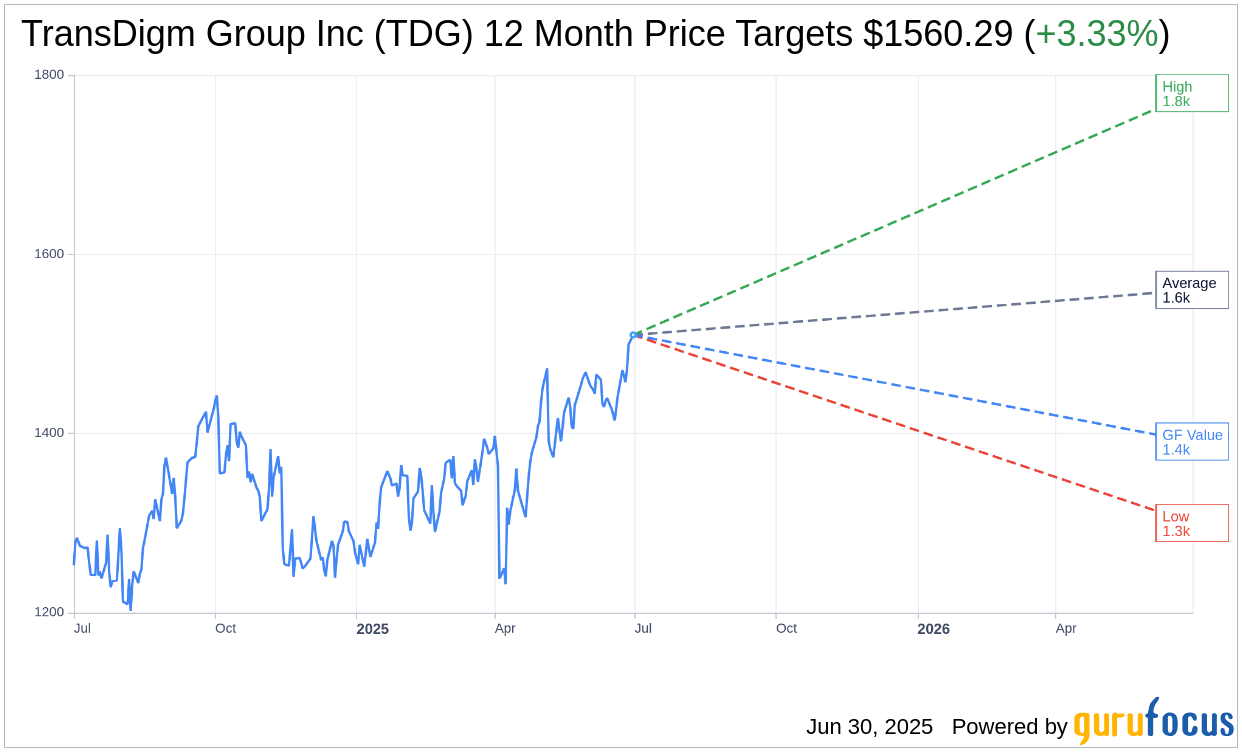

- Analysts forecast a modest upside of 3.25% for TDG's stock within a year, with an average price target of $1,560.29.

- Current GF Value estimation suggests a potential downside of 7.95% from the present stock price.

TransDigm Group's Strategic Acquisition

TransDigm Group (NYSE: TDG), a leader in the aerospace and defense sector, has strategically acquired Simmonds Precision Products from RTX Corp. The transaction, valued at approximately $765 million, aligns perfectly with TransDigm's growth strategy. This acquisition is poised to enhance the company's proprietary aerospace and defense solutions, with Simmonds expected to contribute $350 million in revenue by 2025. The deal also includes significant tax advantages, further bolstering its financial performance.

Wall Street Analysts' Insights

Wall Street analysts have provided a range of price targets for TransDigm Group Inc (TDG, Financial), indicating a positive outlook. The average target stands at $1,560.29, with projections ranging from a high of $1,780.00 to a low of $1,300.00. This average target suggests a potential upside of 3.25% from the current stock price of $1,511.20. For detailed estimate data, visit the TransDigm Group Inc (TDG) Forecast page.

The consensus recommendation from 22 brokerage firms rates TransDigm Group Inc (TDG, Financial) as an "Outperform" with an average score of 1.9 on a scale where 1 signifies Strong Buy and 5 indicates Sell. This suggests strong confidence in the company's future performance.

Evaluating the GF Value of TDG

According to GuruFocus estimates, the one-year projected GF Value for TransDigm Group Inc (TDG, Financial) is $1,391.04. This suggests a downside potential of 7.95% from the current price of $1,511.20. The GF Value represents GuruFocus' estimation of the stock's fair trading value, calculated based on historical trading multiples, past growth, and future business performance projections. For more in-depth data, refer to the TransDigm Group Inc (TDG) Summary page.