Key Highlights:

- Meta (META, Financial) advances AI with a new superintelligence division.

- Wall Street analysts set a mixed outlook with a potential downside.

- GuruFocus projects a significant decline in the stock's fair value.

Meta Platforms Inc. (META) has embarked on an ambitious journey to enhance its artificial intelligence capabilities. Under the leadership of Alexandr Wang, Meta has launched a superintelligence division, marking a significant leap in the company's technological evolution. Committing $14.3 billion toward securing a substantial stake in this initiative, Meta aims to bolster its AI prowess significantly.

In addition to this investment, Meta plans to raise $29 billion, of which $26 billion will be in the form of debt, to further fuel this strategic venture. The market responded favorably, pushing the stock to a high of $747.90.

Wall Street Analysts Forecast

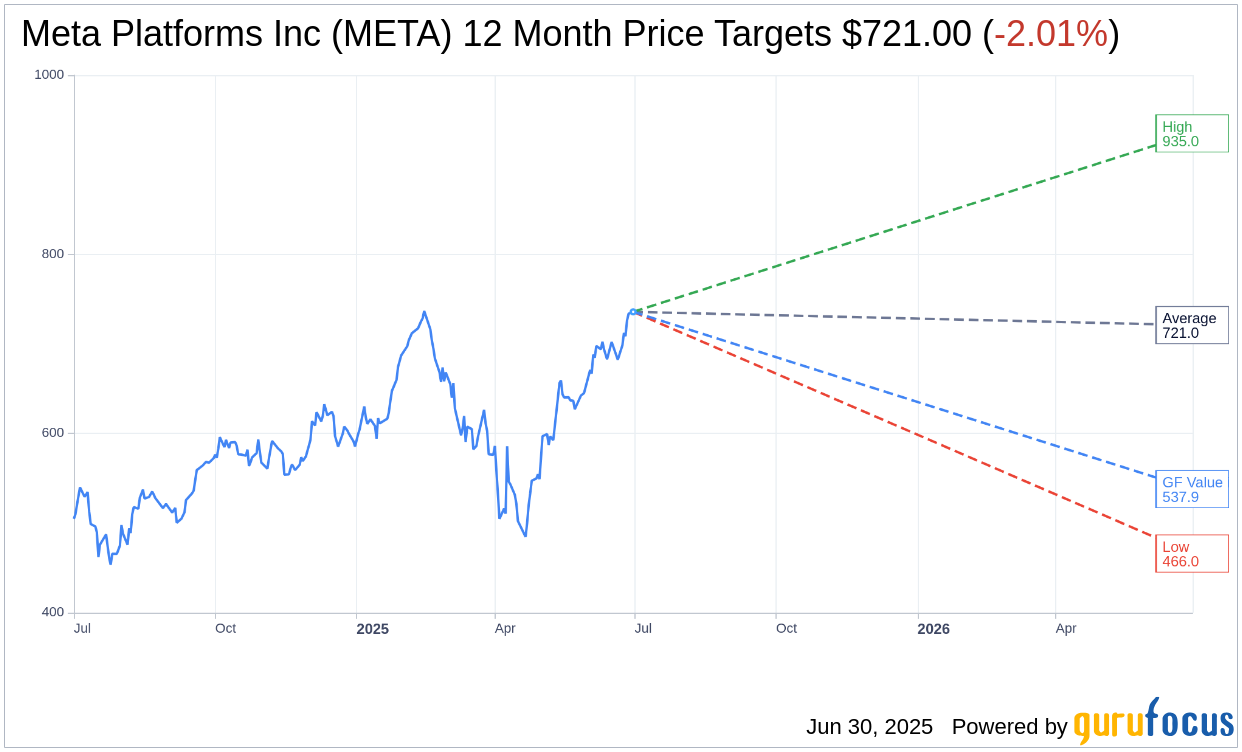

Wall Street analysts have provided a comprehensive outlook for Meta Platforms Inc., with predictions from 61 financial experts. The average one-year price target stands at $721.00, with expectations ranging from a high of $935.00 to a low of $466.00. This suggests a potential downside of 2.01% from the current trading price of $735.79. For a deeper dive into these projections, visit the Meta Platforms Inc (META, Financial) Forecast page.

The consensus among 71 brokerage firms gives Meta an average recommendation of 1.8 on the brokerage rating scale, indicating an "Outperform" status. This scale ranges from 1 (Strong Buy) to 5 (Sell), placing Meta in a strong competitive position.

GuruFocus GF Value Estimate

According to GuruFocus estimates, the one-year GF Value for Meta Platforms Inc. is $537.92, predicting a potential downside of 26.89% from the current price of $735.79. The GF Value represents GuruFocus' assessment of a stock's fair trading value, derived from historical trading multiples and projections of future business performance. For more comprehensive details, explore the Meta Platforms Inc (META, Financial) Summary page.