Key Highlights:

- Hewlett Packard Enterprise (HPE, Financial) successfully acquires Juniper Networks for $14 billion.

- The acquisition supports HPE's growth in hybrid cloud and AI sectors.

- Analysts forecast potential for modest price movement with a consensus "Outperform" recommendation.

Hewlett Packard Enterprise (NYSE: HPE) has taken a significant step in strengthening its market position by completing a $14 billion acquisition of Juniper Networks. This strategic move, approved by Juniper shareholders in April 2024, is set to enhance HPE's capabilities in the burgeoning hybrid cloud and AI sectors. Consequently, Juniper Networks shares are no longer listed on the exchange.

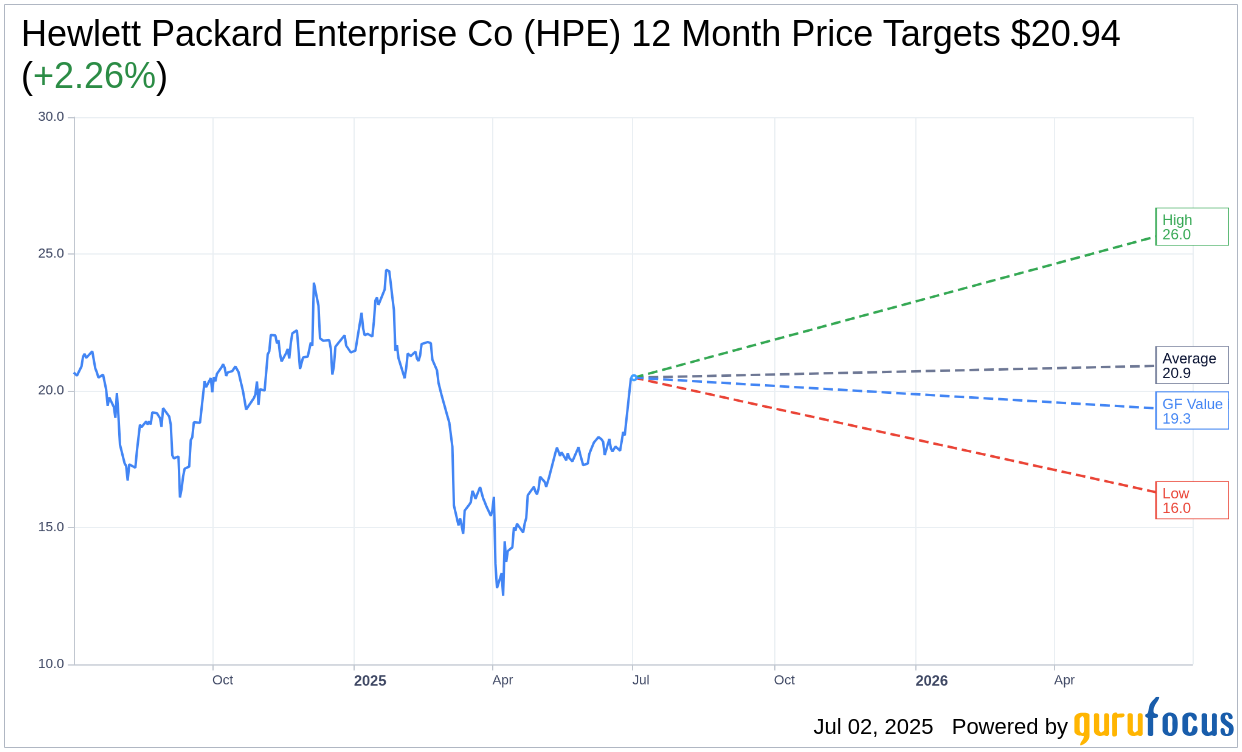

Wall Street Analysts' Price Predictions

Wall Street analysts have shared their one-year price targets for Hewlett Packard Enterprise Co (HPE, Financial), with 14 experts weighing in. The average target price is currently set at $20.94, with projections ranging from a high of $26.00 to a low of $16.00. This average target indicates a potential upside of 2.26% from the current trading price of $20.48. For further details on these estimates, visit the Hewlett Packard Enterprise Co (HPE) Forecast page.

Brokerage Recommendation and Analysis

The collective insight from 16 brokerage firms presents Hewlett Packard Enterprise Co (HPE, Financial) with an average recommendation of 2.2, translating to an "Outperform" status. On the recommendation scale, 1 stands for Strong Buy, while 5 indicates Sell, positioning HPE favorably among investors.

GF Value Assessment

According to GuruFocus, the estimated GF Value for HPE in one year is projected at $19.28, suggesting a possible downside of 5.86% from its current price of $20.48. GF Value reflects GuruFocus' calculated fair stock value, derived from historical trading multiples, past growth trajectories, and anticipated future performance. Investors seeking more comprehensive insights can explore the Hewlett Packard Enterprise Co (HPE, Financial) Summary page.