Key Takeaways:

- Esperion delays Nexletol's generic competition until 2040 through settlement with Accord Healthcare.

- Analysts maintain a diverse view on Esperion's stock potential, with a wide range of price targets.

- Current investor sentiment trends towards "Outperform," with a significant potential upside projected.

Esperion Therapeutics (ESPR, Financial) has strategically maneuvered to delay the U.S. launch of a generic version of its cholesterol medication, Nexletol, until 2040 by reaching a settlement with Accord Healthcare. This settlement comes as part of Esperion's broader effort to preserve Nexletol's market exclusivity amidst ongoing patent disputes with various competitors.

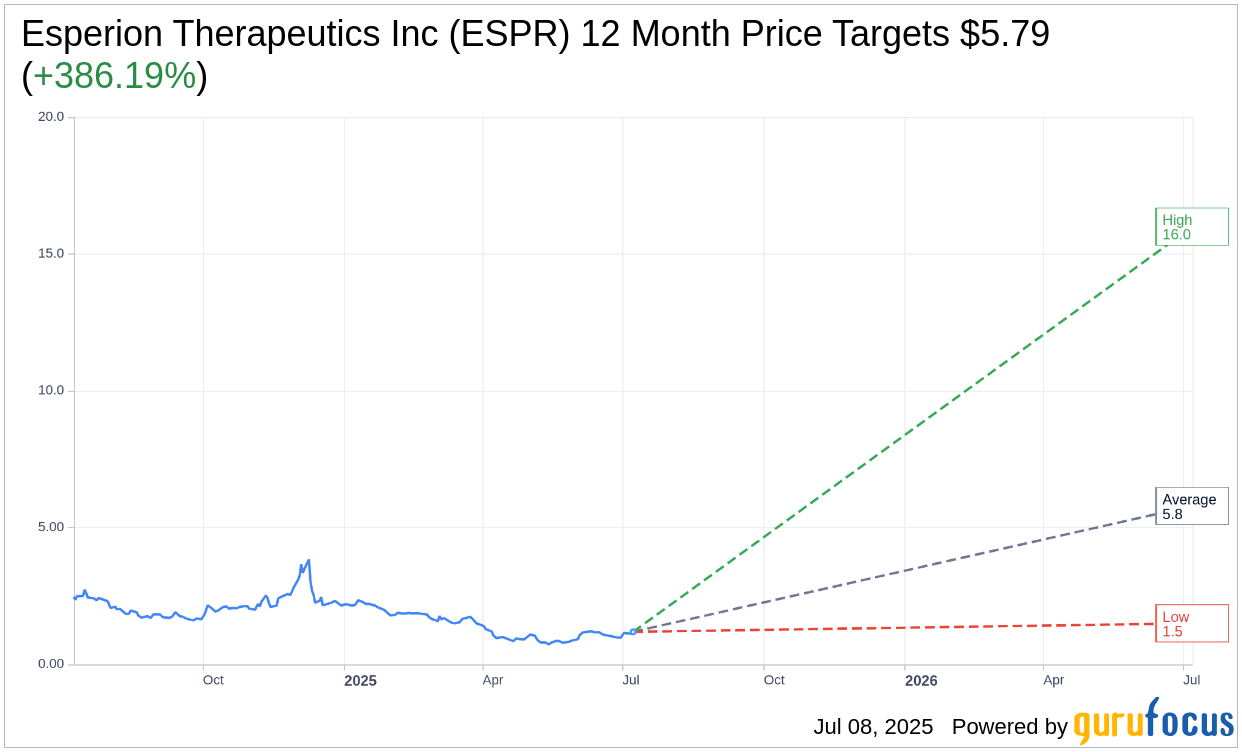

Wall Street Analysts Forecast

Investors eyeing Esperion Therapeutics Inc (ESPR, Financial) should note the diverse projections from seven analysts, who have set a one-year average target price of $5.79. This forecast includes a high of $16.00 and a low of $1.50, suggesting an impressive upside potential of 386.19% compared to the current stock price of $1.19. For further details on these projections, visit the Esperion Therapeutics Inc (ESPR) Forecast page.

The consensus recommendation from eight brokerage firms positions Esperion Therapeutics Inc (ESPR, Financial) at an average recommendation of 2.4, indicative of an "Outperform" status on a rating scale from 1 to 5, where 1 signifies a Strong Buy and 5 denotes Sell.

According to GuruFocus estimates, the GF Value of Esperion Therapeutics Inc (ESPR, Financial) in one year is pegged at $2.44, which implies a potential upside of 105.04% from its current price of $1.19. The GF Value is an insightful measure, as it reflects the fair trading value of the stock based on historical trading multiples, business growth trajectories, and future performance estimates. For more comprehensive data, explore the Esperion Therapeutics Inc (ESPR) Summary page.