In a recent development, Keybanc analyst John Vinh has updated his outlook on NXP Semiconductors (NXPI, Financial), maintaining the stock’s "Overweight" rating while raising the price target from $240.00 to $275.00. This indicates a notable 14.58% increase in the price target.

According to the latest report, Vinh's decision to maintain the "Overweight" rating on NXPI reflects continued confidence in the company's growth prospects and market position. The increase in the price target underscores expectations of robust performance from NXP Semiconductors in the coming periods.

The new price target and maintained rating suggest sustained positive sentiment around the financial and operational performance of NXPI. Investors and stakeholders are likely to find this development encouraging as it aligns with broader market optimism about semiconductor industry potential.

Wall Street Analysts Forecast

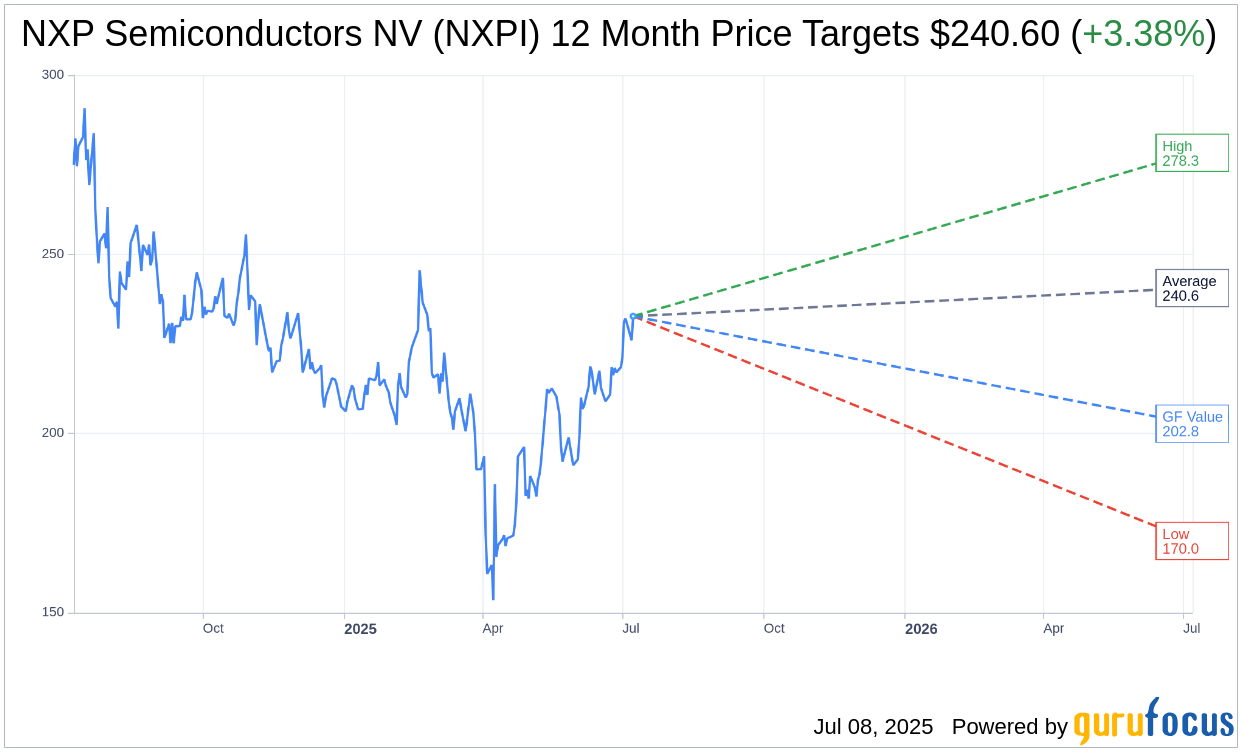

Based on the one-year price targets offered by 27 analysts, the average target price for NXP Semiconductors NV (NXPI, Financial) is $240.60 with a high estimate of $278.34 and a low estimate of $170.00. The average target implies an upside of 3.38% from the current price of $232.73. More detailed estimate data can be found on the NXP Semiconductors NV (NXPI) Forecast page.

Based on the consensus recommendation from 31 brokerage firms, NXP Semiconductors NV's (NXPI, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for NXP Semiconductors NV (NXPI, Financial) in one year is $202.76, suggesting a downside of 12.88% from the current price of $232.725. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the NXP Semiconductors NV (NXPI) Summary page.