Bitdeer Technologies Group (BTDR, Financial) has shared its unaudited updates for mining and operations in June. The company saw a 4% rise in self-mined Bitcoin (BTC) compared to May, totaling 203 Bitcoins. This increase was driven by a higher average self-mining hashrate, thanks to the activation of SEALMINERs.

Regarding their mining rig manufacturing and research and development, the SEALMINER A1 has been powered up with a capacity of 3.9 EH/s. Meanwhile, SEALMINER A2 has produced a total of 14.9 EH/s in mining equipment, with an additional 1.1 EH/s nearing completion by the end of June. The SEALMINER A3 is approaching the final stages before commencing mass production, while the SEALMINER A4 aims to reach a chip efficiency of about 5 J/TH.

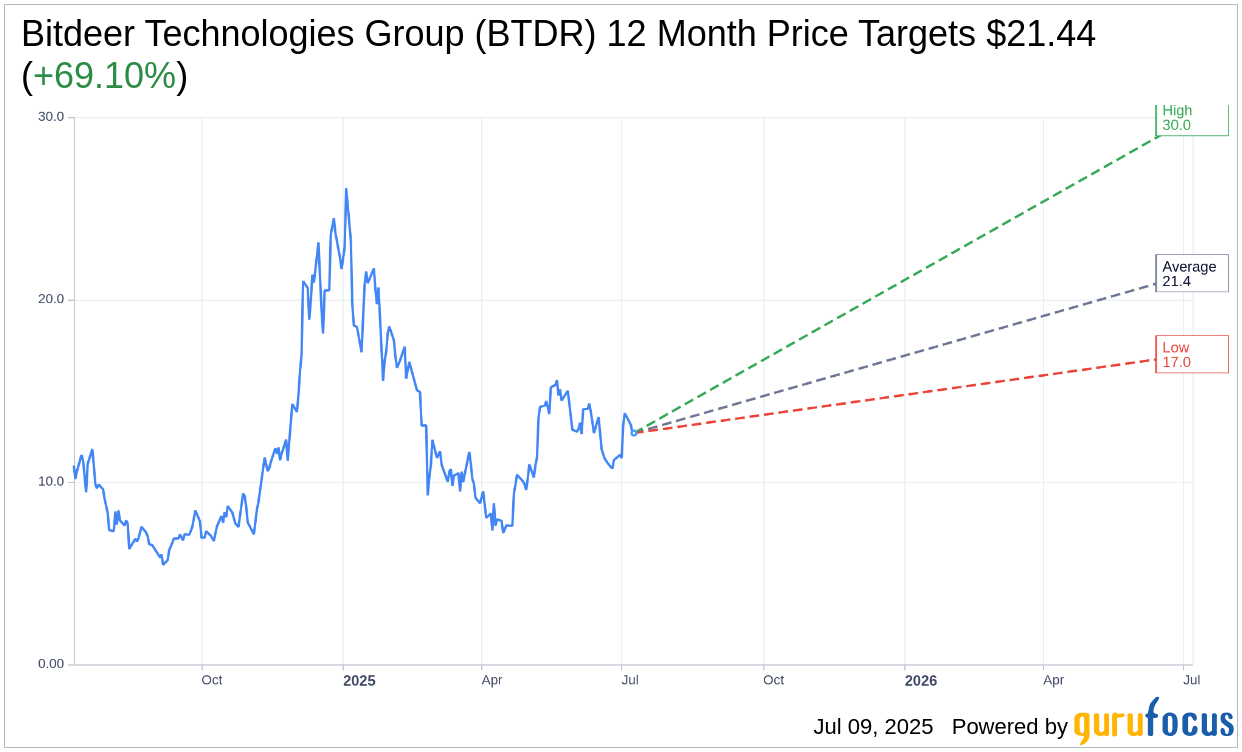

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Bitdeer Technologies Group (BTDR, Financial) is $21.44 with a high estimate of $30.00 and a low estimate of $17.00. The average target implies an upside of 69.10% from the current price of $12.68. More detailed estimate data can be found on the Bitdeer Technologies Group (BTDR) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Bitdeer Technologies Group's (BTDR, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

BTDR Key Business Developments

Release Date: May 15, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Bitdeer Technologies Group (BTDR, Financial) has increased its self-mining hash rate to 11.5 exahash per second, with plans to reach 40 exahash per second by October 2025.

- The company is expanding its global power capacity, with nearly 500 megawatts of new self-mining power capacity expected by mid-year, increasing total capacity to nearly 1.6 gigawatts.

- Bitdeer Technologies Group (BTDR) is focusing on geographic diversification, with significant power capacity in Norway and Bhutan.

- The company is developing its own AI technology, which is expected to provide long-term advantages and cost efficiencies.

- Bitdeer Technologies Group (BTDR) has entered into a loan agreement with Matrix Finance and Technology Holding Company for a financing facility of up to $200 million, supporting its expansion plans.

Negative Points

- Bitdeer Technologies Group (BTDR) reported a negative gross profit of $3.2 million and an adjusted EBITDA of negative $56.1 million for Q1 2025.

- The company's revenue decreased to $70.1 million from $119.5 million, impacted by the April 2024 halving event and increased global network hash rates.

- Cloud hash rate revenue significantly declined due to the expiration of long-term contracts and reallocation to self-mining operations.

- Higher R&D costs related to the development of new mining technology have impacted financial performance.

- Electricity costs were higher in Q1, partly due to extreme weather conditions and procurement challenges in Bhutan.