Summary:

- Bitdeer Technologies reports increased bitcoin output, signaling robust growth in self-mining operations.

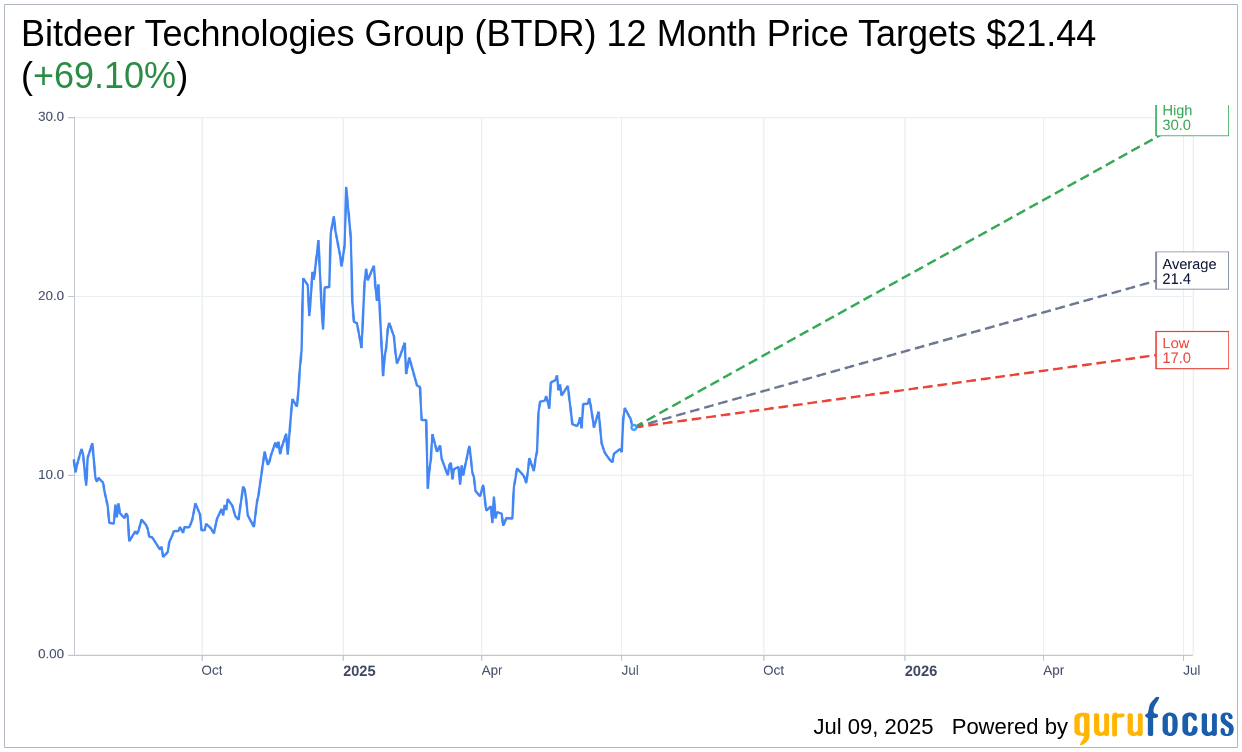

- Analysts predict a significant upside for Bitdeer Technologies with an average price target of $21.44.

- The stock is rated as "Outperform" by multiple brokerage firms, highlighting positive market sentiment.

Bitdeer Technologies (BTDR, Financial) continues to show promising growth in its cryptocurrency mining operations. The company reported a notable increase in its self-mined bitcoin output, reaching 203 units in June, up from 196 in May. This increase is a testament to Bitdeer's strategic expansion and efficient operations. Furthermore, the company's managed hash rate has escalated to 30.6 EH/s, with a significant portion, 16.5 EH/s, dedicated to self-mining operations. By the end of June, Bitdeer held an impressive 1,502 bitcoins, reinforcing its position in the digital currency sector.

Wall Street Analysts Forecast

Market analysts offer an optimistic outlook for Bitdeer Technologies Group (BTDR, Financial), with 12 analysts providing a one-year average price target of $21.44. This projection suggests a potential upside of 69.10% from the current stock price of $12.68. The high estimate reaches $30.00, while the low estimate stands at $17.00. Investors seeking more detailed forecast data can visit the Bitdeer Technologies Group (BTDR) Forecast page.

The consensus from 12 brokerage firms further underscores the stock's potential, rendering an average brokerage recommendation of 1.9, indicative of "Outperform" status. This rating falls on a scale where 1 means Strong Buy and 5 signifies Sell, showcasing a strong market confidence in Bitdeer Technologies' future performance.