Key Takeaways:

- Jefferies initiates coverage on Philip Morris International with a Buy rating, highlighting its success in Heated Tobacco and Oral Nicotine Pouches.

- Analysts anticipate robust EBIT growth, viewing the stock as undervalued compared to industry peers.

- Current Wall Street estimates suggest a moderate upside potential for PM shares.

Jefferies' Bullish Stance on Philip Morris International

Jefferies has initiated coverage on Philip Morris International (NYSE: PM) with a Buy rating, spotlighting its dominant position in the Heated Tobacco and Oral Nicotine Pouch markets. These segments are expected to fuel sustainable EBIT growth, offering a compelling investment case for those seeking value beyond traditional food and household products sectors. The assessment underscores a potentially lucrative entry point for investors.

Wall Street Analysts' Forecast

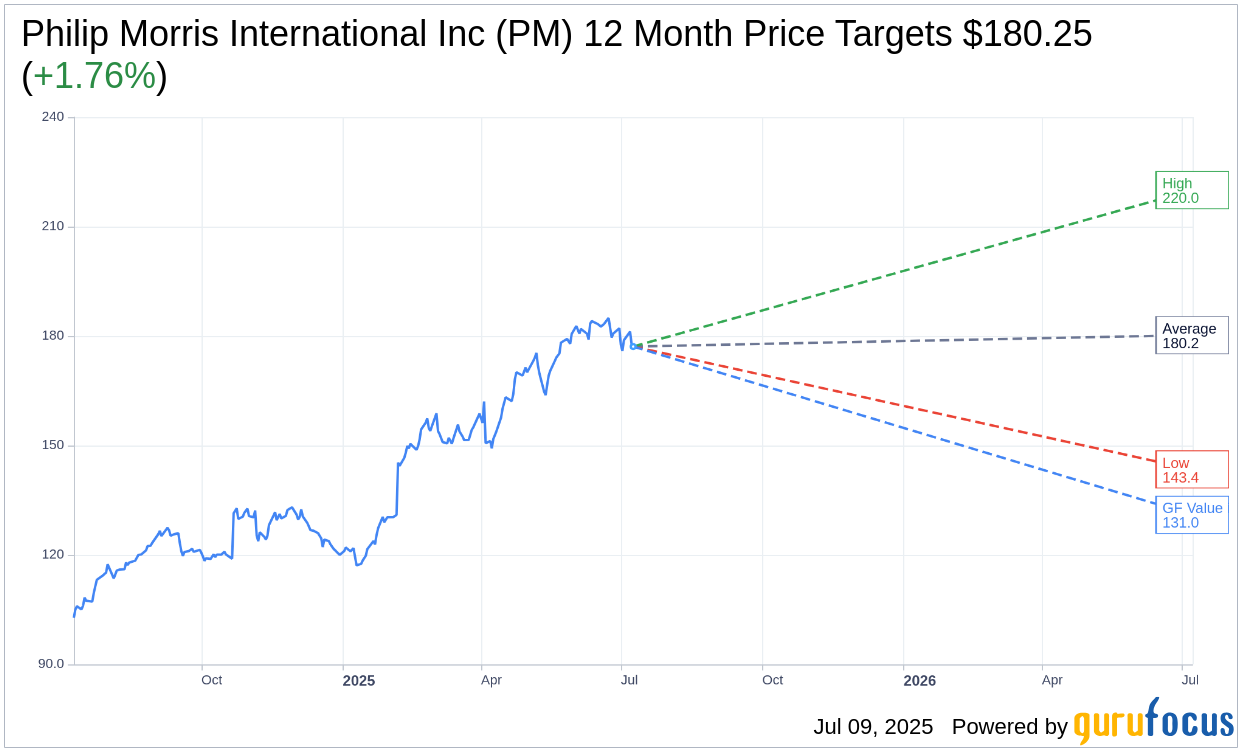

According to forecasts from 14 analysts, the one-year average target price for Philip Morris International Inc (PM, Financial) is $180.25. The projections range from a high of $220.00 to a low of $143.45, implying a modest upside of 1.76% from the current stock price of $177.13. For more detailed estimations, visit the Philip Morris International Inc (PM) Forecast page.

Moreover, the consensus rating from 17 brokerage firms positions Philip Morris at an average recommendation of 2.1, signifying an "Outperform" rating. This scale ranks from 1 (Strong Buy) to 5 (Sell), providing a positive outlook on the company's market performance.

Evaluating GF Value and Investment Implications

Based on GuruFocus estimates, the GF Value for Philip Morris International Inc (PM, Financial) over the next year is projected at $130.99. This suggests a potential downside of 26.05% from the current price of $177.13. The GF Value represents GuruFocus' assessment of what the fair trading price for the stock should be, calculated using historical trading multiples, business growth, and future business performance projections. For in-depth data, explore the Philip Morris International Inc (PM) Summary page.

In summary, while Jefferies and other analysts perceive strong growth potential in Philip Morris International's innovative product lines, the GuruFocus value metrics present a more cautious view. Investors should weigh these conflicting assessments carefully to make informed decisions.