The recent announcement of Chadwick Westlake's departure from OpenText (OTEX, Financial) raised eyebrows, especially as he leaves to assume the CEO position at EQB. While unexpected, this move aligns with Westlake's previous role as CFO at EQB, prior to his tenure at OpenText. Jefferies analyst Samad Samana does not interpret this development negatively, attributing the change to EQB's unforeseen leadership transition.

Despite this, Jefferies anticipates a short-term cloud over OpenText shares due to the absence of a new CFO. Nonetheless, the firm maintains a positive outlook with a Buy rating and a target price of $33 for OpenText shares.

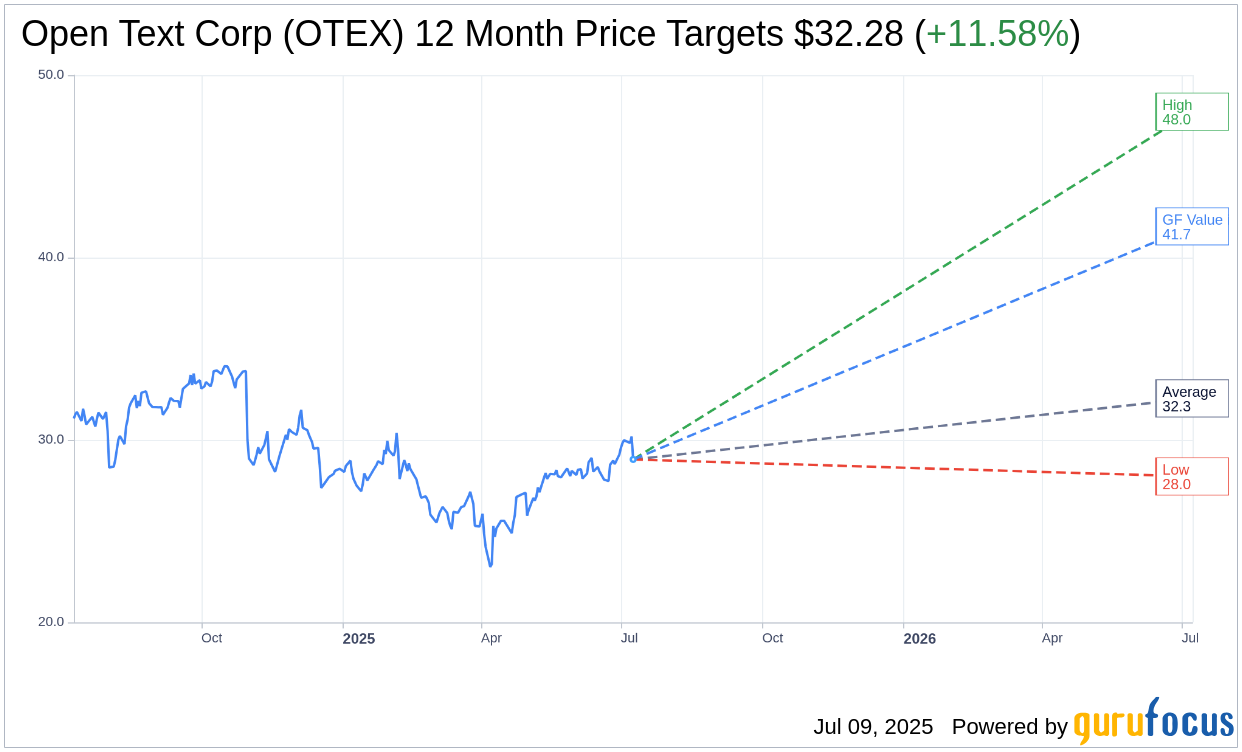

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Open Text Corp (OTEX, Financial) is $32.28 with a high estimate of $48.00 and a low estimate of $28.00. The average target implies an upside of 11.54% from the current price of $28.94. More detailed estimate data can be found on the Open Text Corp (OTEX) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Open Text Corp's (OTEX, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Open Text Corp (OTEX, Financial) in one year is $41.71, suggesting a upside of 44.13% from the current price of $28.94. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Open Text Corp (OTEX) Summary page.

OTEX Key Business Developments

Release Date: May 01, 2025

- Total Revenue: $1.27 billion, down 2.9% year over year, down 1% excluding IP rights and DXC.

- Cloud Revenue: $463 million, up nearly 2% year over year, marking 17 consecutive quarters of organic growth.

- Adjusted EBITDA Margin: 31.5%, ahead of target range.

- Adjusted EPS: $0.82, up year over year excluding AMC divestiture.

- Free Cash Flow: $374 million, up 7% year over year, with a 30% free cash flow margin.

- Cloud Net Renewal Rate: Increased 100 basis points sequentially to 96%.

- Enterprise Bookings: $151 million, down 8.4% year over year.

- Non-GAAP Cloud Margin: Increased approximately 300 basis points to 62.7% year over year.

- Customer Support Revenue: $567 million, slightly below expectations.

- Cash Position: Ended at nearly $1.23 billion.

- Share Repurchase: 4.4 million shares repurchased for $115 million, total outstanding shares at approximately $260 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Open Text Corp (OTEX, Financial) reported strong operational performance with an adjusted EBITDA margin of 31.5%, exceeding their target range.

- The company achieved record free cash flow of $374 million, marking a 7% increase year over year.

- Open Text Corp (OTEX) is leading with an AI-first strategy, integrating AI into their operations and product offerings, which is expected to drive future growth.

- The company has a robust capital allocation strategy, focusing on reinvestment in business, dividends, and share repurchases.

- Open Text Corp (OTEX) has a strong customer base with notable wins in Q3, including contracts with ABN AMRO, Japan Tobacco, and the US Air Force.

Negative Points

- Open Text Corp (OTEX) experienced a revenue shortfall, ending up 50 basis points below their target range due to demand disruptions caused by tariffs.

- The company reported an 8% decline in new cloud bookings, attributed to macroeconomic disruptions.

- There was a 6.4% organic decline in the customer support business, impacted by the DXC contract and other factors.

- Open Text Corp (OTEX) announced a significant restructuring plan, including a net reduction of 2,000 employees, which may indicate operational challenges.

- The company adjusted its fiscal 2025 revenue target downwards, reflecting the ongoing market volatility and unpredictability.