- The U.S. is set to impose a 50% tariff on copper imports by August 2025, potentially boosting domestic producers like Freeport-McMoRan (FCX, Financial).

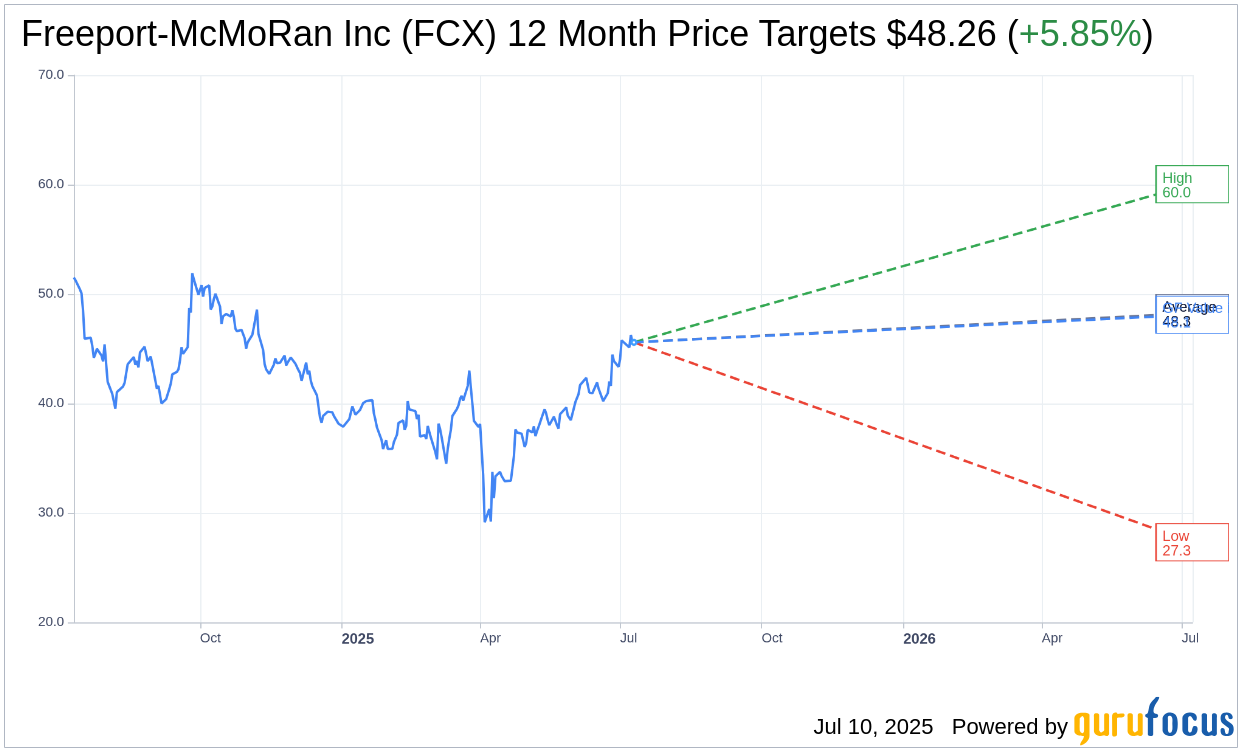

- Wall Street analysts predict an upside potential for Freeport-McMoRan, with an average price target of $48.26.

- Freeport-McMoRan is rated "Outperform" by brokerage firms, suggesting promising growth opportunities.

The planned implementation of a 50% tariff on copper imports starting August 2025 by the U.S. government may significantly benefit domestic copper producers such as Freeport-McMoRan (FCX). This strategic move follows similar measures on steel and aluminum imports and is expected to heighten demand for locally produced copper, especially amid escalating global copper prices.

Wall Street Analysts Forecast: A Promising Outlook

According to the forecasts from 17 analysts covering Freeport-McMoRan Inc (FCX, Financial), the average one-year price target is pegged at $48.26. This estimate includes a high of $60.04 and a low of $27.32. The average forecast suggests a potential upside of 5.85% from the current trading price of $45.59. Investors can access more detailed prediction data on the Freeport-McMoRan Inc (FCX) Forecast page.

Brokerage Recommendations: Outperforming Expectations

With input from 20 leading brokerage firms, Freeport-McMoRan Inc's (FCX, Financial) average recommendation currently stands at 2.1, categorizing the stock as "Outperform." In the brokerage rating system, a score of 1 represents a "Strong Buy," while a score of 5 indicates a "Sell."

Assessing GF Value: A Strategic Investment

GuruFocus's GF Value metric estimates Freeport-McMoRan Inc (FCX, Financial) at $48.11 over the next year, forecasting a potential upside of 5.53% from its existing price of $45.59. The GF Value is calculated by evaluating the historical trading multiples of the stock, its past business growth, and projected future performance. For more in-depth valuation metrics, readers are encouraged to visit the Freeport-McMoRan Inc (FCX) Summary page.