Goldman Sachs has begun coverage of GlobalFoundries (GFS, Financial) with a Neutral rating and set a price target of $40. The investment bank expressed a balanced perspective on the U.S. semiconductor capital equipment, storage, and foundry sectors. Analysts noted that the industry is experiencing a mid-cycle phase, marked by both positive and negative factors that are contributing to steady revenue conditions across these sectors.

The report highlighted more potential downsides than upsides, with stable revenue projections anticipated through 2026. Additionally, Goldman Sachs sees China more as an opportunity rather than a threat for companies in this field. The firm also observed potential gains in the hard-disk-drive market, expecting a NAND recovery by 2026.

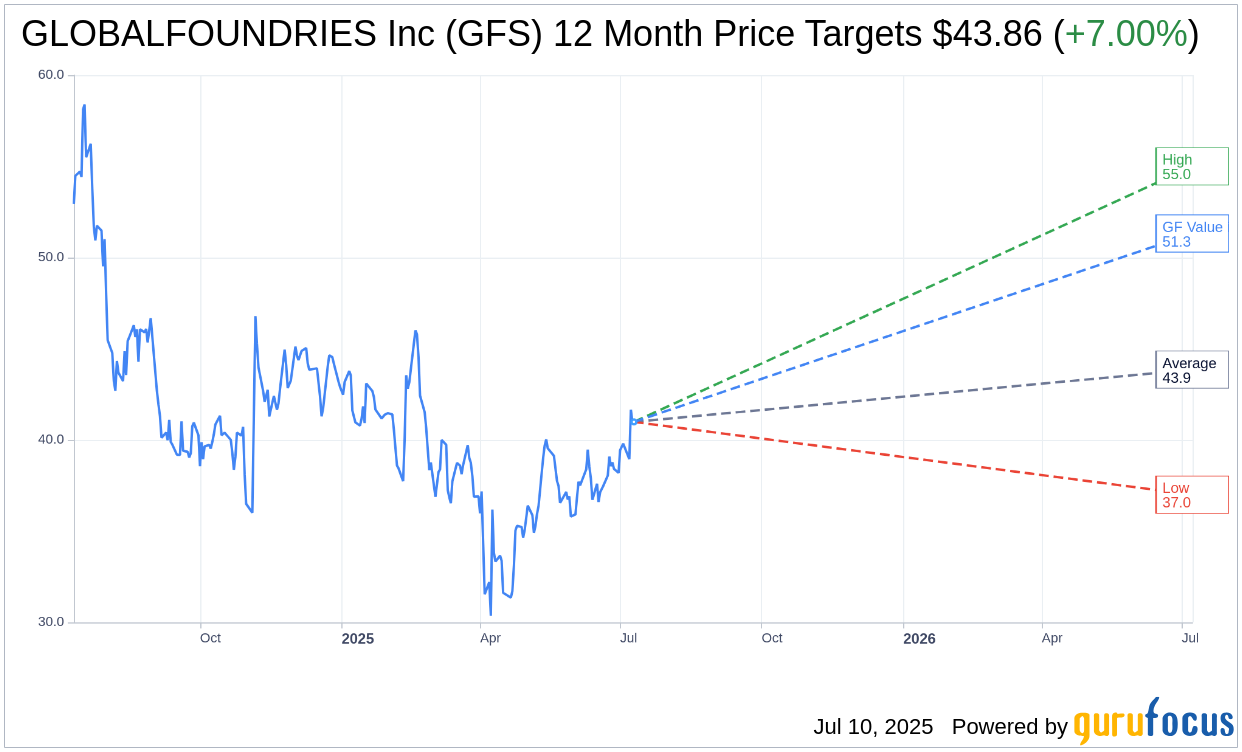

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for GLOBALFOUNDRIES Inc (GFS, Financial) is $43.86 with a high estimate of $55.00 and a low estimate of $37.00. The average target implies an upside of 7.00% from the current price of $40.99. More detailed estimate data can be found on the GLOBALFOUNDRIES Inc (GFS) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, GLOBALFOUNDRIES Inc's (GFS, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for GLOBALFOUNDRIES Inc (GFS, Financial) in one year is $51.32, suggesting a upside of 25.2% from the current price of $40.99. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the GLOBALFOUNDRIES Inc (GFS) Summary page.

GFS Key Business Developments

Release Date: May 06, 2025

- Revenue: $1.585 billion, a 13% decrease sequentially, but a 2% increase year-over-year.

- Gross Margin: 23.9%.

- Net Income: $189 million, an increase of $15 million from the year-ago period.

- Diluted Earnings Per Share (EPS): $0.34.

- Adjusted Free Cash Flow: $165 million, representing a free cash margin of approximately 10%.

- Cash Flow from Operations: $331 million.

- Capital Expenditures (CapEx): $166 million, roughly 10% of revenue.

- Liquidity: $4.7 billion, with $3.7 billion in cash, cash equivalents, and marketable securities.

- Total Debt: Reduced to $1.1 billion after prepaying $664 million on the Term Loan A facility.

- Automotive Revenue: 19% of total revenue, with a 16% increase year-over-year.

- Smart Mobile Devices Revenue: 37% of total revenue, with a 14% decrease year-over-year.

- IoT Revenue: 21% of total revenue, with a 6% increase year-over-year.

- Communications Infrastructure and Data Center Revenue: 11% of total revenue, with a 45% increase year-over-year.

- Second Quarter 2025 Revenue Guidance: $1.675 billion, plus or minus $25 million.

- Second Quarter 2025 Gross Margin Guidance: 25%, plus or minus 100 basis points.

- Second Quarter 2025 Diluted EPS Guidance: $0.36, plus or minus $0.05.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- GLOBALFOUNDRIES Inc (GFS, Financial) delivered solid financial results at the high end of guidance ranges across revenue, gross margin, and EPS for the first quarter of 2025.

- The company reported a year-over-year revenue increase in automotive, communications infrastructure and data center, and IoT end markets.

- GLOBALFOUNDRIES Inc (GFS) generated $165 million of non-IFRS adjusted free cash flow, representing a free cash margin of approximately 10%.

- The company has a strong balance sheet with $4.7 billion of liquidity and continued strong free cash flow generation.

- GLOBALFOUNDRIES Inc (GFS) achieved nearly 90% sole-source design wins over the last four quarters, indicating strong customer reliance on their technology.

Negative Points

- The ongoing trade and tariff disputes are expected to continue impacting the global supply chain and end market demand dynamics into the second half of 2025.

- Average selling price (ASP) per wafer was down modestly year-over-year due to product mix shift and a significant reduction in underutilization payments.

- Revenue from smart mobile devices decreased approximately 21% sequentially and approximately 14% from the prior year period.

- The company expects ASPs to decline roughly mid-single digits for the year, primarily due to product mix changes.

- There is uncertainty regarding the impact of tariffs on consumer-centric and industrial applications, which may affect demand levels in the second half of the year.