Key Takeaways:

- Levi Strauss & Co (LEVI, Financial) exceeds Q2 expectations, fueling post-market gains.

- Positive FY25 outlook driven by robust direct-to-consumer sales.

- Analysts forecast modest upside potential with "Outperform" recommendations.

Levi Strauss & Co (LEVI) has captured investor attention with its impressive post-market surge following a stellar Q2 performance and an upbeat forecast for FY25. The company reported a 6% increase in net revenue, climbing to $1.4 billion, and a notable 37% jump in earnings per share, reaching $0.22. These results are underpinned by potent direct-to-consumer sales and strategic initiatives, prompting an upward revision in the annual revenue and profit guidance.

Analyst Forecasts and Market Sentiment

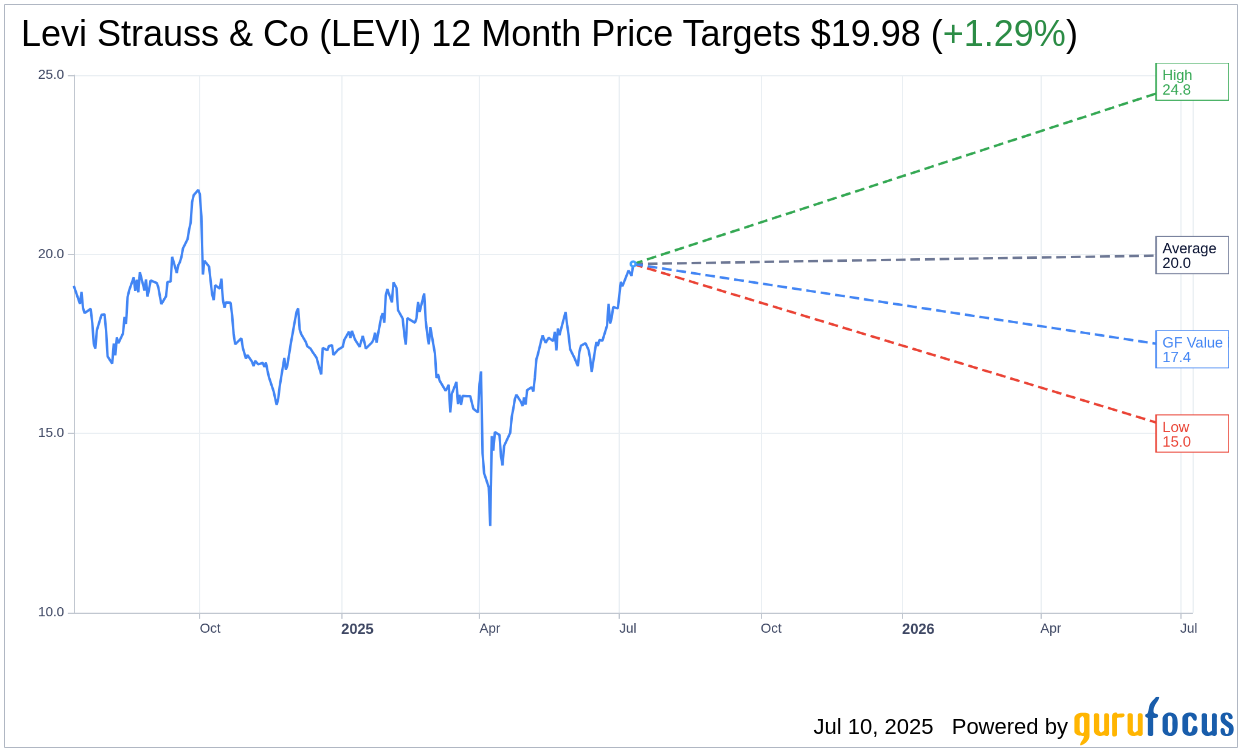

In terms of price targets, a group of 12 analysts have set an average target of $19.99 for Levi Strauss & Co (LEVI, Financial), with projections ranging from a high of $24.82 to a low of $15.00. This average target suggests a potential upside of 1.29% from the current trading price of $19.73. For more detailed insights, investors can visit the Levi Strauss & Co (LEVI) Forecast page.

Analyst sentiment remains positive, with 13 brokerage firms providing an average recommendation of 2.0 for Levi Strauss & Co (LEVI, Financial), indicating an "Outperform" rating. This recommendation scale ranges from 1, representing a Strong Buy, to 5, representing a Sell.

Valuation Insights from GuruFocus

According to GuruFocus metrics, the estimated GF Value for Levi Strauss & Co (LEVI, Financial) in one year is projected to be $17.35. This suggests a potential downside of 12.06% from the current market price of $19.73. The GF Value is GuruFocus' assessment of the fair trading value, calculated by analyzing the historical trading multiples, past business growth, and future performance projections. For more in-depth information, investors should explore the Levi Strauss & Co (LEVI) Summary page.