An analyst from H.C. Wainwright, Robert Burns, has started coverage of Karyopharm Therapeutics (KPTI, Financial) with a Buy rating and set a price target of $27. He highlights the company's work on maintenance therapy for solid tumor indications as having reduced risks. Additionally, Karyopharm is expected to have several major data releases in the near future that could capture investor attention. The analyst's insights suggest that these upcoming milestones may play a significant role in driving interest in the stock.

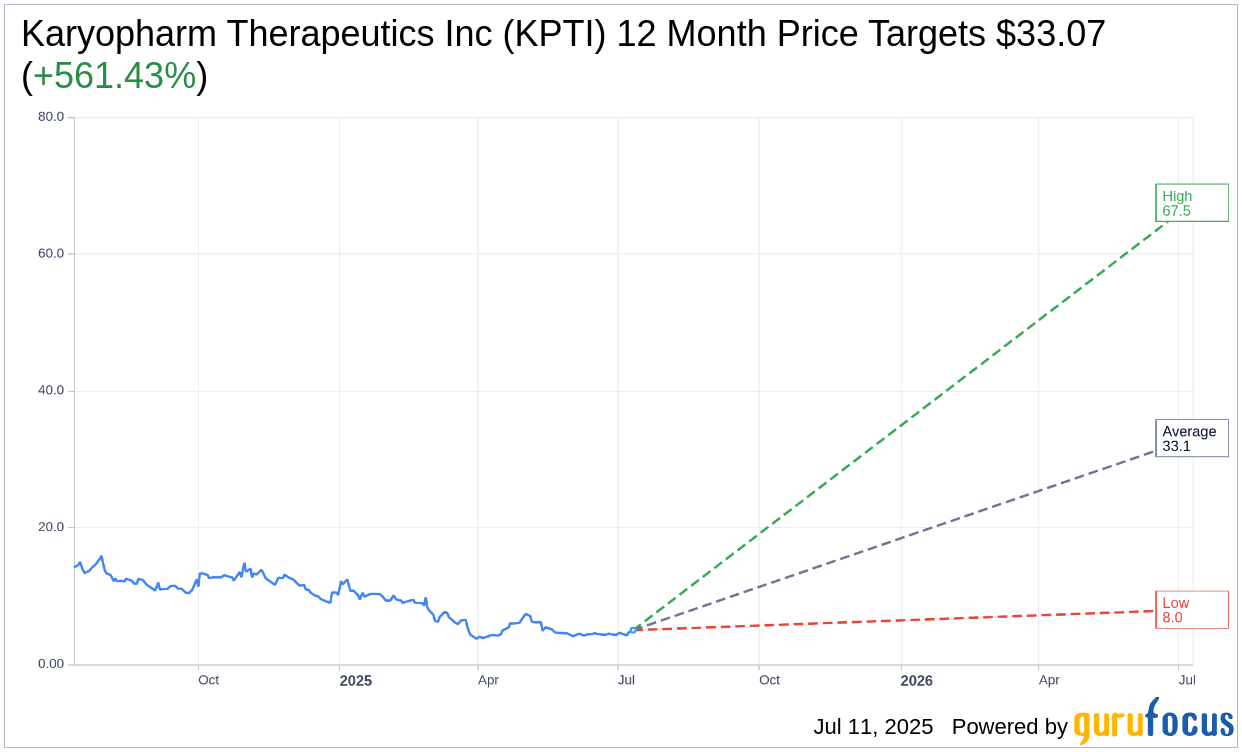

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Karyopharm Therapeutics Inc (KPTI, Financial) is $33.07 with a high estimate of $67.50 and a low estimate of $8.00. The average target implies an upside of 561.43% from the current price of $5.00. More detailed estimate data can be found on the Karyopharm Therapeutics Inc (KPTI) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Karyopharm Therapeutics Inc's (KPTI, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Karyopharm Therapeutics Inc (KPTI, Financial) in one year is $16.84, suggesting a upside of 236.8% from the current price of $5. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Karyopharm Therapeutics Inc (KPTI) Summary page.

KPTI Key Business Developments

Release Date: May 12, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Karyopharm Therapeutics Inc (KPTI, Financial) reported a successful futility analysis for their phase 3 century trial in myelofibrosis, allowing the study to continue as planned.

- The company shared promising new clinical data for selenexor in combination with roxalitinib, showing potential to improve patient outcomes in myelofibrosis.

- Karyopharm Therapeutics Inc (KPTI) achieved 5% demand growth year over year in Q1 2025, despite a competitive market.

- The company has a strong commercial infrastructure with 80% overlap between myelofibrosis and multiple myeloma prescribers, facilitating a rapid launch if approved.

- Royalty revenue increased by 57% to $1.7 million in Q1 2025, reflecting growing global demand for their products.

Negative Points

- Karyopharm Therapeutics Inc (KPTI) experienced a $5 million increase in product return reserve due to atypical returns of expired high-dose products, impacting net product revenue.

- The enrollment for the phase 3 myelofibrosis trial is slightly behind schedule, with completion now expected in June-July 2025.

- Total revenue for Q1 2025 decreased to $30 million from $33.1 million in Q1 2024, partly due to increased gross-to-net provisions.

- The company expects to be at the lower end of their revenue guidance range for 2025 due to atypical product returns.

- Karyopharm Therapeutics Inc (KPTI) is exploring various opportunities to extend their cash runway, indicating potential financial constraints.