Hyperscale Data (GPUS, Financial) has announced that its subsidiary, Ault Markets, is set to introduce a new platform, StableShare, by the first quarter of 2026. Designed as an innovative solution, StableShare will facilitate the tokenization of various assets including public and private securities, real estate, and structured finance products, offering a streamlined approach for broker-dealers, institutional investors, and other market players to access digital assets with real-world backing.

This initiative is part of Ault Markets’ larger plan to establish a comprehensive blockchain-driven financial ecosystem, which recently included a project for creating a decentralized exchange. Both projects will operate on Ault Blockchain, a custom Layer 1 network currently under development. This network aims to offer institutional-grade speed, compliance, and transparency, enhancing asset management through rapid settlement, smart contract integration, and real-time visibility. Via StableShare, Hyperscale Data (GPUS, Financial) expects to provide a compliant, efficient means of managing a diverse array of asset classes, capitalizing on blockchain technology's promise.

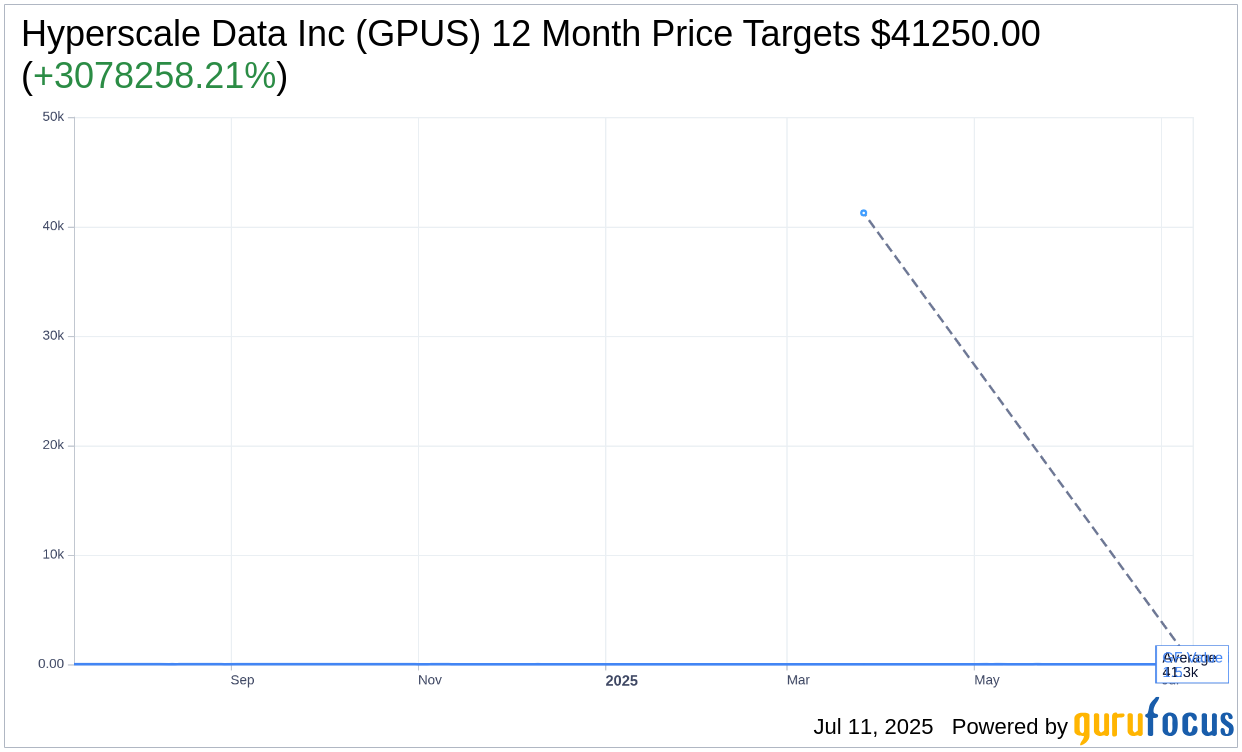

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Hyperscale Data Inc (GPUS, Financial) is $41,250.00 with a high estimate of $41,250.00 and a low estimate of $41,250.00. The average target implies an upside of 3,078,258.21% from the current price of $1.34. More detailed estimate data can be found on the Hyperscale Data Inc (GPUS) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Hyperscale Data Inc's (GPUS, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Hyperscale Data Inc (GPUS, Financial) in one year is $1.48, suggesting a upside of 10.45% from the current price of $1.34. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Hyperscale Data Inc (GPUS) Summary page.