Zepp Health, trading under the ticker ZEPP, has experienced a significant rise in its stock value, climbing 21.7%. The stock saw an increase of $1.32, bringing its price to $7.41. This upward movement marks a noteworthy development for Zepp Health, drawing attention from investors and market observers.

Wall Street Analysts Forecast

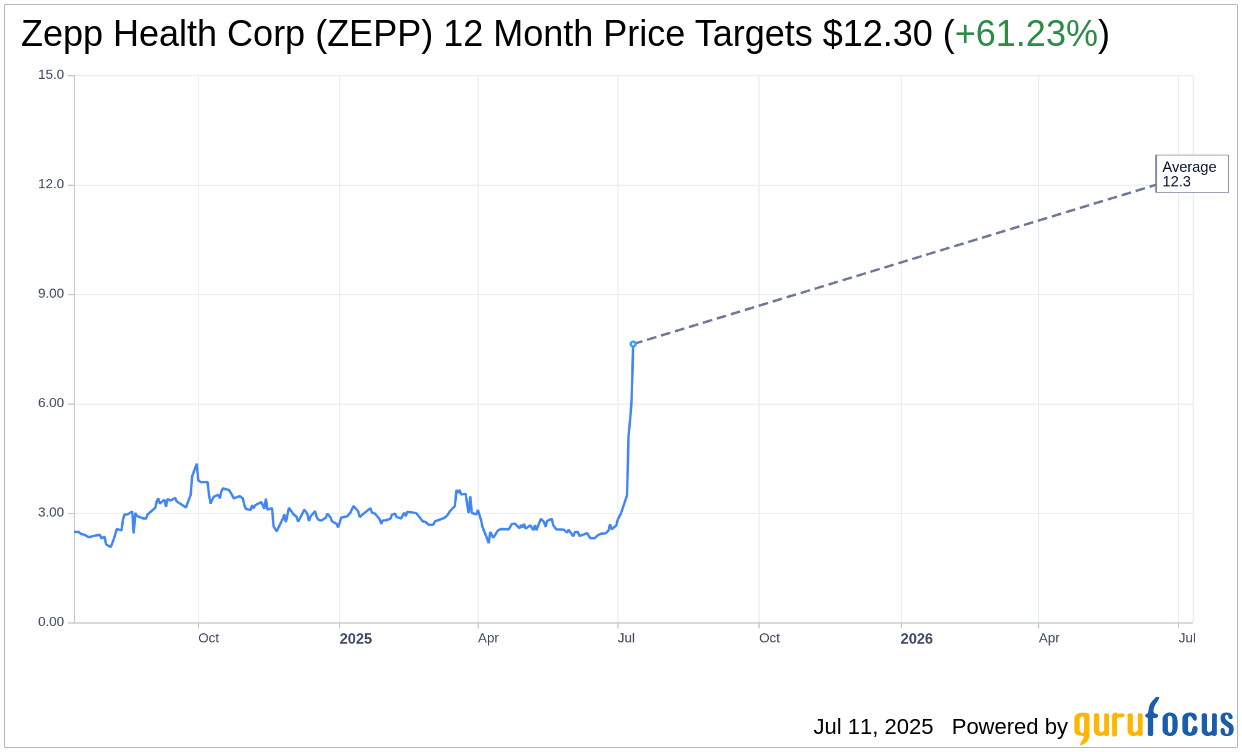

Based on the one-year price targets offered by 1 analysts, the average target price for Zepp Health Corp (ZEPP, Financial) is $12.30 with a high estimate of $12.30 and a low estimate of $12.30. The average target implies an upside of 61.23% from the current price of $7.63. More detailed estimate data can be found on the Zepp Health Corp (ZEPP) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Zepp Health Corp's (ZEPP, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Zepp Health Corp (ZEPP, Financial) in one year is $2.17, suggesting a downside of 71.56% from the current price of $7.63. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Zepp Health Corp (ZEPP) Summary page.

ZEPP Key Business Developments

Release Date: May 20, 2025

- Amazfit Revenue Growth: 10% year-over-year increase in Amazfit revenue.

- Gross Margin: Achieved 37.3%, higher than both Q4 2024 and Q1 2024.

- Operating Expenses: USD31.5 million in Q1 2025, up from USD29.3 million in Q4 2024 and USD27.8 million in Q1 2024.

- Adjusted Operating Loss: USD17.2 million in Q1 2025, compared to USD13.1 million in Q1 2024.

- Cash Balance: USD104 million as of March 31, 2025, down from USD110 million in Q4 2024.

- Debt Repayment: USD11.5 million repaid in Q1 2025, with a total of USD67.8 million retired cumulatively.

- Revenue Guidance for Q2 2025: Expected to be in the range of USD50 million to USD55 million, indicating 23% to 35% year-over-year growth.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Zepp Health Corp (ZEPP, Financial) reported a 10% year-over-year growth in Amazfit revenue, marking the first growth after a two-year transformation period.

- The company successfully launched new products, Amazfit Active 2 and Amazfit Bip 6, which received positive reviews and strong initial sales momentum.

- Zepp Health Corp (ZEPP) has diversified its supply chain by expanding operations in Vietnam and exploring opportunities in the NAFTA region, enhancing operational agility.

- The company achieved a gross margin of 37.3% in Q1 2025, higher than both Q4 2024 and Q1 2024, driven by new product launches.

- Zepp Health Corp (ZEPP) has strengthened its brand presence through strategic partnerships with athletes and participation in global events, enhancing brand visibility and market share.

Negative Points

- Despite the sales growth, fixed operating expenses were not fully absorbed, putting pressure on operating profit.

- The company faced a $1 million impact from foreign exchange headwinds during the quarter.

- Operating expenses increased year-over-year, driven by higher R&D and marketing expenses.

- Zepp Health Corp (ZEPP) reported an adjusted operating loss of $17.2 million for Q1 2025, compared to a loss of $13.1 million in the same period of 2024.

- The company remains exposed to potential tariff impacts, with an estimated $2 million to $3 million impact for the full year 2025, although efforts are being made to offset this through efficiency gains.