Frequency Electronics (FEIM, Financial) has provided further insights into its revenue projections following a recent earnings call, highlighting the potential of its TURbO compact rubidium atomic clock. While the company anticipates earning between $1 million and $2 million in fiscal year 2026 from existing orders, this forecast understates the broader market potential of the technology. TURbO, or Time Unit Rubidium Oscillator, is an innovative atomic clock developed by FEIM, designed to offer a smaller size and high performance. This development is expected to significantly increase market opportunities, particularly with the growing demand for drones.

The recent announcement from the Department of Defense to strengthen the U.S. drone manufacturing sector and enhance drone use for military applications could further expand this market. The company estimates that these initiatives could represent a market potential exceeding $20 million for FEIM by fiscal year 2027.

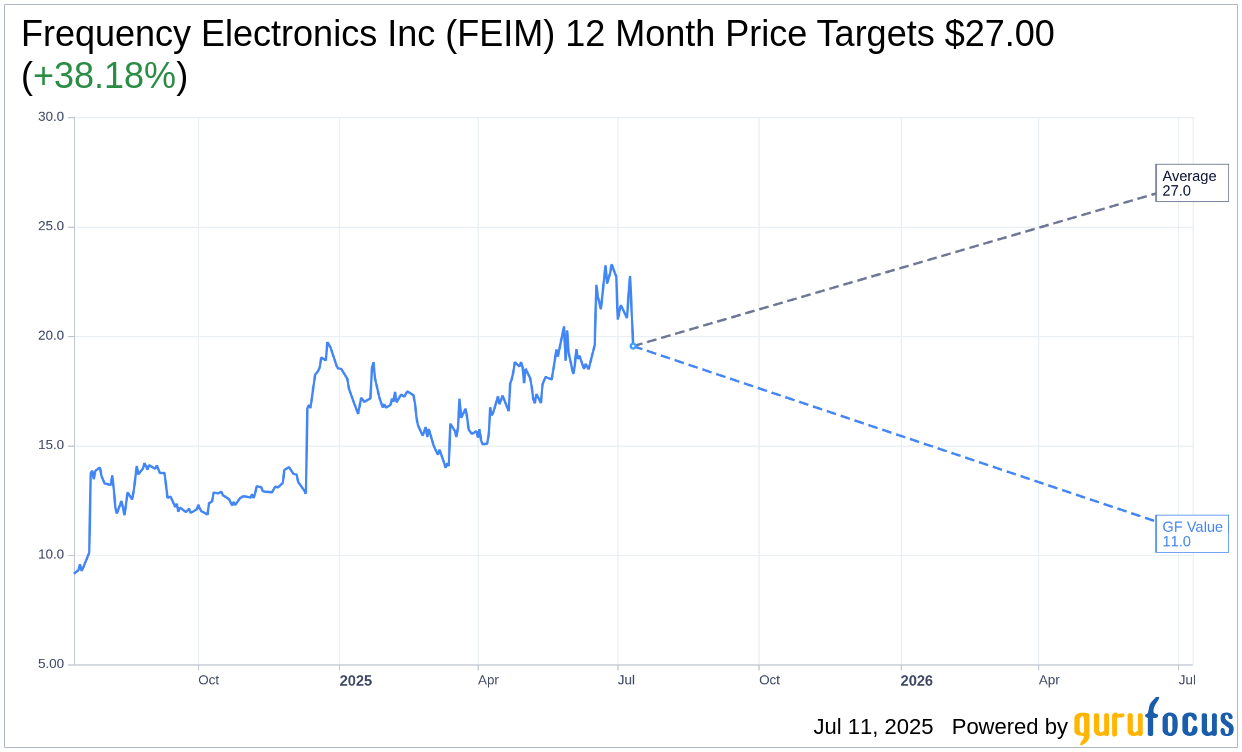

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Frequency Electronics Inc (FEIM, Financial) is $27.00 with a high estimate of $27.00 and a low estimate of $27.00. The average target implies an upside of 38.18% from the current price of $19.54. More detailed estimate data can be found on the Frequency Electronics Inc (FEIM) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Frequency Electronics Inc's (FEIM, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Frequency Electronics Inc (FEIM, Financial) in one year is $10.97, suggesting a downside of 43.86% from the current price of $19.54. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Frequency Electronics Inc (FEIM) Summary page.

FEIM Key Business Developments

Release Date: July 10, 2025

- Revenue: $69.8 million for fiscal year ended April 30, 2025, up from $55.3 million in the prior fiscal year.

- Commercial and US Government Satellite Programs Revenue: $40.9 million, representing 59% of total revenue.

- Non-Space US Government and DOD Revenue: $26.5 million, accounting for 38% of total revenue.

- Other Commercial and Industrial Revenue: $2.4 million.

- Gross Profit: Increased due to higher revenue and gross margin, particularly in the FEI New York segment.

- Selling and Administrative Expenses: 8% of consolidated revenue, consistent with the prior year.

- R&D Expense: $6.1 million, up from $3.4 million, representing 9% of consolidated revenue.

- Operating Income: $11.7 million, compared to $5 million in the prior fiscal year.

- Pretax Income: $12.1 million, up from $5.5 million in the previous fiscal year.

- Net Income: $23.7 million or $2.46 per share, compared to $5.6 million or $0.59 per share previously.

- Backlog: $70 million at the end of April 2025, down from $78 million the previous year.

- Working Capital: Approximately $30 million with a current ratio of 2.3:1.

- Cash Flow: Cash decreased by $13.6 million, with $9.6 million due to dividend payments.

- Contract Liabilities: Decreased by $8.2 million since year-end.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Frequency Electronics Inc (FEIM, Financial) reported the highest revenue order in the past 25 years, indicating strong growth.

- Consolidated revenue for the fiscal year ended April 30, 2025, was $69.8 million, up from $55.3 million in the prior year.

- The company is expanding its customer base beyond traditional prime contractors, positioning itself well for future growth.

- FEIM is actively involved in promising areas such as quantum sensing and alternate navigation technologies, which have significant market potential.

- The company maintains a strong balance sheet with a working capital position of approximately $30 million and is debt-free.

Negative Points

- The company does not provide guidance due to the lumpiness of contract awards, which may lead to variability in quarterly results.

- Revenues from non-space US government and DOD customers decreased compared to the prior fiscal year.

- Cash decreased by approximately $13.6 million since the prior fiscal year-end, partly due to dividend payments.

- There is potential variability in the timing of future contracts due to changes in administration and funding priorities.

- R&D expenses increased significantly, reflecting the company's commitment to technical excellence but also impacting short-term profitability.