- Delta Air Lines (DAL, Financial) shares surged over 11% on strong Q2 performance.

- Analysts forecast a potential upside of over 14% from current prices.

- GuruFocus estimates indicate a notable downside based on current valuation metrics.

Delta Air Lines Soars on Q2 Performance

Delta Air Lines (NYSE: DAL) galvanized the travel sector with an impressive 11.38% surge in its stock following the company's robust Q2 earnings report, which exceeded Wall Street's expectations. This marked a four-month high for the airline's shares, driven by strong operational efficiency and a reinforced full-year outlook.

Analyst Predictions on Delta's Future

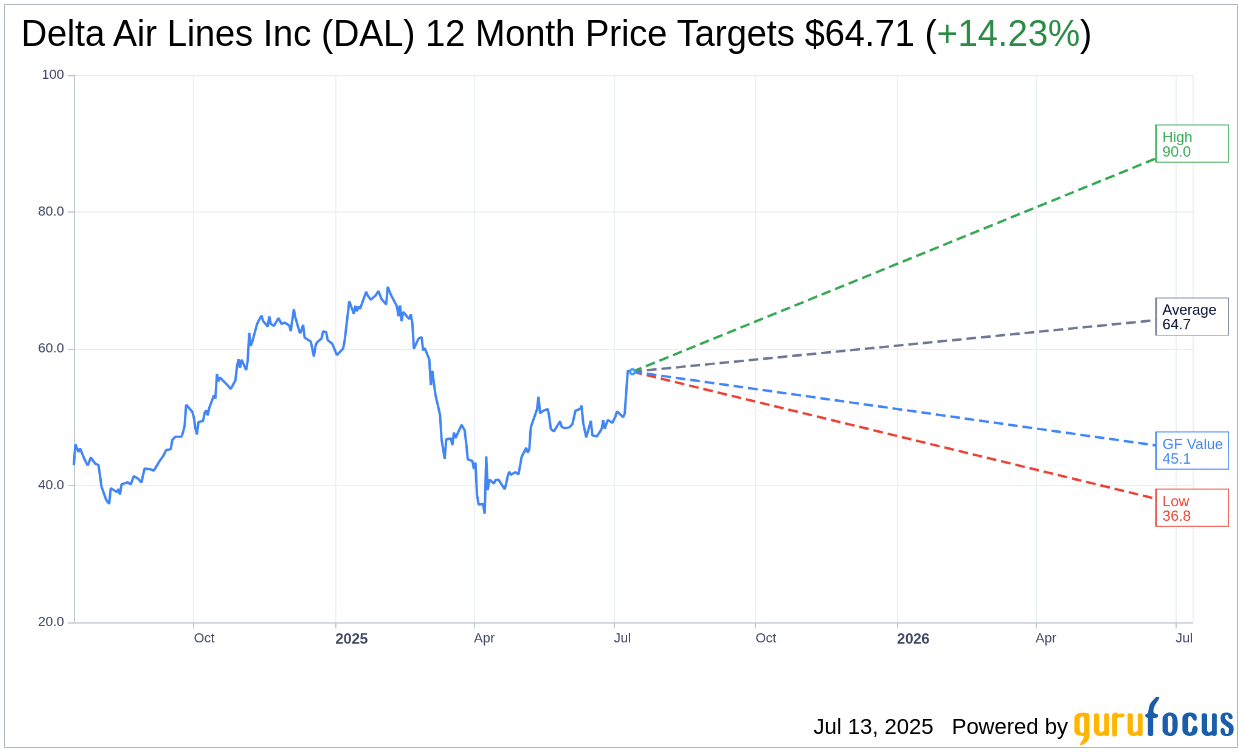

Wall Street remains optimistic about Delta's prospects. According to the one-year price targets from 19 analysts, the average target price is $64.71, with projections ranging from a high of $90.00 to a low of $36.77. This suggests a potential upside of 14.23% from the current trading price of $56.65. For a more comprehensive analysis, visit the Delta Air Lines Inc (DAL, Financial) Forecast page.

Additionally, the consensus among 23 brokerage firms rates Delta Air Lines Inc at 1.8, indicating an "Outperform" status. This rating aligns with the scale where 1 is a Strong Buy and 5 denotes Sell.

GuruFocus Valuation Insights

Contrasting analyst optimism, GuruFocus provides a tempered valuation perspective. The estimated GF Value for Delta Air Lines Inc in one year stands at $45.12. This valuation implies a potential downside of 20.35% from the current price, reflecting the fair value based on historical trading multiples and projected business performance. For more insights, explore the Delta Air Lines Inc (DAL, Financial) Summary page.

Investors are encouraged to weigh these divergent views carefully, balancing the analysts' bullish stance against the conservative valuation metrics from GuruFocus, to make informed decisions on Delta Air Lines' stock trajectory.