Stifel analyst Brian Brophy has raised his rating for Custom Truck One Source (CTOS, Financial) from Hold to Buy, setting a new price target of $7, up from the previous $5. This upgrade comes on the back of a favorable transmission and distribution survey. Recent data indicates that only 2% of respondents reported tighter equipment availability in the second quarter, compared to 4% who noted looser availability in the first quarter. This shift signals improved rental utilization trends in the market.

Stifel anticipates that these positive developments will bolster Custom Truck’s earnings outlook, according to the analyst's latest research note.

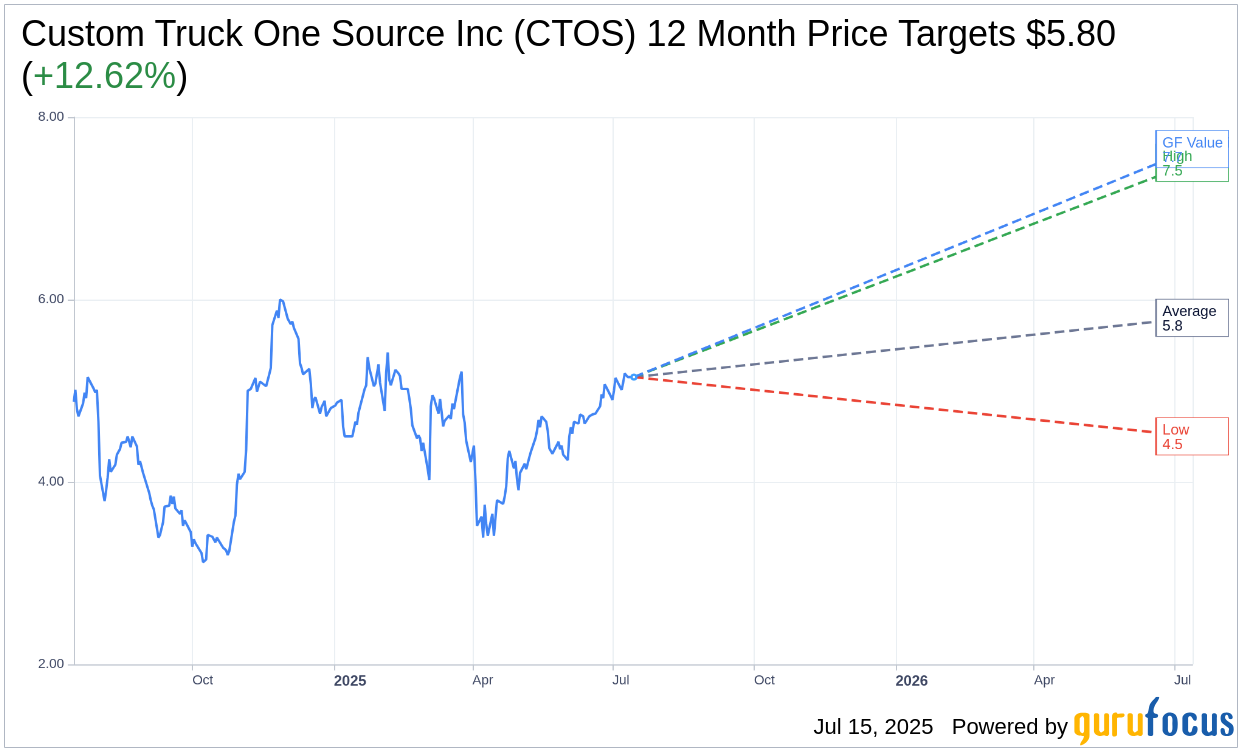

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Custom Truck One Source Inc (CTOS, Financial) is $5.80 with a high estimate of $7.50 and a low estimate of $4.50. The average target implies an upside of 12.62% from the current price of $5.15. More detailed estimate data can be found on the Custom Truck One Source Inc (CTOS) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Custom Truck One Source Inc's (CTOS, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Custom Truck One Source Inc (CTOS, Financial) in one year is $7.65, suggesting a upside of 48.54% from the current price of $5.15. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Custom Truck One Source Inc (CTOS) Summary page.

CTOS Key Business Developments

Release Date: May 01, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Custom Truck One Source Inc (CTOS, Financial) reported strong financial performance with a 13% year-over-year increase in revenue for the ERS segment.

- Average utilization of the rental fleet improved to just under 78%, up 440 basis points from the previous year.

- The company experienced significant growth in its backlog, increasing by over $51 million or 14% in the quarter.

- Custom Truck One Source Inc (CTOS) reaffirmed its full-year 2025 guidance, indicating confidence in achieving expected growth targets.

- The company has strong relationships with strategic suppliers and a diversified customer base, which are key to its success.

Negative Points

- Segment gross margin continues to be under pressure due to mixed and improved inventory levels across the broader industry.

- There is hesitancy from smaller customers to purchase vehicles, opting to rent instead, influenced by high interest rates and economic caution.

- The company faces economic uncertainty due to evolving US tariff policies, which could impact operations.

- TES segment gross margin was down compared to the previous year, impacted by product mix and inventory levels.

- Borrowings under the ABL increased by $73 million, contributing to a net leverage of 4.8 times, with a target to reduce it below 3 times by the end of fiscal 2026.