Jacobs (J, Financial), in collaboration with AtkinsRealis, has been selected by England’s National Highways for its latest Specialist Professional and Technical Services Framework. The joint venture will offer engineering and technical consultancy related to road transport, as well as research and innovation services. This initiative follows the successful implementation of two previous frameworks, aiming to bolster National Highways' capacity to execute the Roads Investment Strategy across England.

With a projected value of up to $680 million over six years, the framework involves six suppliers, including the AtkinsRealis-Jacobs partnership. It is designed to provide an array of expert services in areas such as strategic transport planning, transport modeling, engineering, sustainability, and network resilience. Additionally, the framework allows for the incorporation of significant social value components into project delivery. Various public entities, like the Department for Transport, will also have access to these services.

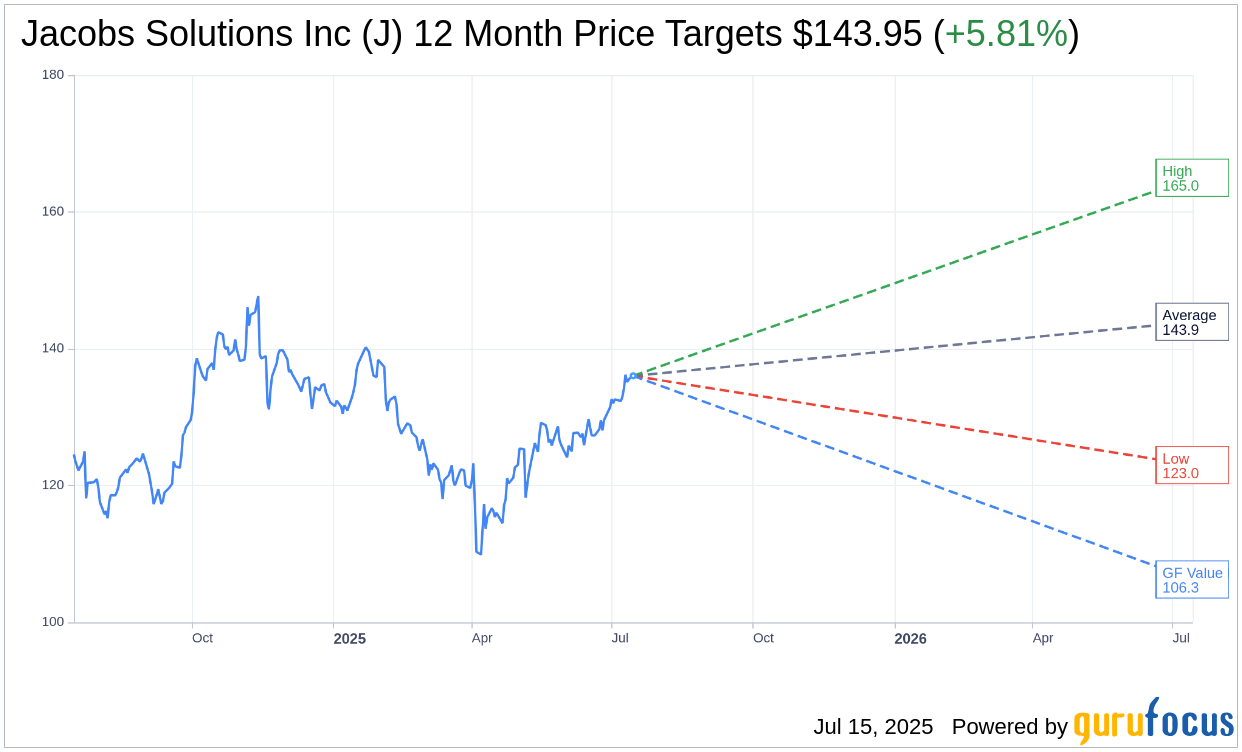

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Jacobs Solutions Inc (J, Financial) is $143.95 with a high estimate of $165.00 and a low estimate of $123.00. The average target implies an upside of 5.81% from the current price of $136.04. More detailed estimate data can be found on the Jacobs Solutions Inc (J) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Jacobs Solutions Inc's (J, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Jacobs Solutions Inc (J, Financial) in one year is $106.27, suggesting a downside of 21.88% from the current price of $136.04. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Jacobs Solutions Inc (J) Summary page.

J Key Business Developments

Release Date: May 06, 2025

- Adjusted EPS: Increased over 22% to $1.43.

- Backlog: Grew 20% to more than $22 billion, a new record.

- Adjusted Net Revenue: Rose over 3% in Q2.

- Adjusted EBITDA: $287 million, representing an 8% year-over-year increase.

- Adjusted EBITDA Margin: Improved to 13.4%, an increase of 62 basis points year-over-year.

- Gross Revenue: Grew 2% year-over-year.

- Free Cash Flow: Negative $114 million for Q2.

- Share Repurchases: $351 million in shares repurchased during the quarter.

- Net Leverage Ratio: Ended the quarter at the midpoint of the 1.0 to 1.5 times target.

- Dividend: $0.32 per share, representing 10% year-over-year growth.

- Fiscal 2025 Outlook: Adjusted net revenue to grow mid-to-high single digits; adjusted EBITDA margin to range from 13.8% to 14%; adjusted EPS of $5.85 to $6.20.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Adjusted EPS grew over 22% to $1.43, supported by solid year-over-year margin expansion.

- PA Consulting's revenue growth turned positive, reaching mid-single digits and driving double-digit operating profit growth.

- Backlog grew 20% to more than $22 billion, setting a new record.

- Strong operating performance allowed the company to absorb the impact of a legal reserve and still grow adjusted EBITDA by 8%.

- The company reaffirmed its full-year guidance metrics, indicating confidence in future performance.

Negative Points

- Revenue growth during Q2 was adversely impacted by a legal reserve related to a joint venture matter and foreign exchange headwinds.

- The legal reserve had a meaningful impact on adjusted net revenue and adjusted operating profit.

- The procurement cycle is extending, which could delay project execution.

- Free cash flow was negative $114 million in Q2, reflecting seasonal cash timing events.

- GAAP EPS was impacted by a $109 million pretax loss associated with the mark-to-market adjustment of the investment in Amentum.