Summary:

- Riot Platforms Inc. (RIOT, Financial) trims its position in Bitfarms (BITF) by selling 1,784,000 shares, reducing its ownership to 10.29%.

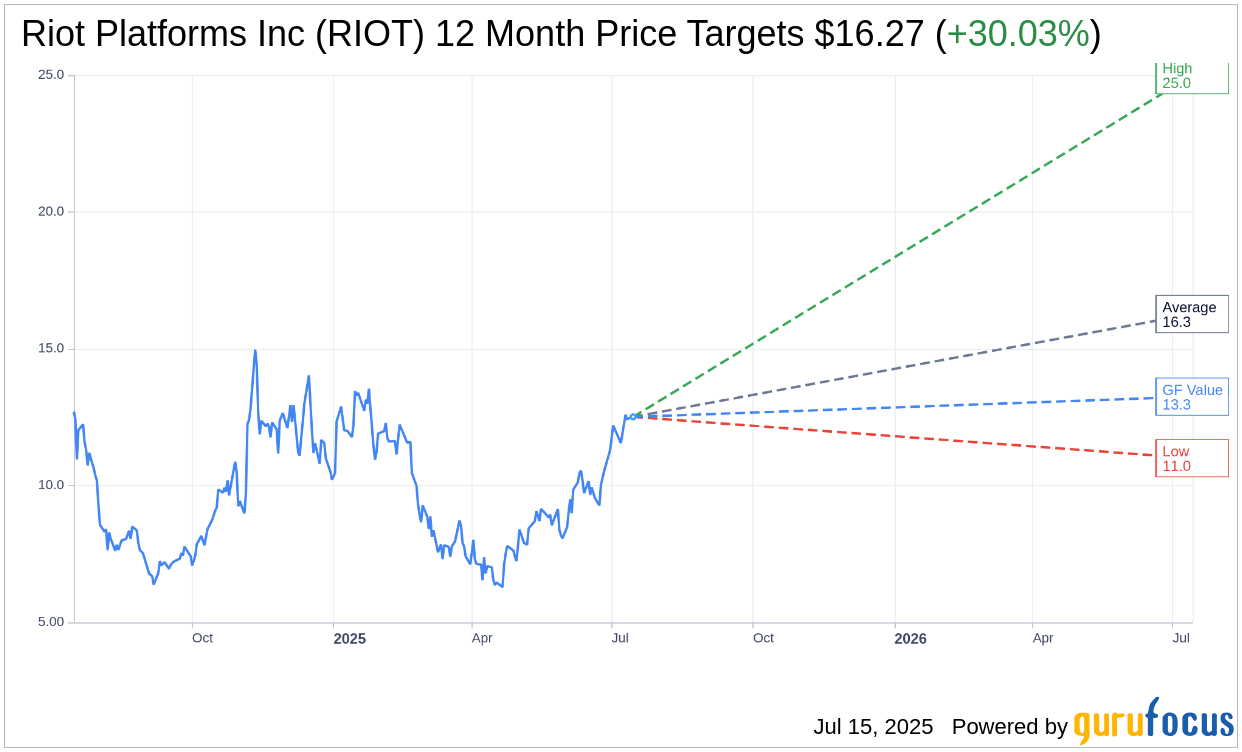

- Wall Street analysts project a 30.03% upside for RIOT with a one-year target average price of $16.27.

- According to GuruFocus, RIOT has a GF Value estimate of $13.25, indicating a 5.92% potential gain.

Riot Platforms Reduces Stake in Bitfarms

Riot Platforms (RIOT) has recently sold 1,784,000 common shares of Bitfarms (BITF), effectively decreasing its shareholding to roughly 10.29% of Bitfarms' total outstanding shares. This strategic decision is part of Riot's continuous assessment of its investments within the bitcoin mining sector.

Analysts' Price Targets for Riot Platforms

Fifteen Wall Street analysts have provided a range of one-year price targets for Riot Platforms Inc (RIOT, Financial). The average target price is $16.27, with predictions ranging from a high of $25.00 to a low of $11.00. This average target suggests a substantial upside potential of 30.03% compared to the current trading price of $12.51. For more comprehensive price targets, visit the Riot Platforms Inc (RIOT) Forecast page.

Brokerage Firms' Recommendations

The consensus recommendation from 16 brokerage firms places Riot Platforms Inc (RIOT, Financial) at an average rating of 1.9, which equates to an "Outperform" status. The scale used ranges from 1 to 5, with 1 being a Strong Buy and 5 indicating a Sell.

GuruFocus GF Value Evaluation

According to GuruFocus estimates, the GF Value for Riot Platforms Inc (RIOT, Financial) in a year's time is $13.25, pointing to a modest upside of 5.92% from the current market price of $12.51. The GF Value is calculated by analyzing the historical trading multiples of the stock, past business growth, and future business performance projections. For further details, please visit the Riot Platforms Inc (RIOT) Summary page.