Summary:

- Hong Kong introduces new licensing requirements for ride-hailing services like Uber.

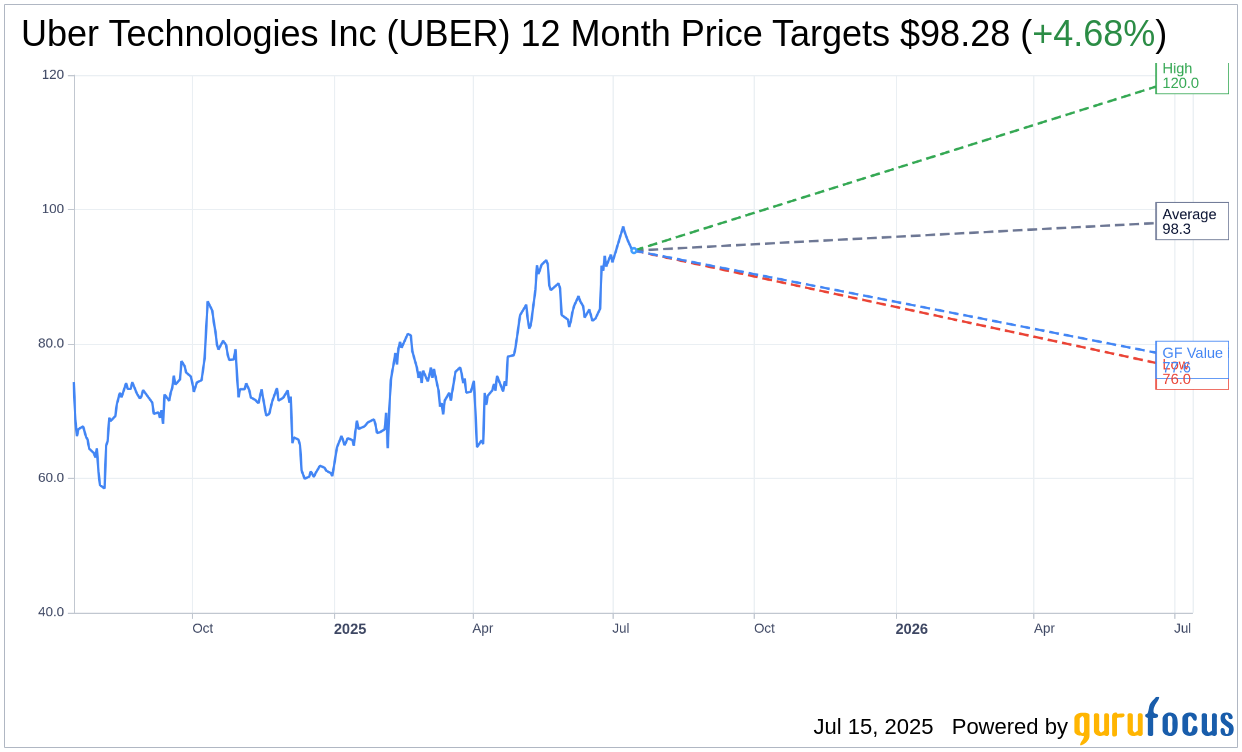

- Wall Street analysts predict an average increase of 4.68% in Uber's stock price over the next year.

- GuruFocus estimates suggest a potential downside for Uber's stock value in the coming year.

The Hong Kong government has announced a significant regulatory change for online ride-hailing companies such as Uber Technologies Inc. (NYSE: UBER). This new policy mandates that these companies must secure licenses for their operational platforms, vehicles, and drivers to legally operate. Additionally, these firms need to establish a local business presence and fulfill specific criteria, which include demonstrating financial capability and providing adequate insurance coverage for their vehicles and drivers.

Wall Street Analysts Forecast

Current insights from 46 Wall Street analysts offer a comprehensive look into Uber's stock trajectory. They have set an average one-year price target of $98.28, with projections ranging between $120.00 at the high end and $76.00 at the low end. This suggests a potential upside of 4.68% from the current stock price of $93.89. For further detailed estimates, visit the Uber Technologies Inc (UBER, Financial) Forecast page.

The consensus recommendation from 54 brokerage firms rates Uber Technologies Inc. as a 2.0, which corresponds to an "Outperform" status on their scale. This recommendation system ranges from 1 (Strong Buy) to 5 (Sell), placing Uber in a favorable position among investors.

Providing a different perspective, GuruFocus's estimates reveal an estimated GF Value for Uber Technologies Inc. at $77.63 one year from now. This suggests a potential downside of 17.32% compared to the current trading price of $93.89. This valuation is derived from historical trading multiples, past business growth, and projected future performance. For more comprehensive data, see the Uber Technologies Inc (UBER, Financial) Summary page.