The financial firm Stephens has increased its price target for Fastenal (FAST, Financial) from $40 to $45. This adjustment comes in response to the company's second-quarter earnings report, reflecting a positive outlook from the analyst. Despite the raised target, the firm maintains an Equal Weight rating on Fastenal's shares, indicating a balanced view of the stock's future performance.

Wall Street Analysts Forecast

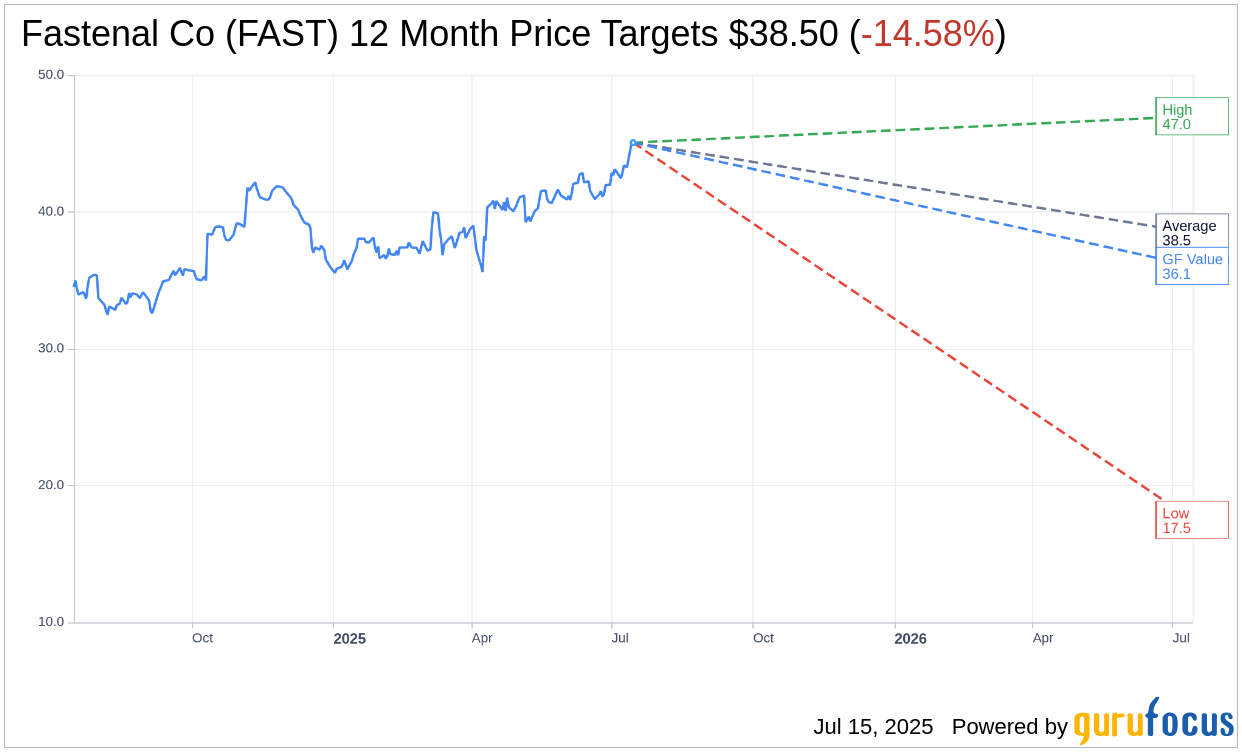

Based on the one-year price targets offered by 12 analysts, the average target price for Fastenal Co (FAST, Financial) is $38.50 with a high estimate of $47.00 and a low estimate of $17.50. The average target implies an downside of 14.58% from the current price of $45.07. More detailed estimate data can be found on the Fastenal Co (FAST) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Fastenal Co's (FAST, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Fastenal Co (FAST, Financial) in one year is $36.06, suggesting a downside of 19.99% from the current price of $45.07. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Fastenal Co (FAST) Summary page.

FAST Key Business Developments

Release Date: July 14, 2025

- Revenue: Exceeded $2 billion for the first time, with an 8.6% increase in Q2 2025.

- Daily Sales Growth: Highest since early 2023, with a growth rate of 8.6%.

- Contract Customer Sales: Increased by 11%, representing 73.2% of total revenues.

- Operating Margin: Achieved 21%, up 80 basis points year-over-year.

- Gross Margin: 45.3%, up 20 basis points from the previous year.

- Earnings Per Share (EPS): $0.29, a 12.7% increase from the previous year.

- Operating Cash Flow: $279 million, representing 84.4% of net income.

- Inventory Growth: Increased by 14.7% to improve product availability and efficiency.

- Accounts Receivable: Up 9.9%, reflecting sales growth and deferred payments.

- FMI Technology Sales: Represented 44.1% of sales, with an 11% increase in installed devices.

- E-business Sales: Grew by 13.5%, surpassing 30% of total sales for the first time.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Fastenal Co (FAST, Financial) achieved over $2 billion in revenue for the first time in its history, marking a significant milestone.

- Sales in the second quarter increased by 8.6%, with the highest daily growth since early 2023.

- Contract customer sales increased by 11%, now representing 73.2% of revenues, up from 71.2% the previous year.

- The company saw a 30% year-over-year revenue increase in non-manufacturing sites generating $50,000 or more per month.

- E-business sales grew by 13.5%, surpassing 30% of total sales for the first time, indicating strong digital growth.

Negative Points

- Market conditions remain sluggish, with trade policy creating caution and uncertainty among customers.

- There was a decline in the number of accounts generating under $5,000, particularly those under $500, which could impact smaller customer segments.

- The FMI Technology adoption was softer than expected, with a slight decrease in new customer signings compared to previous years.

- Higher import duty fees and transportation costs negatively impacted gross margins.

- The company faces challenges in managing price costs due to ongoing tariff uncertainties, which could affect future profitability.