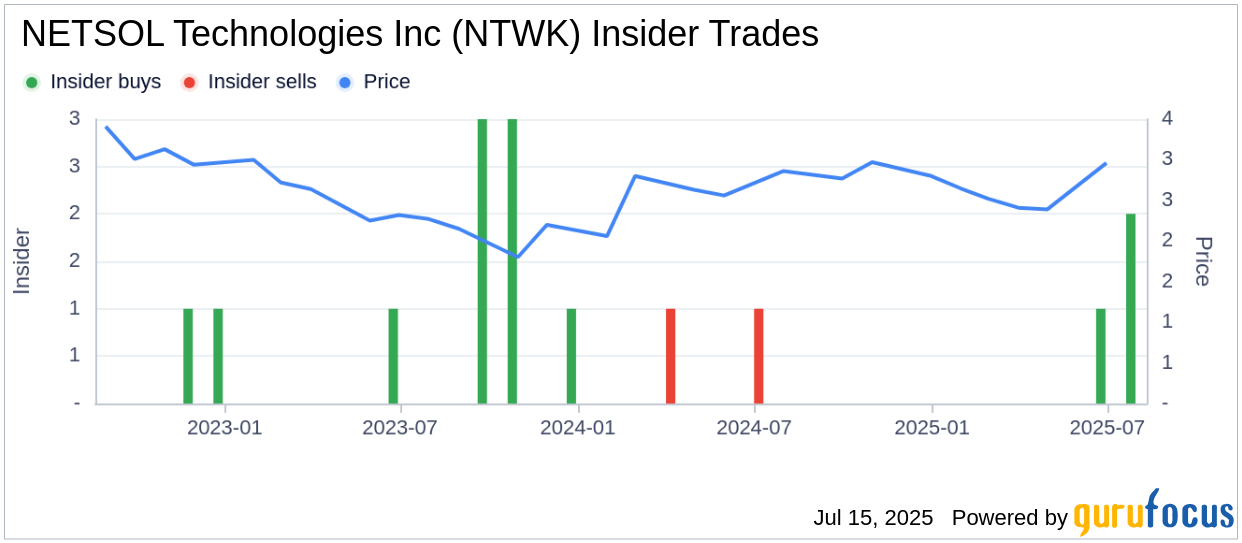

On July 14, 2025, Najeeb Ghauri, the CEO of NETSOL Technologies Inc (NTWK, Financial), acquired 5,025 shares of the company, as per the SEC Filing. Following this transaction, the insider now holds a total of 923,338 shares in the company. NETSOL Technologies Inc is a provider of IT and enterprise software solutions primarily serving the global leasing and finance industry. The company offers a range of services including software development, consulting, and implementation. The recent purchase by the insider is part of a broader trend of insider buying at NETSOL Technologies Inc. Over the past year, there have been three insider buys and zero insider sells, indicating a positive sentiment among the company's insiders.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.