Summary:

- Palo Alto Networks (PANW, Financial) and Okta (OKTA) join forces to enhance security solutions with AI technology.

- Current analyst expectations for Palo Alto Networks suggest potential upside in stock value.

- GuruFocus GF Value indicates a slight increase in PANW's fair market value.

Palo Alto Networks and Okta: An Enhanced Security Partnership

Palo Alto Networks (PANW) and Okta (OKTA) have elevated their collaboration to tackle identity attacks effectively via AI-driven security solutions. This partnership is set to revolutionize security operations for nearly 2,000 joint clients by introducing new integrated features such as automated threat responses and secure application access.

Wall Street Analysts’ Insights

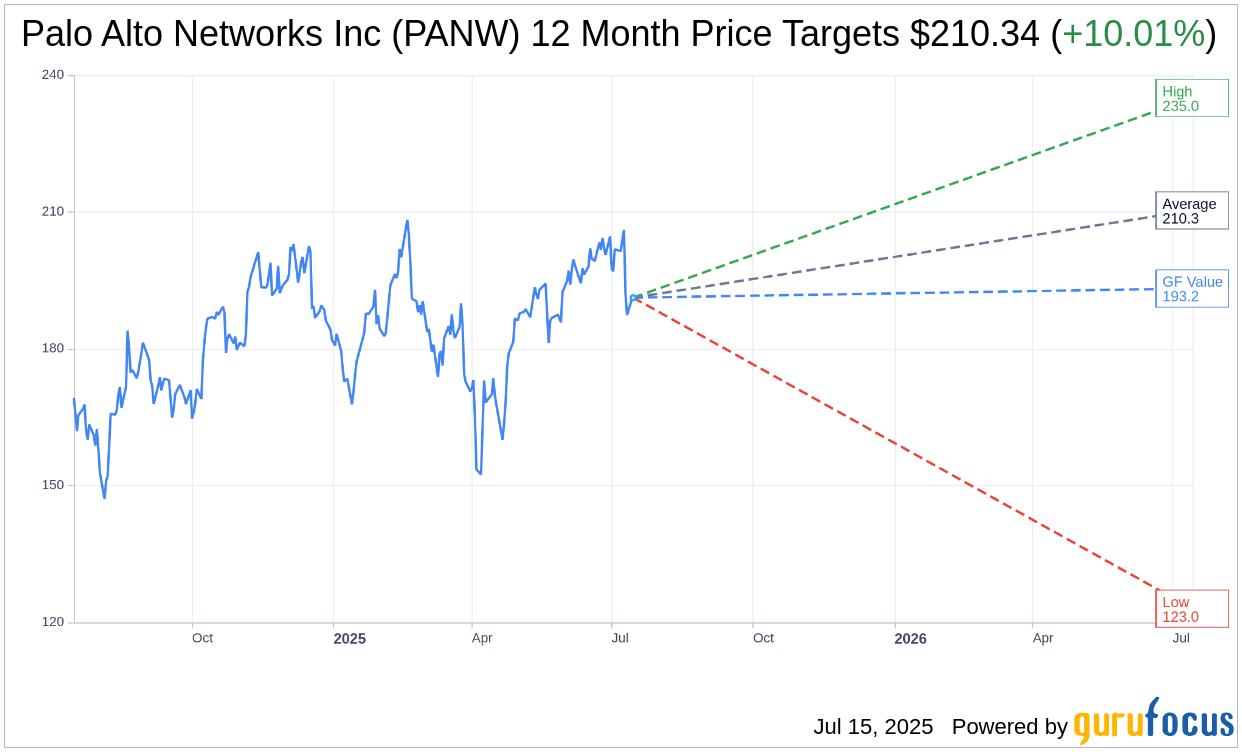

According to projections from 48 Wall Street analysts, the one-year price target for Palo Alto Networks Inc (PANW, Financial) averages at $210.34, with a high of $235.00 and a low of $123.00. This average target suggests a potential upside of 10.01% from the current trading price of $191.21. Investors can access more detailed estimate data on the Palo Alto Networks Inc (PANW) Forecast page.

Moreover, based on evaluations from 55 brokerage firms, Palo Alto Networks Inc (PANW, Financial) holds an average brokerage recommendation of 2.1, reflecting an "Outperform" status. The recommendation scale ranges from 1 to 5, where 1 signifies a Strong Buy, and 5 indicates a Sell.

GuruFocus GF Value Analysis

According to GuruFocus estimates, the projected GF Value for Palo Alto Networks Inc (PANW, Financial) in one year is $193.22. This implies a modest 1.05% upside from the current share price of $191.205. The GF Value represents GuruFocus' fair market value estimation, derived from historical trading multiples, past business growth, and future performance forecasts. For more comprehensive insights, visit the Palo Alto Networks Inc (PANW) Summary page.