Wells Fargo & Co. (WFC, Financial) highlighted continued strength in its credit performance during the second quarter, noting improvements in this area. The company also confirmed its capability to maintain share buybacks, indicating financial stability and confidence in its stock value.

Moreover, debit card spending has remained robust, suggesting consumer confidence and steady transactional activity. However, the mortgage market presents a contrasting picture, as it continues to lag behind historical performance levels, reflecting broader market challenges in this sector.

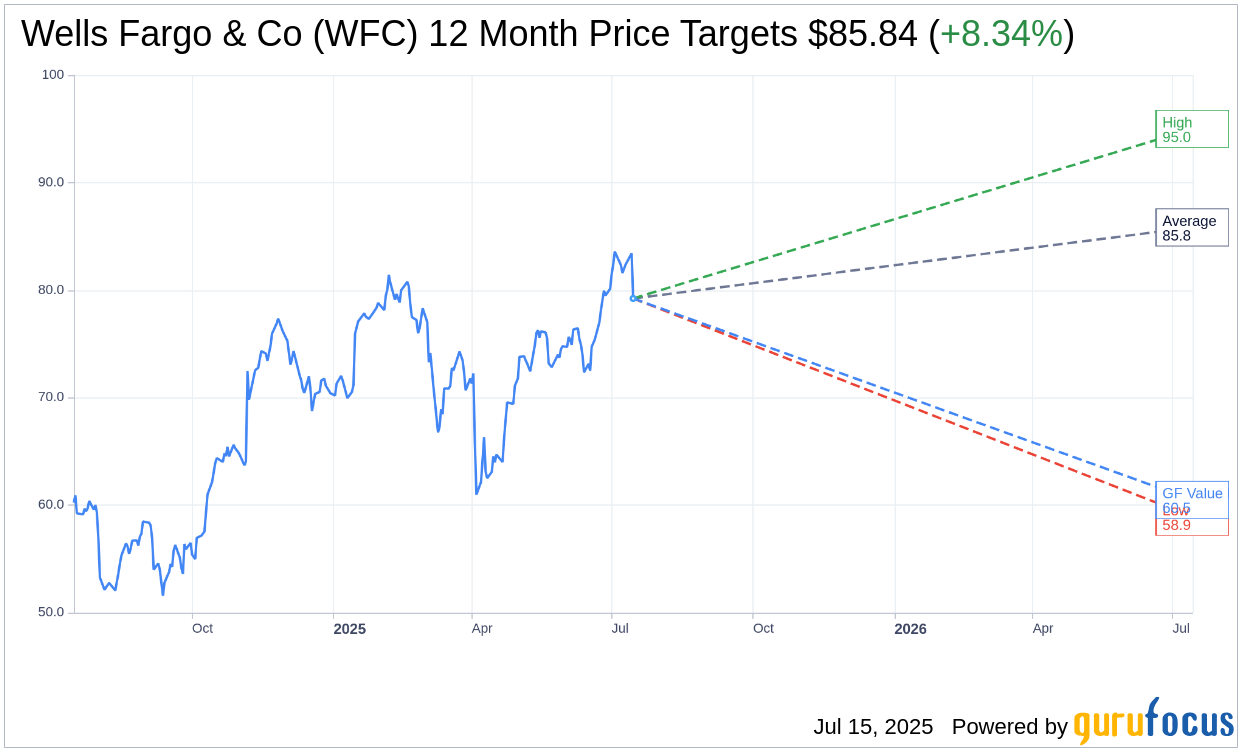

Wall Street Analysts Forecast

Based on the one-year price targets offered by 22 analysts, the average target price for Wells Fargo & Co (WFC, Financial) is $85.84 with a high estimate of $95.00 and a low estimate of $58.92. The average target implies an upside of 8.34% from the current price of $79.23. More detailed estimate data can be found on the Wells Fargo & Co (WFC) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, Wells Fargo & Co's (WFC, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Wells Fargo & Co (WFC, Financial) in one year is $60.49, suggesting a downside of 23.65% from the current price of $79.23. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Wells Fargo & Co (WFC) Summary page.