Ramaco Resources (METC, Financial) witnessed a significant increase in options trading activity, with a total of 9,299 call options exchanged—three times the usual amount. This spike in activity coincided with a rise in implied volatility, which climbed nearly 3 points to reach 100.85%. Among the options, the August 25th 16 puts and September 25th 30 calls saw the highest trading volumes, collectively accounting for approximately 4,300 contracts. The Put/Call Ratio currently stands at 0.42. The company is anticipated to report its earnings on August 7th.

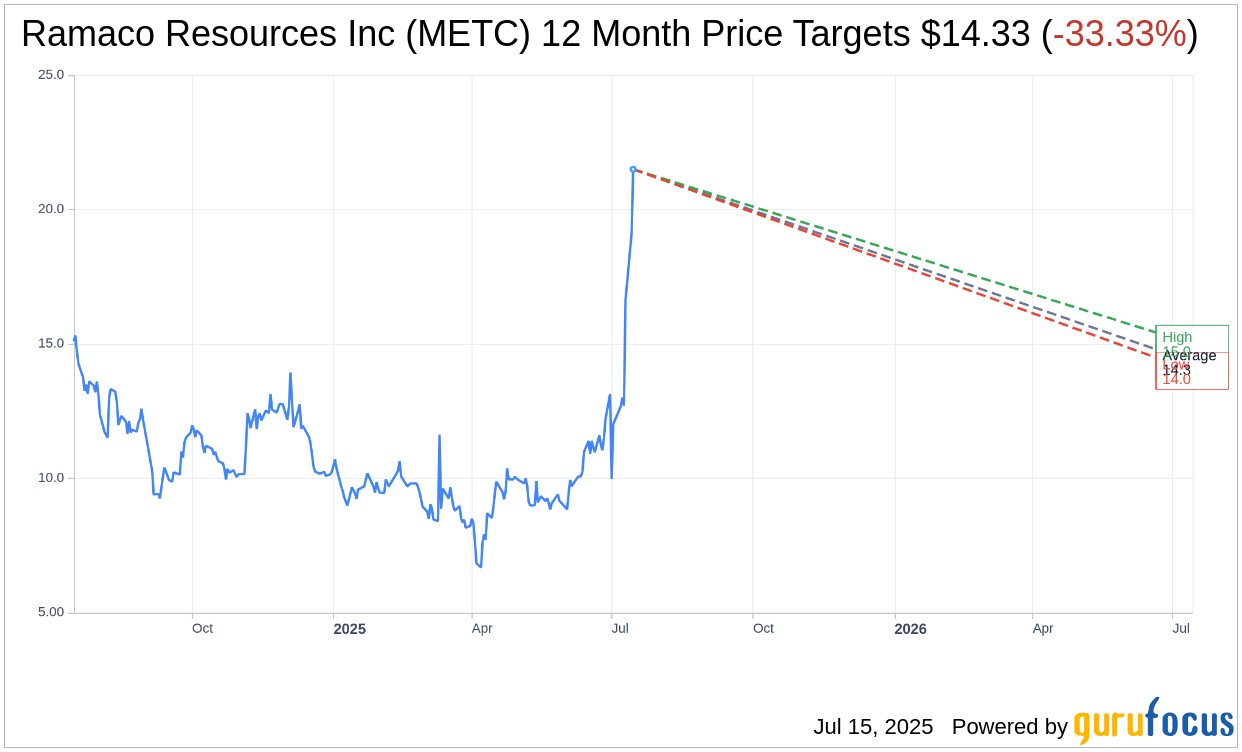

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Ramaco Resources Inc (METC, Financial) is $14.33 with a high estimate of $15.00 and a low estimate of $14.00. The average target implies an downside of 33.33% from the current price of $21.50. More detailed estimate data can be found on the Ramaco Resources Inc (METC) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Ramaco Resources Inc's (METC, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ramaco Resources Inc (METC, Financial) in one year is $10.57, suggesting a downside of 50.84% from the current price of $21.5. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ramaco Resources Inc (METC) Summary page.

METC Key Business Developments

Release Date: May 12, 2025

- Adjusted EBITDA: $10 million in Q1 2025, down from $29 million in Q4 2024.

- Net Loss: $9 million in Q1 2025, compared to a net income of $4 million in Q4 2024.

- Class A EPS: $0.19 loss in Q1 2025 versus a $0.06 gain in Q4 2024.

- Cash Cost per Ton Sold: Under $100 for the second straight quarter.

- Quarterly Production: Record level, annualizing to 4 million tons despite weather impacts.

- Liquidity: $118 million as of March 31, 2025, up almost 25% year on year.

- 2025 Production Guidance: Reduced to 3.9 million to 4.3 million tons from 4.2 million to 4.6 million tons.

- 2025 Sales Guidance: Reduced to 4.1 million to 4.5 million tons from 4.4 million to 4.8 million tons.

- CapEx Guidance: Reduced to $55 million to $65 million from $60 million to $70 million.

- Cash SG&A Guidance: Increased to $36 million to $40 million from $34 million to $38 million.

- DDA Guidance: Reduced to $71 million to $76 million from $73 million to $78 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ramaco Resources Inc (METC, Financial) achieved the highest cash margins per ton and the highest realized sales price among its publicly traded peer group in Q1 2025.

- The company set a quarterly production record with 1 million tons produced, annualizing to 4 million tons, despite challenging weather conditions.

- Ramaco Resources Inc (METC) maintained cash costs per ton sold under $100 for the second consecutive quarter, placing it in the first quartile of the US coal met producers' cost curve.

- The company is poised to expand production by an additional 2 million tons when market conditions improve, with plans for a deep mine expansion and new mining sections.

- Ramaco Resources Inc (METC) is advancing its Brook Mine Rare Earth Project, with plans to become a major critical minerals producer, leveraging a significant domestic rare earth deposit.

Negative Points

- The company experienced a decline in earnings due to falling US and Australian met coal prices, despite strong operational performance.

- Ramaco Resources Inc (METC) reduced its 2025 production and sales guidance due to weak market conditions, opting not to force tons into the spot market.

- The company faced production setbacks due to extreme weather conditions, losing approximately 150,000 tons of production in Q1 2025.

- Q1 2025 adjusted EBITDA decreased to $10 million from $29 million in Q4 2024, with a net loss of $9 million compared to a net income of $4 million in the previous quarter.

- The company anticipates continued weak market conditions, with Q2 2025 sales projected to be similar to Q1 levels, impacting cash market costs.