Quick Highlights:

- XPeng (XPEV, Financial) has set ambitious hiring targets for 2025, aiming to strengthen its AI and smart driving capabilities.

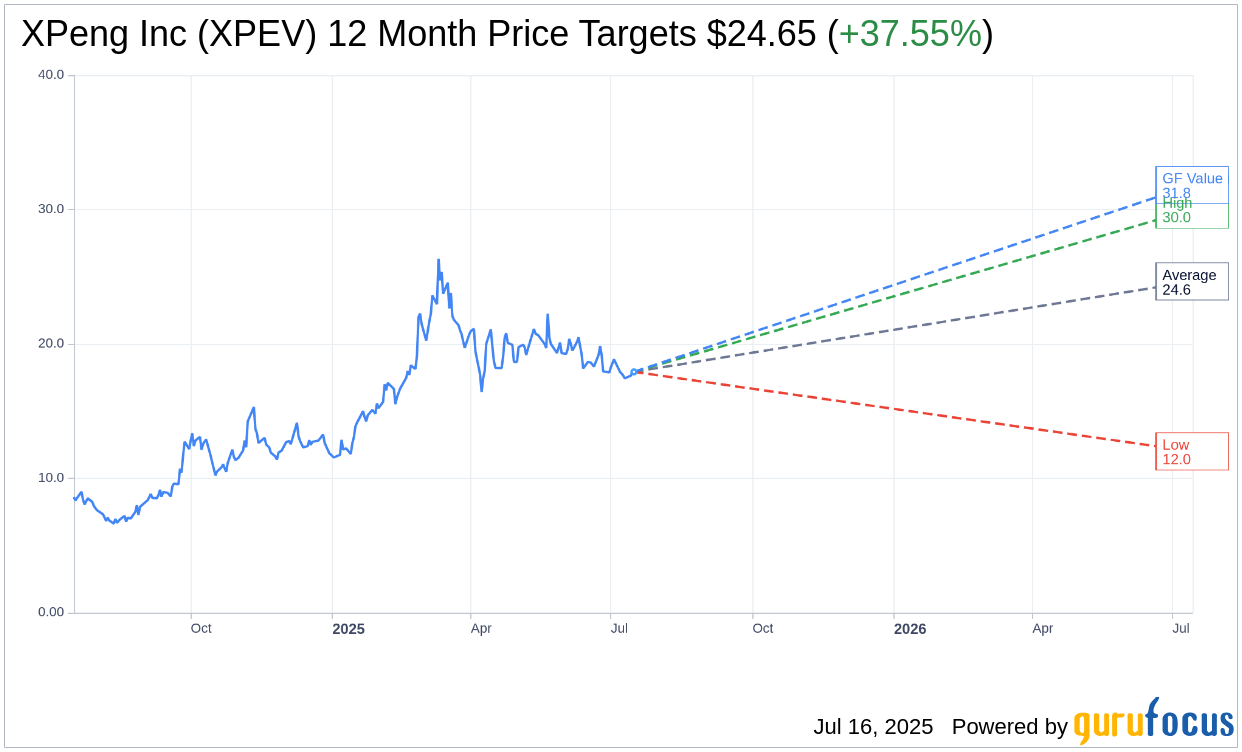

- Analysts suggest an average price target of $24.65, indicating significant potential upside.

- GuruFocus metrics imply a notable increase in valuation, forecasting a GF Value of $31.82.

XPeng (XPEV) is ramping up its workforce with a new hiring target of 8,000 employees by 2025, an increase from its initial goal of 6,000. This strategic move is designed to enhance the company’s smart driving and AI capabilities, positioning XPeng at the forefront of global AI automotive innovation.

Analyst Predictions and Price Targets

The average price target set by 25 Wall Street analysts for XPeng Inc (XPEV, Financial) is $24.65, with projections ranging from a high of $30.00 to a low of $12.00. This average target suggests a potential upside of 37.55% from the current trading price of $17.92. For comprehensive analysis, investors can visit the XPeng Inc (XPEV) Forecast page.

According to the consensus recommendation from 26 brokerage firms, XPeng Inc (XPEV, Financial) holds an average brokerage recommendation of 2.1, reflecting an "Outperform" status. This rating is positioned on a scale from 1 to 5, where a rating of 1 indicates a Strong Buy, and 5 represents a Sell.

Future Valuation Insights from GuruFocus

GuruFocus projects the estimated GF Value for XPeng Inc (XPEV, Financial) to be $31.82 in one year, indicating a promising upside of 77.57% from its current price of $17.92. The GF Value is GuruFocus' calculation of what the stock should be valued at, derived from historical trading multiples, past business growth, and future performance estimates. Detailed information is available on the XPeng Inc (XPEV) Summary page.