- ASML Holding (ASML, Financial) shares declined by over 6% following a company announcement of no anticipated growth in 2026.

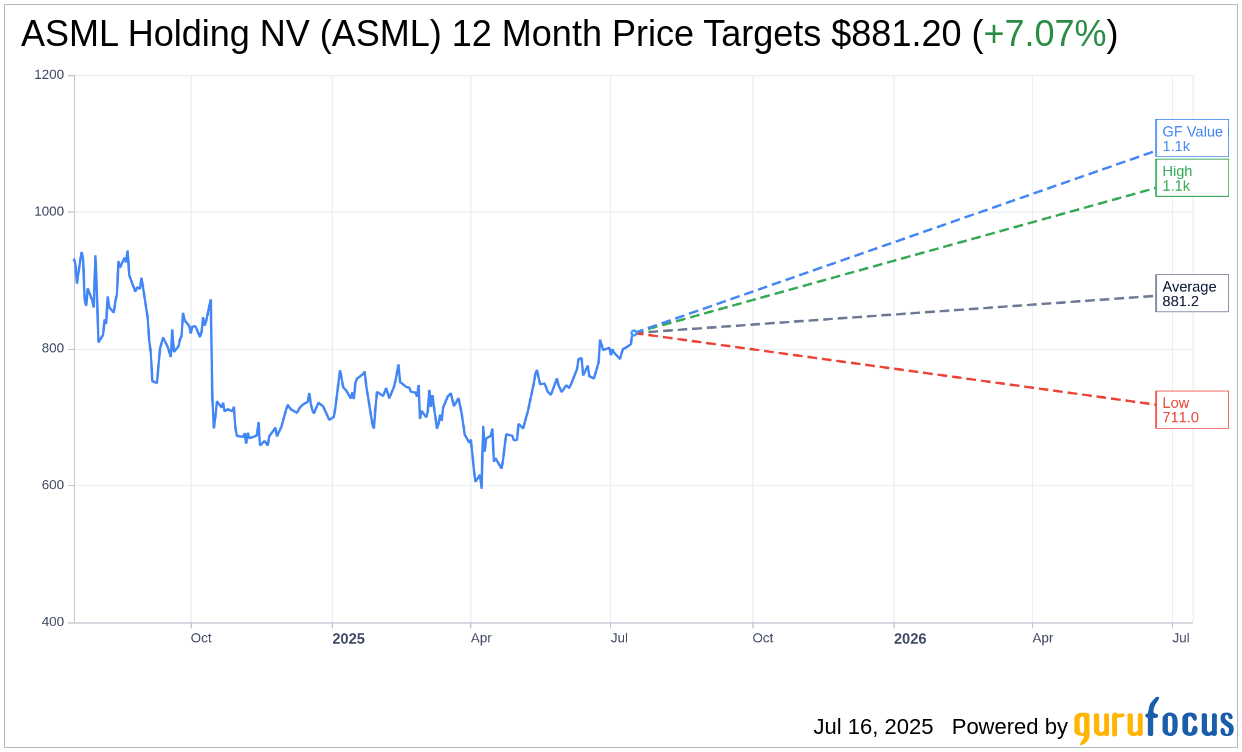

- Wall Street analysts offer an average one-year price target of $876.13, implying a potential 6.45% gain from current levels.

- The stock is rated "Outperform" by brokerage firms, with a GuruFocus GF Value estimate suggesting a 34.65% upside.

ASML Holding (ASML) recently faced a notable setback in its share price, dropping more than 6% after the company revealed its projections for 2026, which do not foresee any growth. This announcement triggered a wave of selling, despite overall market movements influenced by mixed inflation data.

Wall Street Analysts' Insights

According to 12 analysts providing one-year price targets for ASML Holding NV (ASML, Financial), the average target stands at $876.13. This target reflects a potential upside of 6.45% from the current trading price of $823.02. The highest estimate is $1,044.01, while the lowest is $706.91. For more comprehensive estimate data, visit the ASML Holding NV (ASML) Forecast page.

Currently, 16 brokerage firms have an average recommendation for ASML Holding NV (ASML, Financial) of 2.0, signifying an "Outperform" status. The scale for ratings ranges from 1 to 5, where 1 indicates a Strong Buy, and 5 suggests a Sell position.

GuruFocus Valuation

Based on GuruFocus estimates, the projected GF Value for ASML Holding NV (ASML, Financial) in the coming year is $1,108.17. This estimation suggests a substantial 34.65% upside from the current price of $823.02. The GF Value represents GuruFocus' analysis of the stock's fair trading value, derived from historical multiples, past business growth, and future business performance projections. For further detailed data, explore the ASML Holding NV (ASML) Summary page.