Piper Sandler has adjusted its price target for Hancock Whitney (HWC, Financial), moving it up to $72 from $70, while maintaining an Overweight rating on the stock. This decision reflects the company's solid performance in the second quarter, which was highlighted by approximately 6% loan growth on a linked-quarter annualized basis. Additionally, the firm acknowledges improvements in asset quality and significant advancements following the acquisition of Sabal Trust Company. These factors contribute to a positive outlook for Hancock Whitney's future performance.

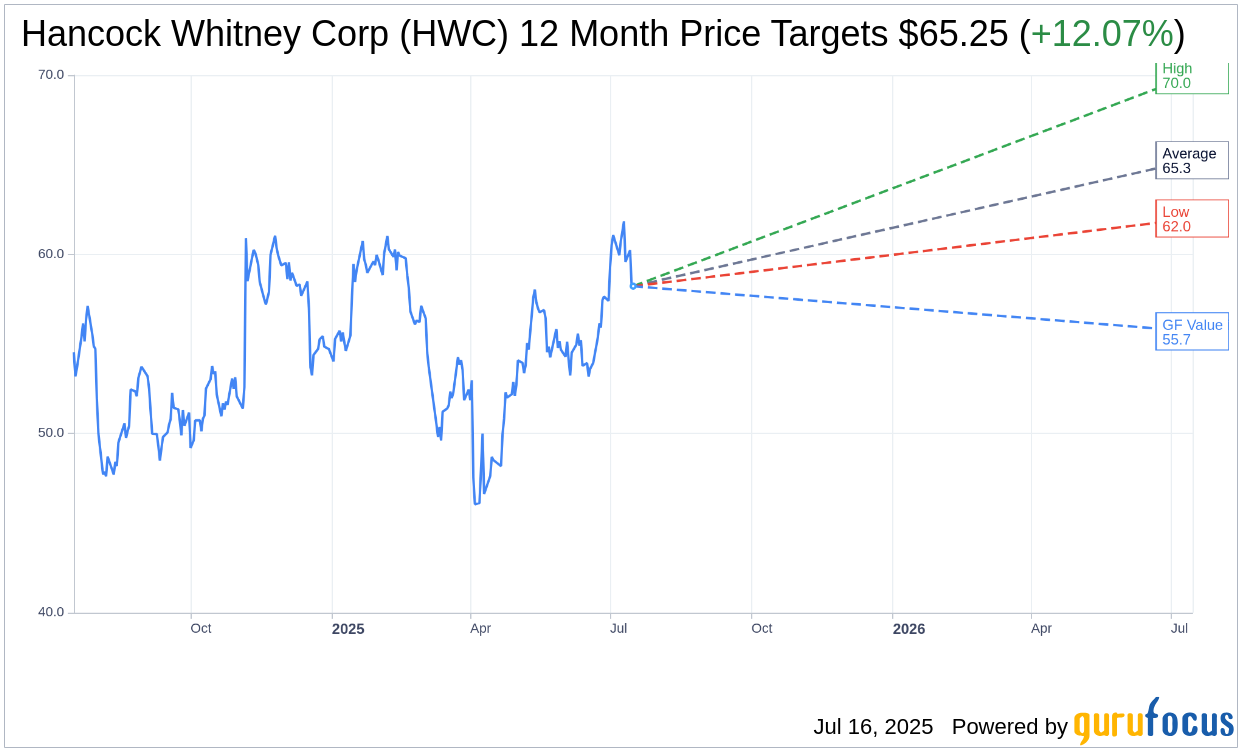

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Hancock Whitney Corp (HWC, Financial) is $65.25 with a high estimate of $70.00 and a low estimate of $62.00. The average target implies an upside of 12.07% from the current price of $58.22. More detailed estimate data can be found on the Hancock Whitney Corp (HWC) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Hancock Whitney Corp's (HWC, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Hancock Whitney Corp (HWC, Financial) in one year is $55.70, suggesting a downside of 4.33% from the current price of $58.22. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Hancock Whitney Corp (HWC) Summary page.

HWC Key Business Developments

Release Date: July 15, 2025

- Net Interest Margin (NIM): Expanded by 6 basis points.

- Return on Assets (ROA): Achieved 1.37% after adjustments.

- Loan Growth: Increased by $364 million or 6% annualized.

- Deposits: Decreased by $148 million.

- Fee Income: Increased by $4 million or 4%.

- Efficiency Ratio: Improved to 54.91% from 55.22% last quarter.

- Adjusted Net Income: $118 million or $1.37 per share.

- Net Interest Income (NII): Increased by $7 million or 2%.

- Common Equity Tier 1 Ratio: 14.03%.

- Tangible Common Equity (TCE): 9.84%.

- Share Repurchases: 750,000 shares repurchased.

- Allowance for Credit Losses: 1.45% of loans.

- Nonaccrual Loans: Decreased by 9% to $95 million.

- Net Charge-Offs: 31 basis points.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Hancock Whitney Corp (HWC, Financial) reported a strong second quarter with a net income of $118 million, reflecting a focus on profitability and efficiency.

- The company achieved a 6 basis point expansion in net interest margin (NIM) and a return on assets (ROA) of 1.37%, indicating improved financial performance.

- Loan growth was robust, with an increase of $364 million or 6% annualized, driven by stronger demand and increased line utilization.

- Fee income grew by 4%, with trust fees being a significant contributor, bolstered by the acquisition of Sabal Trust Company.

- HWC continued to return capital to shareholders by repurchasing 750,000 shares, maintaining strong capital ratios with a common equity Tier 1 ratio of 14.03%.

Negative Points

- Deposits decreased by $148 million, primarily due to a decline in CDs and public funds, reflecting challenges in deposit retention.

- The cost of funds was slightly unfavorable due to an increase in other borrowings, impacting overall financial efficiency.

- Net charge-offs increased to 31 basis points, indicating some pressure on credit quality despite a diverse loan portfolio.

- The construction and development loan book experienced a decline, with expectations for growth not materializing until late 2025 or early 2026.

- The macroeconomic environment remains dynamic, posing potential challenges to future growth and financial stability.