Windtree Therapeutics (WINT, Financial) has entered into a significant $60 million securities purchase agreement, primarily led by Build and Build Corp. This deal holds the potential to expand by an additional $140 million through future subscriptions, reaching a total of $200 million. The funds acquired, anticipated to be in cash, Osprey BNB Chain Trust shares, and BNB, are intended to support a strategic foray into the BNB digital asset sector. Upon meeting shareholder approval and closing conditions, Windtree will emerge as the first NASDAQ-listed entity to offer direct access to the BNB token, which ranks as the fifth-largest blockchain by market cap.

This initiative aims to provide both retail and institutional investors regulated entry into the Binance ecosystem, addressing a key market demand. The proposed BNB Crypto Treasury Strategy will encompass areas such as asset custody, security, and yield generation, positioning Windtree at the forefront of the BNB and Binance Ecosystem. The involvement of Build and Build Corp highlights confidence in Windtree's strategic direction to become a leader in the digital asset space, bringing transformative opportunities as the landscape continues to evolve.

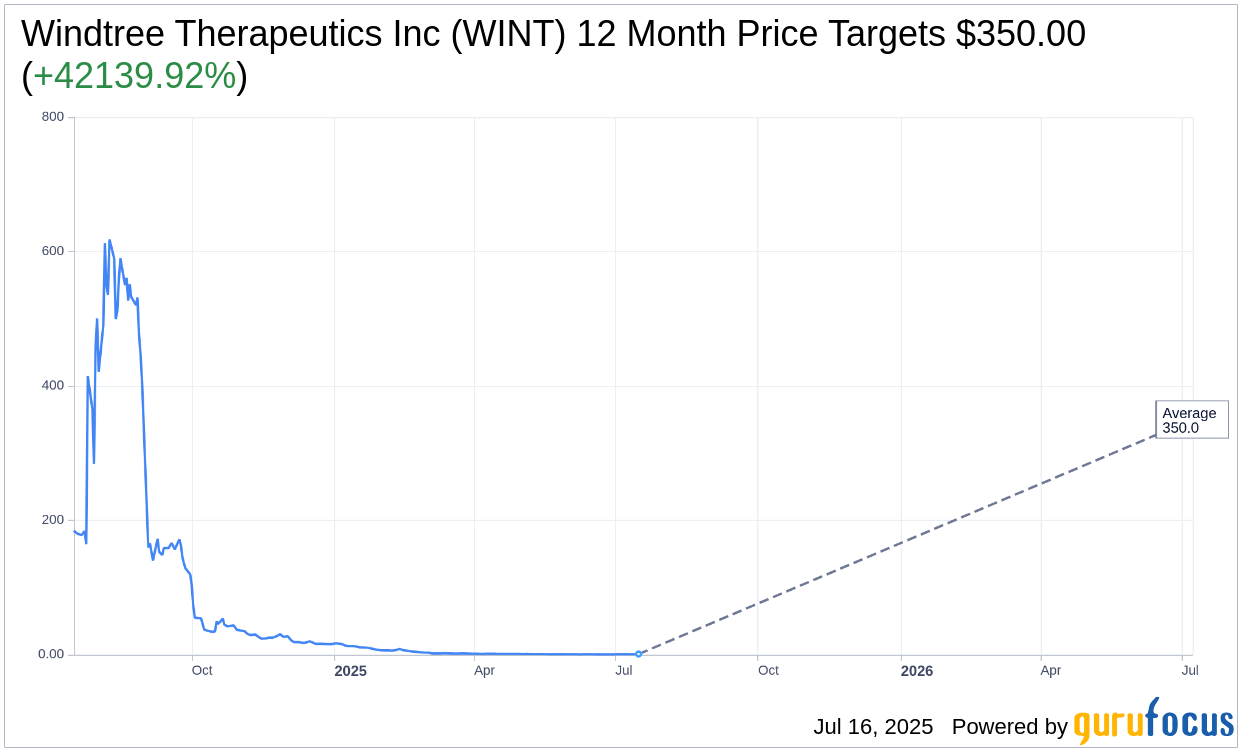

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Windtree Therapeutics Inc (WINT, Financial) is $350.00 with a high estimate of $350.00 and a low estimate of $350.00. The average target implies an upside of 42,139.92% from the current price of $0.83. More detailed estimate data can be found on the Windtree Therapeutics Inc (WINT) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Windtree Therapeutics Inc's (WINT, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.