Key Takeaways:

- Microsoft collaborates with Idaho National Laboratory to enhance nuclear permitting via Azure and AI.

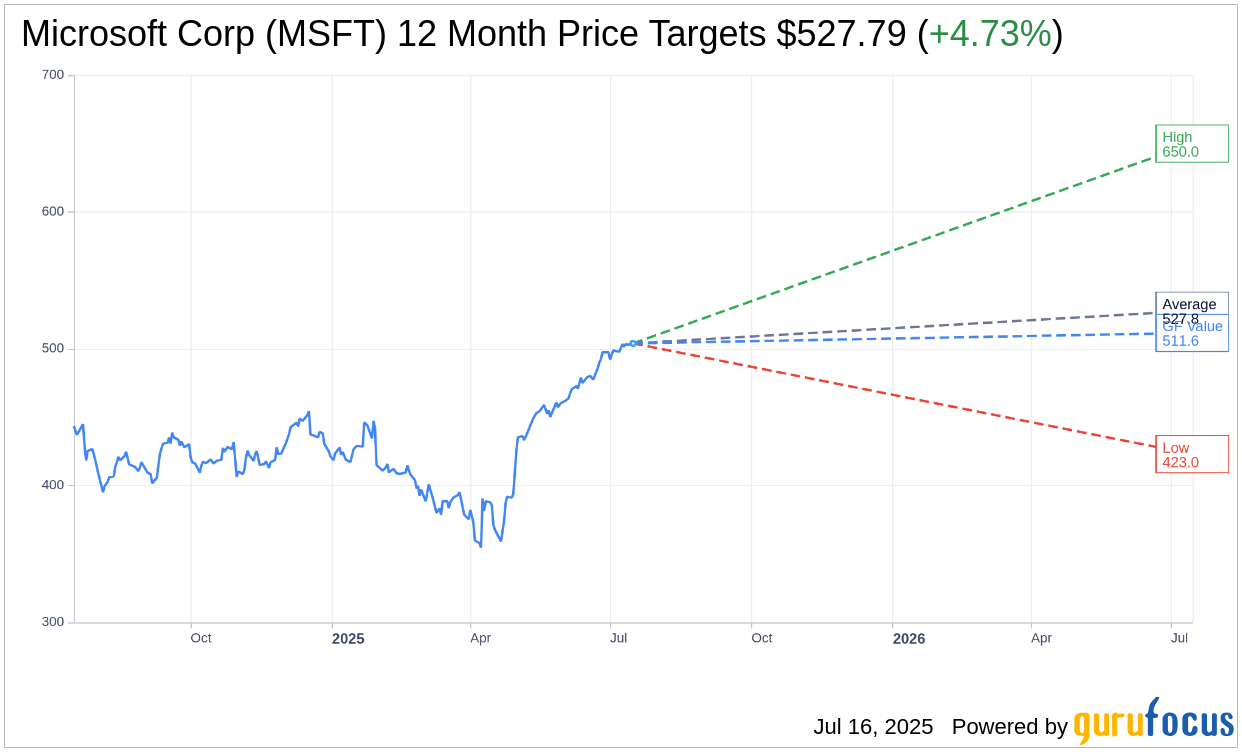

- Average analyst price target for Microsoft is $527.79, suggesting potential upside.

- Microsoft is currently rated as "Outperform" by analysts with a GF Value of $511.57.

Microsoft and Idaho National Laboratory Partnership

In a notable collaboration, Microsoft (MSFT, Financial) joins forces with Idaho National Laboratory to revolutionize nuclear permitting. By leveraging Azure cloud and cutting-edge AI technologies, the partnership aims to streamline the intricate process of developing engineering and safety analysis reports. This initiative supports the efforts of the U.S. Nuclear Regulatory Commission and the Department of Energy in advancing reactor licensing.

Wall Street Analysts' Forecasts

According to predictions from 50 analysts, the average one-year price target for Microsoft Corp (MSFT, Financial) stands at $527.79. This assessment offers a range from a high of $650.00 to a low of $423.00, indicating an implied upside of 4.73% from the current price of $503.94.

Brokerage Recommendations

The consensus among 62 brokerage firms places Microsoft Corp (MSFT, Financial) in the "Outperform" category, with an average recommendation of 1.7 on a 1 to 5 scale, where 1 represents a Strong Buy and 5 indicates a Sell. This insight provides investors a robust basis for evaluating Microsoft's stock potential.

GuruFocus Valuation Metrics

From the perspective of GuruFocus estimates, Microsoft's GF Value is projected at $511.57 in one year. This valuation suggests a modest upside of 1.52% from the current price of $503.935. The GF Value metric considers historical trading multiples, past growth, and future business performance estimates. Additional insights are available on the Microsoft Corp (MSFT, Financial) Summary page.