McEwen Mining (MUX, Financial) has received an updated price target from National Bank. The firm's analysts have raised their target to C$21.50, up from the previous C$21.25, while maintaining an Outperform rating on the stock. This adjustment reflects the bank's continued positive outlook on the company's performance and potential in the market.

Wall Street Analysts Forecast

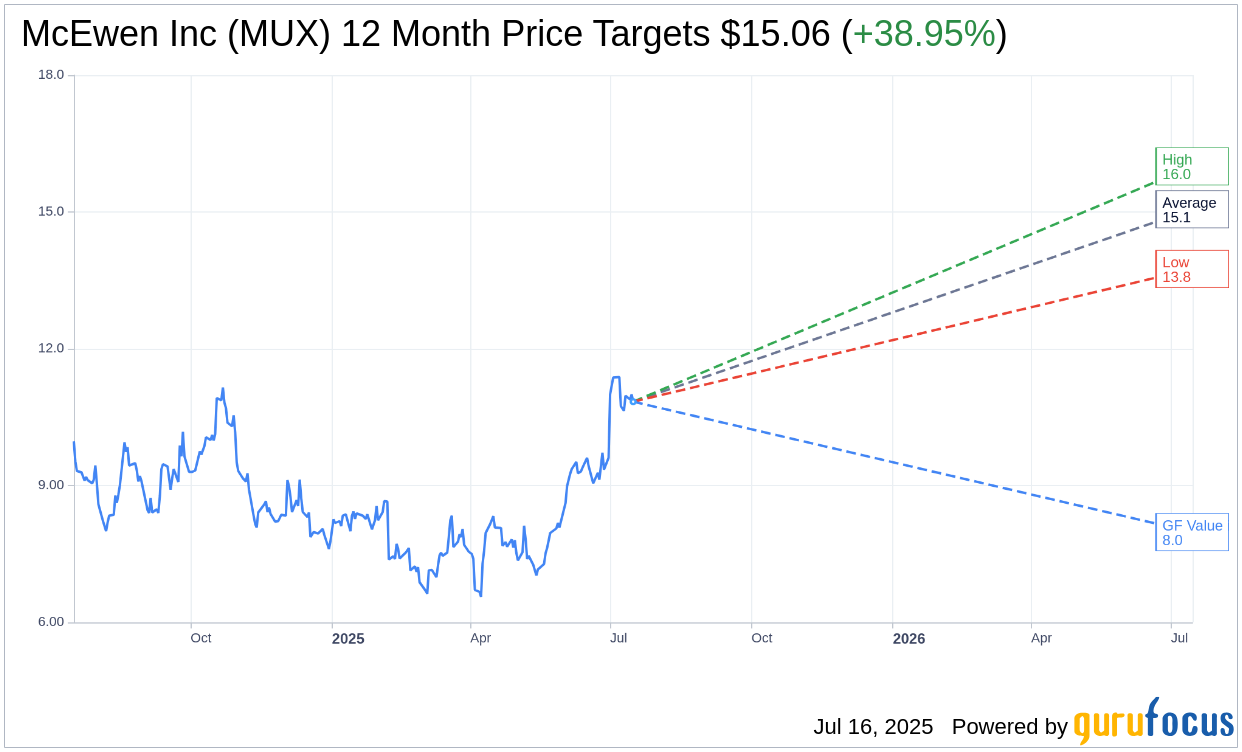

Based on the one-year price targets offered by 4 analysts, the average target price for McEwen Inc (MUX, Financial) is $15.06 with a high estimate of $16.00 and a low estimate of $13.75. The average target implies an upside of 38.95% from the current price of $10.84. More detailed estimate data can be found on the McEwen Inc (MUX) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, McEwen Inc's (MUX, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for McEwen Inc (MUX, Financial) in one year is $7.98, suggesting a downside of 26.38% from the current price of $10.84. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the McEwen Inc (MUX) Summary page.

MUX Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- McEwen Mining Inc (MUX, Financial) has increased its liquidity through a cap call convertible note, reducing potential share dilution.

- The company expects a significant increase in consolidated annual production by 2030, potentially reaching 225,000 to 255,000 ounces, an over 80% increase from current levels.

- Goldbar produced 10% more gold than budgeted at a cash cost 24% below the low end of annual guidance.

- The company reported a 68% increase in gross profit and a 38% increase in adjusted EBITDA compared to Q1 2024.

- Exploration activities at the Fox Complex and Gold Bar are yielding positive results, with promising growth in resources at Gray Fox.

Negative Points

- The Fox Complex experienced operational challenges with lower than budgeted production and higher costs per ounce.

- Goldbar's all-in sustaining cost per ounce was approximately $2,200, significantly higher due to accelerated stripping costs.

- McEwen Copper's treasury is below $10 million, indicating a need for additional financing to complete the feasibility study.

- The company's total debt increased to $130 million from $40 million, raising concerns about financial leverage.

- The Argentine peso's strength negatively impacts reported US dollar cash costs at the San Jose mine.