Key Highlights:

- Lucid Diagnostics (LUCD, Financial) shares dropped by 8% due to impending discussions on Medicare coverage for its EsoGuard test.

- Analysts estimate a significant upside potential of 251.31% from the current stock price.

- The stock has an "Outperform" rating with a projected one-year GF Value suggesting a 341.03% increase.

Lucid Diagnostics Inc. (LUCD) is currently facing a pivotal moment as its stock price experienced an 8% decline. The downturn comes as the medical community anticipates a critical discussion on Medicare coverage for the company's EsoGuard esophageal DNA test. The conversations, set to occur at the MolDX Contractor Advisory Committee, will address Local Coverage Determination L39256 in September, potentially shaping Medicare's future stance on this innovative diagnostic tool.

Wall Street Analysts Forecast

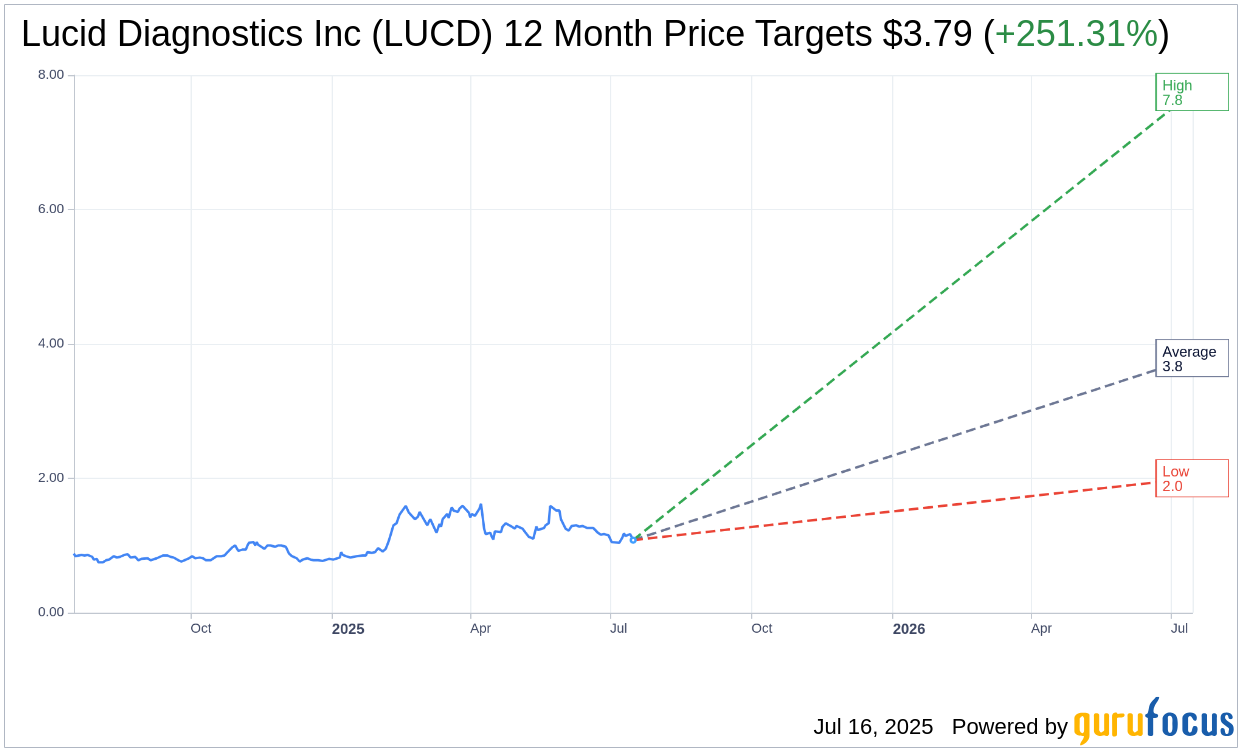

Lucid Diagnostics Inc. (LUCD, Financial) has captured the attention of Wall Street analysts, with six experts offering a one-year price target that averages at $3.79. This projection includes a high estimate of $7.75 and a low of $2.00. Given the current price of $1.08, the average target indicates an impressive potential upside of 251.31%. Investors seeking more nuanced prediction details can explore the Lucid Diagnostics Inc (LUCD) Forecast page.

The stock's "Outperform" consensus recommendation, rated at 1.8 on a scale where 1 signifies Strong Buy and 5 denotes Sell, reflects confidence among six brokerage firms. This analysis underscores a positive outlook for Lucid Diagnostics' market performance.

According to GuruFocus, the estimated GF Value for Lucid Diagnostics Inc. (LUCD, Financial) in one year is projected at $4.76. This valuation suggests a potential upside of 341.03% from the current price of $1.0793. The GF Value, derived from historical trading multiples, past business growth, and future performance estimates, represents the fair trading value of the stock. For more comprehensive insights, investors can visit the Lucid Diagnostics Inc (LUCD) Summary page.