TFIN has released its financial results for the second quarter, reporting a tangible book value per share of $19.31. Additionally, the company disclosed a CET1 capital ratio of 8.43%. In this period, TFIN achieved a net income of $3.6 million attributable to common stockholders, translating to $0.15 per diluted share. Although the quarter presented complexities, the company views it as a period with promising developments amidst the challenges.

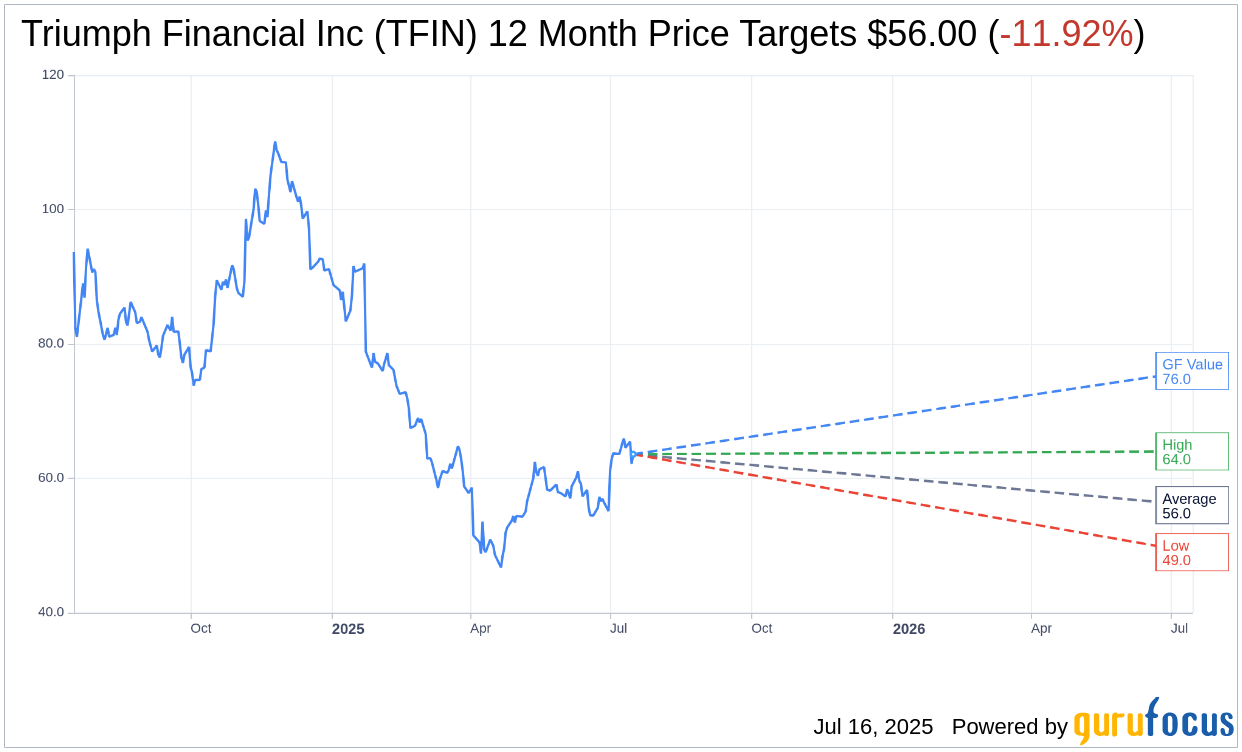

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Triumph Financial Inc (TFIN, Financial) is $56.00 with a high estimate of $64.00 and a low estimate of $49.00. The average target implies an downside of 11.92% from the current price of $63.58. More detailed estimate data can be found on the Triumph Financial Inc (TFIN) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Triumph Financial Inc's (TFIN, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Triumph Financial Inc (TFIN, Financial) in one year is $75.98, suggesting a upside of 19.5% from the current price of $63.58. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Triumph Financial Inc (TFIN) Summary page.

TFIN Key Business Developments

Release Date: April 17, 2025

- Transportation Business Metrics: Improvement in almost every reported metric.

- Payments Segment Performance: Notable improvements observed.

- Credit Quality: Improved credit quality reported.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Triumph Financial Inc (TFIN, Financial) reported improvements in almost every metric within its transportation businesses, particularly in the Payments segment.

- The company has seen an improvement in credit quality, setting a positive foundation for future growth.

- Triumph Financial Inc (TFIN) is positioned to grow revenue profitably throughout the remainder of the year despite challenging market conditions.

- There is significant potential for revenue growth from existing customer bases, particularly through the Payments segment and the integration of new technologies like LoadPay and Greenscreens.

- The company is actively working on repricing legacy clients and has seen early success in these efforts, indicating potential for increased revenue from existing contracts.

Negative Points

- The transportation market is facing strong headwinds, which could impact Triumph Financial Inc (TFIN)'s overall performance.

- The second quarter is expected to have significant noise due to the potential closing of Greenscreens and other factors, which may affect revenue clarity.

- There is uncertainty around tariffs and economic conditions, which could impact the equipment finance portfolio and overall business environment.

- Revenue growth is contingent on successfully monetizing new and existing relationships, which may not materialize as expected.

- The company faces challenges in maintaining profitability without reducing investments, which could impact long-term growth strategies.