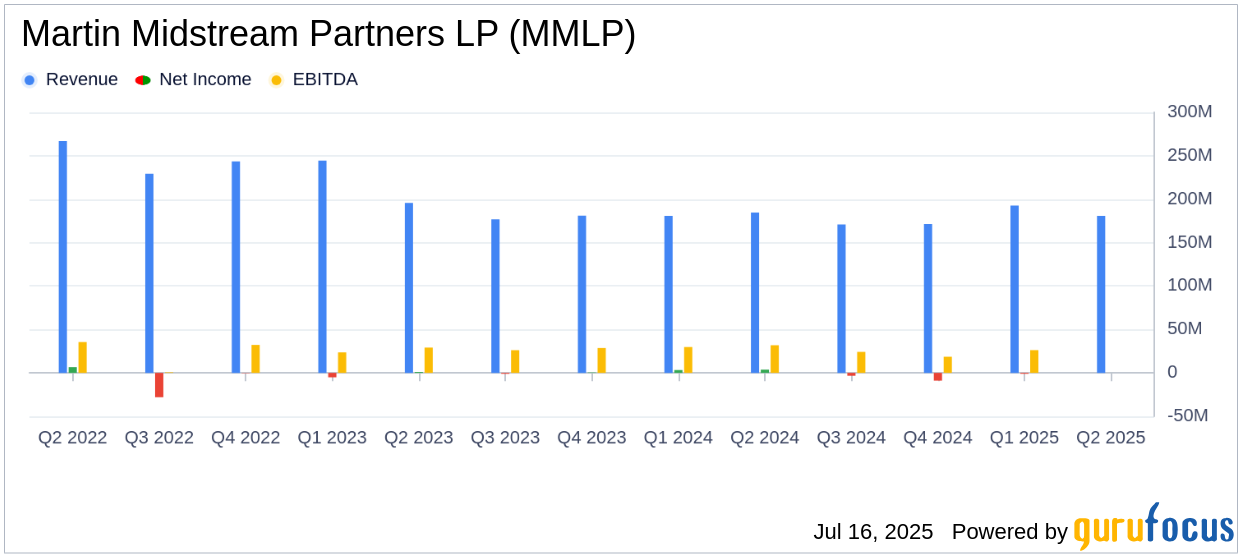

On July 16, 2025, Martin Midstream Partners LP (MMLP, Financial) released its 8-K filing detailing the financial results for the second quarter of 2025. The company reported a net loss of $2.4 million for the quarter, translating to a loss of $0.06 per unit, which fell short of the analyst estimate of $0.08 earnings per share. Revenue for the quarter was $180.7 million, also missing the estimated $199.39 million.

Company Overview

Martin Midstream Partners LP operates primarily in the United States Gulf Coast region, focusing on terminalling, processing, storage, and packaging services for petroleum products and by-products. The company also provides land and marine transportation services, sulfur and sulfur-based products processing, and natural gas liquids marketing. The majority of its revenue is derived from the Specialty Products segment.

Performance and Challenges

The company's performance in the second quarter was mixed across its segments. The Sulfur Services segment exceeded internal projections in sales volumes and margins, positioning it well for the upcoming turnaround season. However, the Transportation segment faced challenges, with marine business utilization falling below expectations due to equipment repairs, impacting cash flow. The Specialty Products segment experienced temporary volume reductions in the grease business unit, although the lubricants business performed above expectations.

Bob Bondurant, President and CEO of Martin Midstream GP LLC, commented, “The Partnership reported adjusted EBITDA of $27.1 million for the quarter. Based on performance over the first half of the year, we are reaffirming our full year adjusted EBITDA guidance of $109.1 million. However, we remain cautious and continue to closely monitor the potential impacts of the proposed tariffs.”

Financial Achievements and Industry Context

Despite the challenges, Martin Midstream Partners LP maintained its full-year adjusted EBITDA guidance of $109.1 million. The company declared a quarterly cash dividend of $0.005 per common unit. These financial achievements are crucial for maintaining investor confidence and ensuring the company's ability to navigate the volatile oil and gas industry.

Key Financial Metrics

| Metric | Q2 2025 | Q2 2024 |

|---|---|---|

| Net Income (Loss) | $(2.4) million | $3.8 million |

| Adjusted EBITDA | $27.1 million | $31.7 million |

| Revenue | $180.7 million | $184.5 million |

The company's adjusted EBITDA of $27.1 million, although lower than the previous year's $31.7 million, highlights its ability to generate cash flow despite a challenging environment. The adjusted leverage ratio remained stable at 4.20 times, indicating a consistent approach to managing debt levels.

Analysis and Outlook

Martin Midstream Partners LP's performance in the second quarter reflects both the resilience and challenges faced by midstream companies in the oil and gas sector. The company's ability to maintain its EBITDA guidance and declare a dividend demonstrates its commitment to shareholder value. However, the missed earnings and revenue estimates underscore the need for strategic adjustments, particularly in the Transportation and Specialty Products segments.

As the company navigates the second half of the year, its focus on operational efficiency and strategic investments will be critical in overcoming industry headwinds and achieving its financial targets.

Explore the complete 8-K earnings release (here) from Martin Midstream Partners LP for further details.