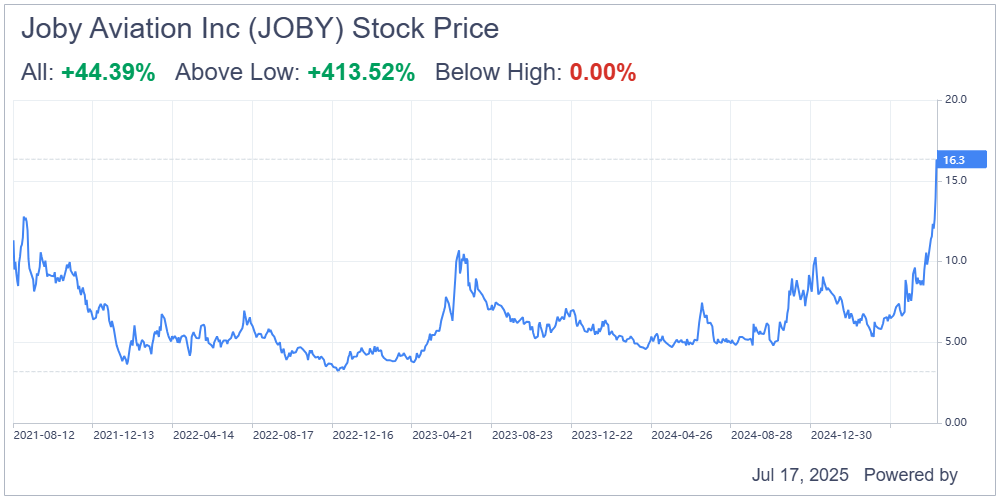

July 17 — Shares of Joby Aviation (JOBY, Financial) climbed about 17% Wednesday after the company completed piloted demonstration flights of its electric air taxis in Dubai, signaling a major step toward commercial operations.

The tests were seen as a breakthrough in the company's global expansion plans, as it eyes near-term launches in international markets. Joby said the flights were part of ongoing collaboration with Dubai's transport authorities to evaluate aerial mobility options in the region.

Separately, Joby said it would double its production capacity across facilities in Marina, California, and Dayton, Ohio. The firm aims to produce up to 24 aircraft annually.

The Marina site expansion includes upgrades to manufacturing space and final assembly lines, aligning with Joby's strategy to fast-track its commercial rollout. Production ramp-up is expected to begin in the second half of 2025.

On the financial front, the company disclosed a recent insider stock sale by a director, though no official reason was provided.

Is JOBY Stock a Buy Now?

Based on the one year price targets offered by 7 analysts, the average target price for Joby Aviation Inc is $8.71 with a high estimate of $13.00 and a low estimate of $4.00. The average target implies a downside of -46.64% from the current price of $16.33.