JPMorgan has reinstated its coverage of Hewlett Packard Enterprise (HPE, Financial), awarding it an Overweight rating and setting a price target of $30. The company has also been included in JPMorgan's Analyst Focus List. This follows HPE's acquisition of Juniper, establishing the company as a major player in the networking sector by expanding its portfolio to include switches, wireless access points, and routers.

According to the firm, HPE is currently undervalued, presenting a promising opportunity for investors. JPMorgan's analysis highlights the potential for growth at the current share price levels.

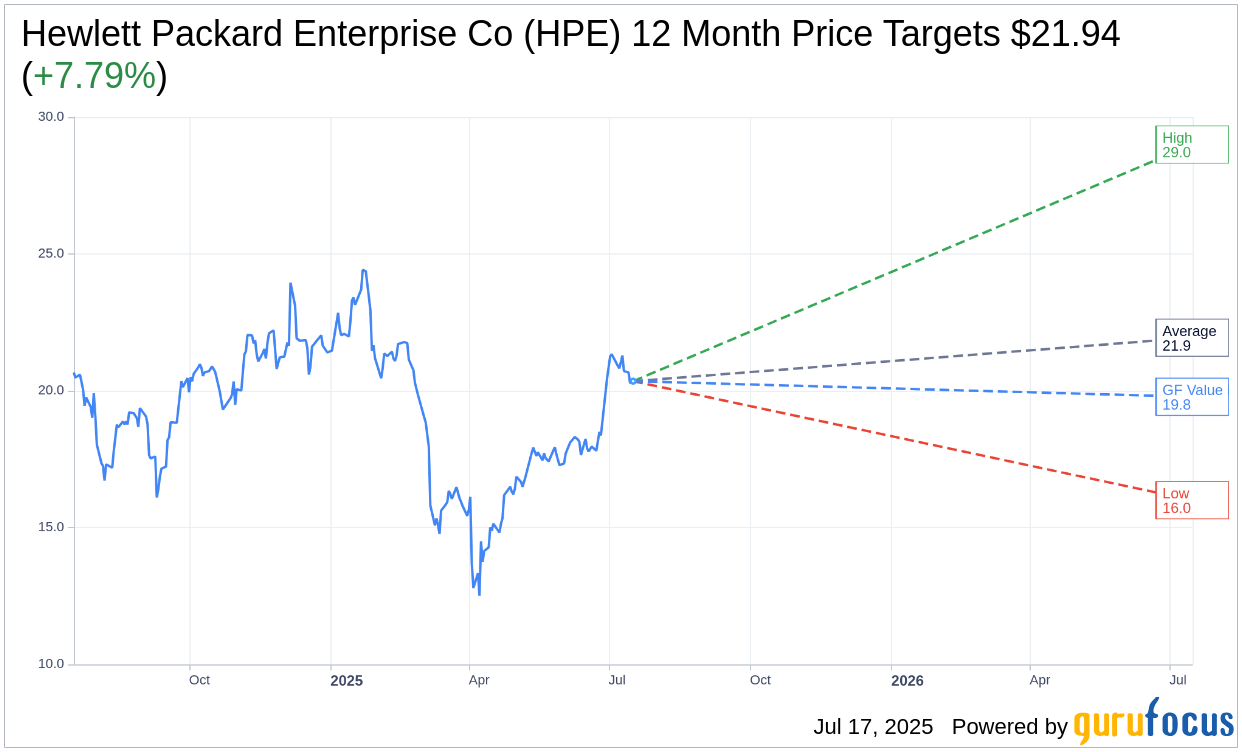

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Hewlett Packard Enterprise Co (HPE, Financial) is $21.94 with a high estimate of $29.00 and a low estimate of $16.00. The average target implies an upside of 7.79% from the current price of $20.35. More detailed estimate data can be found on the Hewlett Packard Enterprise Co (HPE) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Hewlett Packard Enterprise Co's (HPE, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Hewlett Packard Enterprise Co (HPE, Financial) in one year is $19.78, suggesting a downside of 2.8% from the current price of $20.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Hewlett Packard Enterprise Co (HPE) Summary page.

HPE Key Business Developments

Release Date: June 03, 2025

- Revenue: $7.6 billion, up 7% year over year.

- Non-GAAP Diluted Net Earnings Per Share: $0.38, above guidance.

- Operating Margin: 8%, down 150 basis points year over year.

- Free Cash Flow: Negative $847 million.

- Server Revenue: $4.1 billion, up 7% year over year.

- Intelligent Edge Revenue: $1.2 billion, up 8% year over year.

- Hybrid Cloud Revenue: $1.5 billion, up 15% year over year.

- Financial Services Revenue: $856 million, up 1% year over year.

- Annualized Revenue Run Rate (ARR): $2.2 billion, up 47% year over year.

- Gross Margin: 29.4%, down 370 basis points year over year.

- GAAP Diluted Net Loss Per Share: $0.82, due to a non-cash goodwill impairment charge.

- AI Systems Revenue: Over $1 billion, up from $900 million last quarter.

- Customer Count for GreenLake: Approximately 42,000.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Hewlett Packard Enterprise Co (HPE, Financial) delivered Q2 revenue of $7.6 billion, up 7% year over year, exceeding the high end of guidance.

- The company saw year-over-year revenue growth in every product segment, with strong performance in AI systems, Intelligent Edge, and Hybrid Cloud.

- HPE's GreenLake Cloud subscription services showed significant growth, contributing to a 47% increase in annualized revenue run rate.

- The company implemented effective measures to address previous operational challenges in the Server segment, leading to improved margin performance.

- HPE's commitment to innovation is evident with new product launches, including advanced private cloud solutions and AI partnerships with NVIDIA.

Negative Points

- HPE faced a complex macroeconomic and geopolitical landscape, impacting demand and creating uncertainty.

- Non-GAAP gross margin was down 370 basis points year over year, affected by an unfavorable mix within the Server segment.

- Free cash flow was negative $847 million, although slightly better than expected.

- The company recorded a non-cash goodwill impairment charge of approximately $1.4 billion related to its Hybrid Cloud business.

- HPE's Financial Services segment saw a 20% year-over-year decrease in financing volumes.