Marsh & McLennan Companies (MMC, Financial) announced a robust second quarter, reporting $7.0 billion in revenue, exceeding analysts' expectations of $6.93 billion. The company experienced a 12% increase in revenue, driven by consistent business momentum and successful acquisitions. Underlying revenue grew by 4%, while adjusted operating income surged by 14%, and adjusted earnings per share rose by 11%.

Furthermore, Marsh & McLennan has increased its dividend by 10%, reflecting its commitment to delivering value to shareholders. CEO John Doyle emphasized the company's ability to navigate a complex and dynamic environment while consistently executing its strategies effectively.

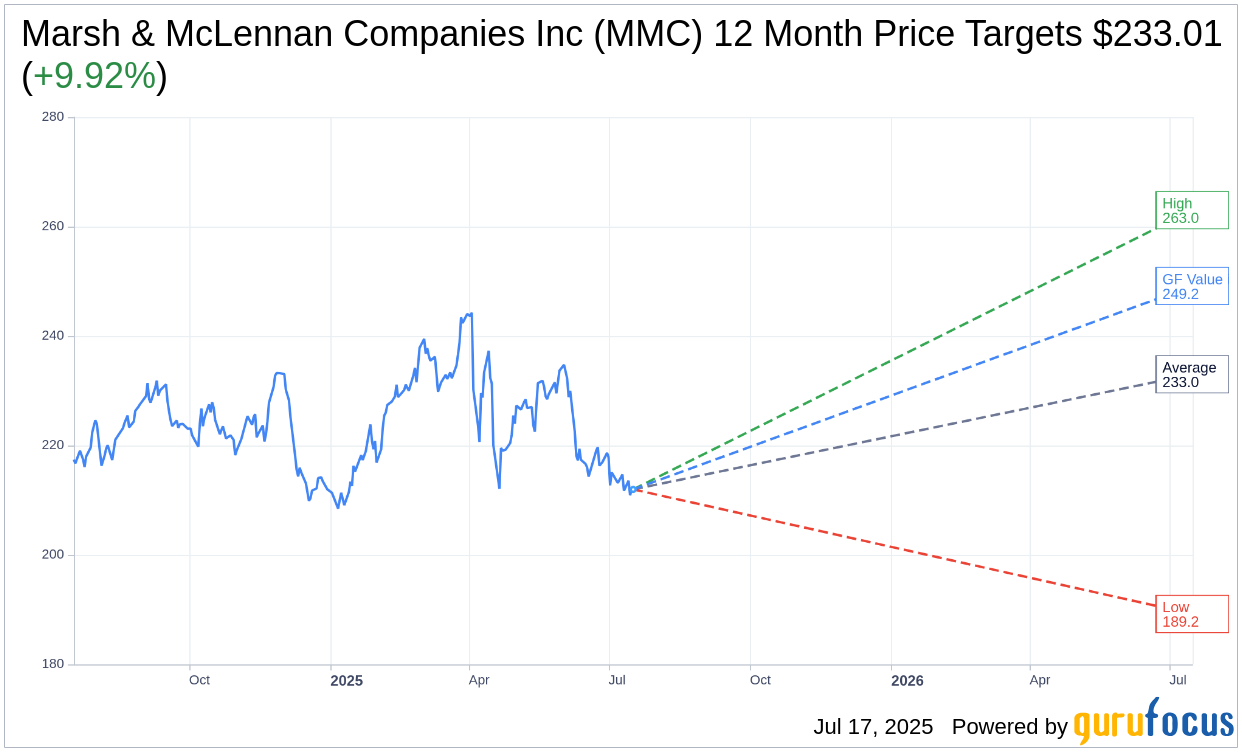

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Marsh & McLennan Companies Inc (MMC, Financial) is $233.01 with a high estimate of $263.00 and a low estimate of $189.21. The average target implies an upside of 9.92% from the current price of $211.98. More detailed estimate data can be found on the Marsh & McLennan Companies Inc (MMC) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Marsh & McLennan Companies Inc's (MMC, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Marsh & McLennan Companies Inc (MMC, Financial) in one year is $249.15, suggesting a upside of 17.53% from the current price of $211.98. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Marsh & McLennan Companies Inc (MMC) Summary page.

MMC Key Business Developments

Release Date: January 30, 2025

- Total Revenue: $24.5 billion, up 8% for 2024.

- Underlying Revenue Growth: 7% for 2024.

- Adjusted Operating Income: $6.2 billion, up 11% for 2024.

- Adjusted Operating Margin: Increased by 80 basis points to 26.8% for 2024.

- Adjusted EPS: $8.80, up 10% for 2024.

- Acquisitions: $9.4 billion invested, including $7.75 billion for McGriff.

- Dividend Increase: 15% for 2024.

- Share Repurchases: $900 million completed in 2024.

- Fourth Quarter Revenue: $6.1 billion, up 9%.

- Fourth Quarter Adjusted EPS: $1.87, up 11%.

- Risk & Insurance Services Revenue: $15.4 billion for 2024, with 8% underlying growth.

- Consulting Revenue: $9.1 billion for 2024, with 6% underlying growth.

- Assets Under Management: $617 billion at the end of Q4 2024.

- Interest Expense: $231 million in Q4 2024.

- Cash Position: $2.4 billion at the end of Q4 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Marsh & McLennan Companies Inc (MMC, Financial) reported a strong financial performance for 2024, with total revenue growing 8% to $24.5 billion and adjusted operating income increasing by 11% to $6.2 billion.

- The company achieved its 17th consecutive year of reported margin expansion, with an 80 basis point increase in adjusted operating margin.

- Marsh & McLennan Companies Inc (MMC) had a record year of mergers and acquisitions, investing $9.4 billion, including a significant $7.75 billion acquisition of McGriff.

- The company returned significant capital to shareholders by raising its dividend by 15% and completing $900 million in share repurchases.

- Marsh & McLennan Companies Inc (MMC) continues to innovate with digital tools like Sentrisk, Blue[i], and LenAI, enhancing value for clients and colleagues.

Negative Points

- The California wildfires resulted in insured losses expected to exceed $30 billion, impacting the insurance industry significantly.

- The global insurance and reinsurance market remains dynamic, with a decrease in the Marsh Global Insurance Market Index by 2% in the fourth quarter.

- Fiduciary income is expected to face a headwind in 2025 due to anticipated short-term interest rate declines.

- The integration of McGriff is expected to be modestly dilutive to adjusted EPS in the first quarter of 2025.

- The company faces potential headwinds from foreign exchange and favorable discrete tax items in 2024, which could impact financial performance in 2025.