Needham analyst Joshua Reilly has revised Jamf Holding's (JAMF, Financial) price target, lowering it from $25 to $20, while maintaining a Buy rating on the stock. This adjustment follows the company's strategic decision to shift its investment focus, which includes a 6.4% reduction in workforce and increased emphasis on the enterprise market and AI technologies.

The company indicated that servicing small and medium-sized business (SMB) clients has become less cost-effective compared to their customer lifetime value. To address this, Jamf plans to enhance automation to boost productivity. These strategic changes are intended to better position the company within the enterprise sector, thereby guiding the adjustment in the stock's price target.

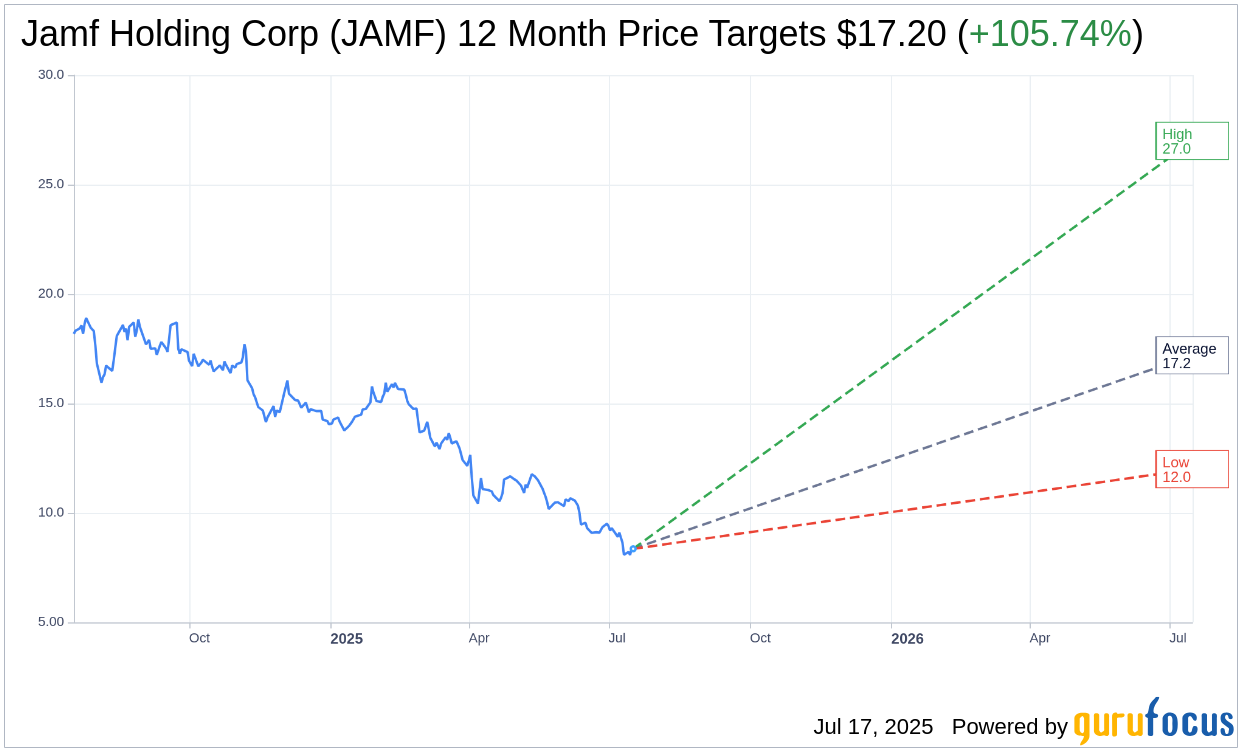

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Jamf Holding Corp (JAMF, Financial) is $17.20 with a high estimate of $27.00 and a low estimate of $12.00. The average target implies an upside of 105.74% from the current price of $8.36. More detailed estimate data can be found on the Jamf Holding Corp (JAMF) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Jamf Holding Corp's (JAMF, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Jamf Holding Corp (JAMF, Financial) in one year is $23.36, suggesting a upside of 179.43% from the current price of $8.36. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Jamf Holding Corp (JAMF) Summary page.

JAMF Key Business Developments

Release Date: May 06, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Jamf Holding Corp (JAMF, Financial) achieved a solid year-over-year revenue growth of 10% and a non-GAAP operating income margin of 22%, exceeding their outlook.

- Total Annual Recurring Revenue (ARR) grew by 9% year-over-year to $658 million, with strong new logo bookings in both commercial and education sectors.

- Security bookings were robust, driving a 17% year-over-year growth in security ARR to $162 million.

- The successful launch of new platform solutions, Jamf for Mac and Jamf for K-12, has enhanced their platform capabilities and driven strong education performance.

- The acquisition of Identity Automation is expected to enhance Jamf's Apple-first security platform, particularly in mobile-centric industries, and expand their presence in education with over 500 customers.

Negative Points

- Recurring revenue, while growing at 11%, represents 98% of total revenues, indicating a decline in less strategic sources such as services and licenses.

- The net retention rate remained flat at 104%, suggesting challenges in expanding existing customer accounts.

- Unlevered free cash flow margin decreased slightly to 12.3% due to the timing of billings and collections.

- The company faces headwinds from currency fluctuations, with a $2 to $3 million impact expected for the remainder of the year.

- Despite strong demand, the company maintained its revenue outlook due to uncertainties in the macroeconomic environment.