On July 17, 2025, Hewlett Packard (HPE, Financial) received a significant market update as JP Morgan analyst Samik Chatterjee reinstated coverage on the stock with a new price target and rating. This move is noteworthy for investors seeking insights into HPE's potential market performance.

JP Morgan has set the price target for Hewlett Packard (HPE, Financial) at USD 30.00. This target is freshly initiated, as there was no prior price target disclosed. The evaluation aligns with the 'Overweight' rating from JP Morgan, suggesting a positive outlook for HPE's market trajectory.

The 'Overweight' rating implies that, according to JP Morgan's analysis, Hewlett Packard (HPE, Financial) is expected to perform better than the average market return in the foreseeable future. The analysis did not indicate any percentage change from a previous target or rating, marking this as a fresh analysis rather than an adjustment from prior assessments.

Investors and market watchers are likely to monitor this development closely, given the influence of such updates on stock performance. As always, these insights are part of ongoing market evaluations and should be considered as one of many factors in investment decisions concerning Hewlett Packard (HPE, Financial).

Wall Street Analysts Forecast

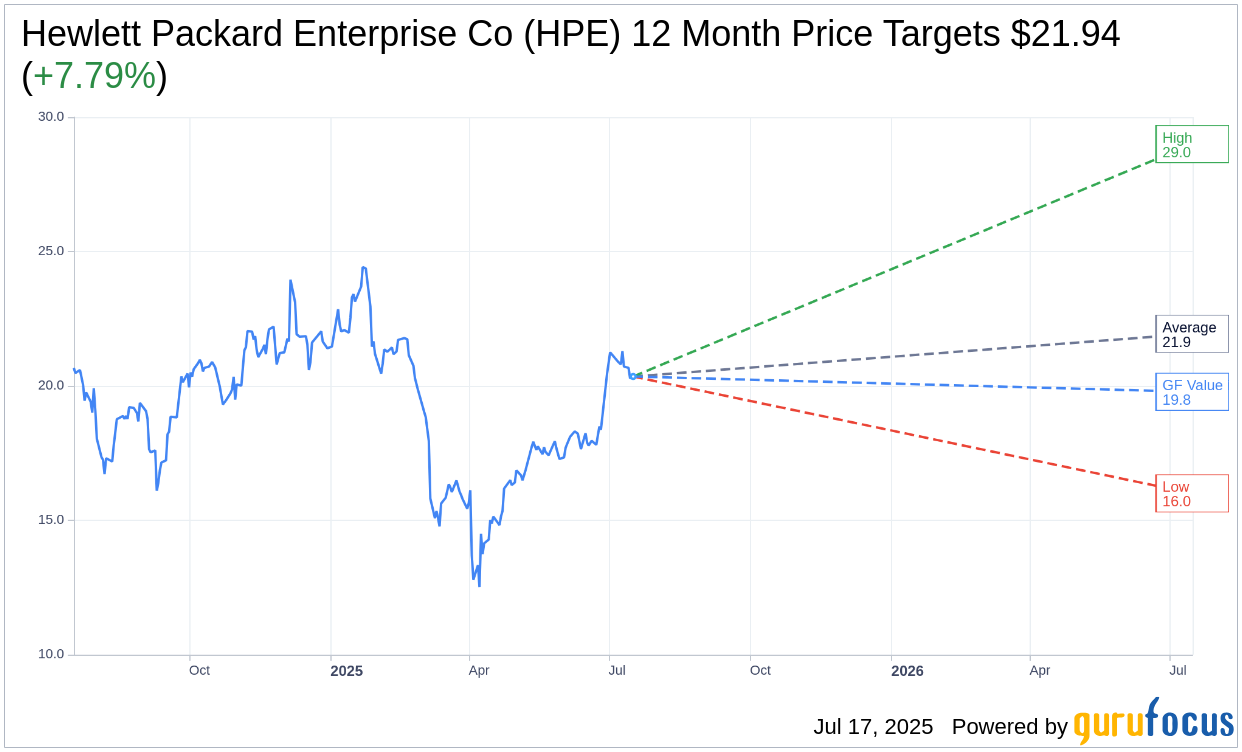

Based on the one-year price targets offered by 14 analysts, the average target price for Hewlett Packard Enterprise Co (HPE, Financial) is $21.94 with a high estimate of $29.00 and a low estimate of $16.00. The average target implies an upside of 7.79% from the current price of $20.35. More detailed estimate data can be found on the Hewlett Packard Enterprise Co (HPE) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Hewlett Packard Enterprise Co's (HPE, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Hewlett Packard Enterprise Co (HPE, Financial) in one year is $19.78, suggesting a downside of 2.8% from the current price of $20.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Hewlett Packard Enterprise Co (HPE) Summary page.