UBS has revised its price target for Colgate-Palmolive, reducing it from $109 to $106 while maintaining a Buy rating on the stock (CL, Financial). This update reflects UBS's ongoing positive outlook on the company's performance despite the slight adjustment in expected valuation. Investors continue to regard Colgate-Palmolive as a strong contender in its market sector.

Wall Street Analysts Forecast

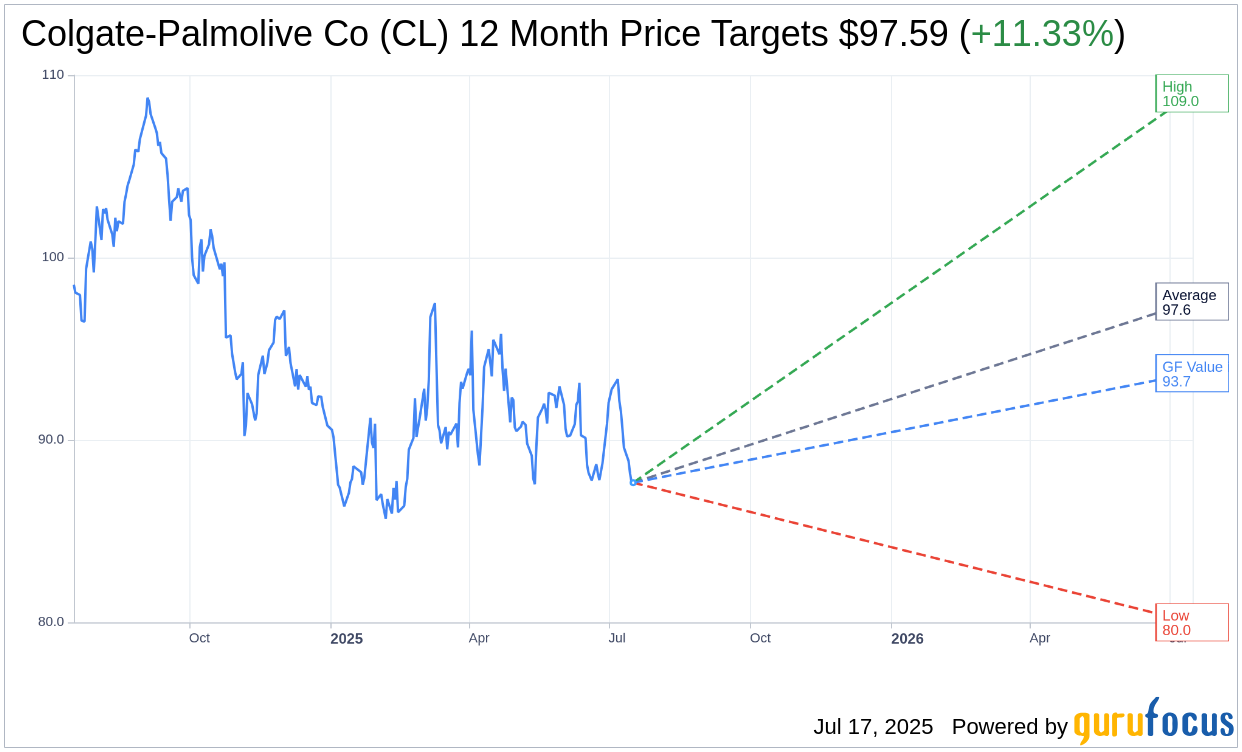

Based on the one-year price targets offered by 19 analysts, the average target price for Colgate-Palmolive Co (CL, Financial) is $97.59 with a high estimate of $109.00 and a low estimate of $80.00. The average target implies an upside of 11.33% from the current price of $87.66. More detailed estimate data can be found on the Colgate-Palmolive Co (CL) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Colgate-Palmolive Co's (CL, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Colgate-Palmolive Co (CL, Financial) in one year is $93.66, suggesting a upside of 6.84% from the current price of $87.66. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Colgate-Palmolive Co (CL) Summary page.

CL Key Business Developments

Release Date: April 25, 2025

- Tariff Impact: Incremental impact of roughly $200 million in 2025 versus initial guidance.

- Supply Chain Investment: Approximately $2 billion invested in the U.S. supply chain over the past five years.

- Advertising Spending: At an all-time high entering 2025.

- Net Debt Levels: Low levels of net debt reported.

- Profit Growth: Strong profit growth delivered despite volatility in the quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Colgate-Palmolive Co (CL, Financial) has built flexibility into its plans to navigate the volatile and uncertain market environment of 2025.

- The company is focused on delivering value-added, science-based core innovation, such as the relaunch of Colgate Total and Hill's Science Diet with ActivBiome Technology.

- Colgate-Palmolive Co (CL) has invested approximately $2 billion in its supply chain in the United States over the past five years, enhancing its ability to adapt to changing environments.

- The company has a strong balance sheet with low levels of net debt and plans to drive significant cash flow to fund growth and productivity.

- Colgate-Palmolive Co (CL) has seen strong profit growth in the first quarter despite market volatility, indicating effective management and strategy execution.

Negative Points

- The company faces challenges from weaker consumer demand and macroeconomic uncertainty, impacting volume growth.

- Tariffs announced since January are expected to have an incremental impact of roughly $200 million in 2025, posing a financial challenge.

- There has been a slowdown in category growth, particularly in the US and other global markets, affecting overall sales performance.

- Colgate-Palmolive Co (CL) is experiencing some trade down from super-premium to mid-tier products in North America, indicating consumer price sensitivity.

- The company is exiting private label production, which will be a drag on volume growth in the short term.