Key Takeaways:

- Marsh & McLennan Companies, Inc. (MMC, Financial) reported a 12% revenue increase in Q2 2025, boosted by acquisitions.

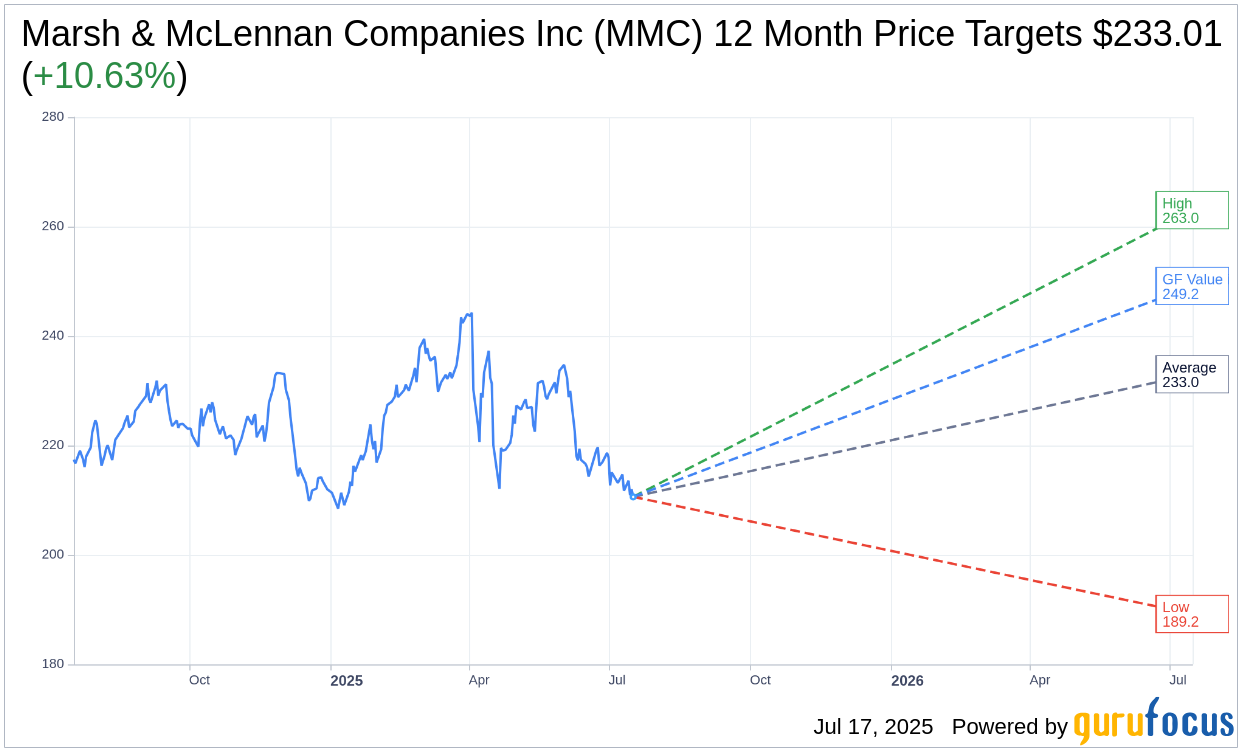

- Analysts project an average price target of $233.01, indicating a potential 10.63% upside.

- The stock's GF Value suggests an 18.29% upside from its current market price.

Marsh & McLennan Companies, Inc. (MMC), a prominent player in the financial services industry, delivered a robust performance in the second quarter of 2025. The company's revenue surged by 12%, reaching $7 billion, primarily driven by strategic acquisitions. In addition to steady revenue growth, MMC reported a 14% rise in adjusted operating income and an 11% increase in adjusted EPS, underscoring its resilience amid market headwinds and escalating litigation expenses.

Wall Street Analysts Forecast

Investor sentiment towards Marsh & McLennan remains positive, as reflected by the price targets provided by 17 financial analysts. They project an average target price of $233.01 for MMC, with estimates ranging from a high of $263.00 to a low of $189.21. This average target suggests a potential upside of 10.63% from its current trading price of $210.62. For a deeper dive into these estimations, visit the Marsh & McLennan Companies Inc (MMC, Financial) Forecast page.

Currently, the consensus recommendation from 21 brokerage firms places MMC at a "Hold" status, with an average brokerage recommendation of 2.9 on a rating scale where 1 signifies a "Strong Buy" and 5 indicates "Sell".

Furthermore, according to GuruFocus' proprietary metrics, the estimated GF Value for MMC in one year sits at $249.15. This estimation implies an 18.29% upside from its current price of $210.62. The GF Value represents GuruFocus' calculated fair value based on MMC's historical trading multiples, its business growth trajectory, and anticipated future performance. For more detailed insights, visit the Marsh & McLennan Companies Inc (MMC, Financial) Summary page.