On July 17, 2025, JP Morgan announced an adjustment to their price target for Super Micro Computer (SMCI, Financial), increasing it from $35.00 to $46.00 USD. This change represents a 31.43% increase in the target price.

The analyst responsible for this adjustment, Samik Chatterjee, maintained a 'Neutral' rating for SMCI. The previous rating also stood at 'Neutral', indicating a consistent outlook on the stock's performance despite the revised price target.

Super Micro Computer (SMCI, Financial) continues to be under close observation by investors and analysts, as reflected in JP Morgan's latest update.

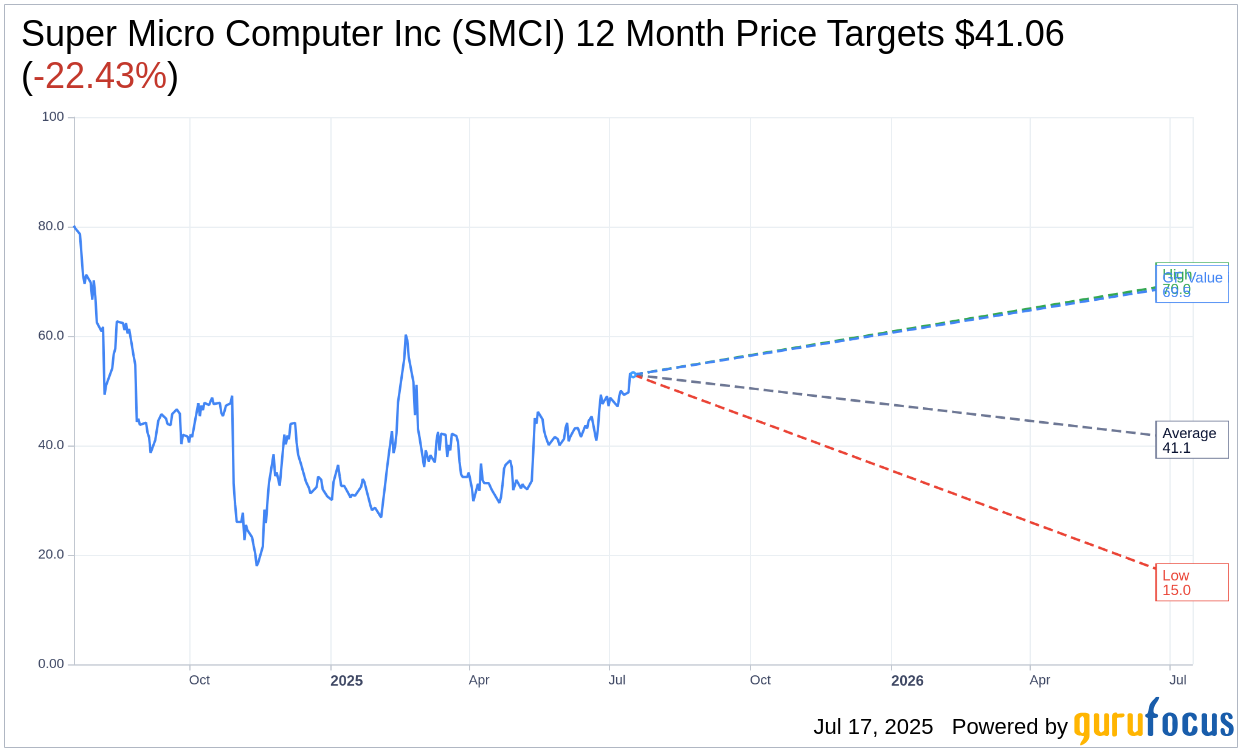

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for Super Micro Computer Inc (SMCI, Financial) is $41.06 with a high estimate of $70.00 and a low estimate of $15.00. The average target implies an downside of 22.43% from the current price of $52.93. More detailed estimate data can be found on the Super Micro Computer Inc (SMCI) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Super Micro Computer Inc's (SMCI, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Super Micro Computer Inc (SMCI, Financial) in one year is $69.53, suggesting a upside of 31.36% from the current price of $52.9316. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Super Micro Computer Inc (SMCI) Summary page.