- Texas Instruments (TXN, Financial) maintains its quarterly dividend at $1.36 per share, resulting in a forward yield of 2.51%.

- Market analysts estimate an average target price of $192.35 for TXN, indicating a potential downside from its current valuation.

- GuruFocus metrics suggest a GF Value for TXN at $168.85, hinting at an overvaluation based on the current market price.

Texas Instruments (TXN) has reaffirmed its commitment to shareholder returns by approving a quarterly dividend of $1.36 per share, consistent with its preceding payout. This dividend provides investors with a forward yield of 2.51%. Payments are due on August 12, and shareholders must be on record by July 31. The ex-dividend date is also set for July 31.

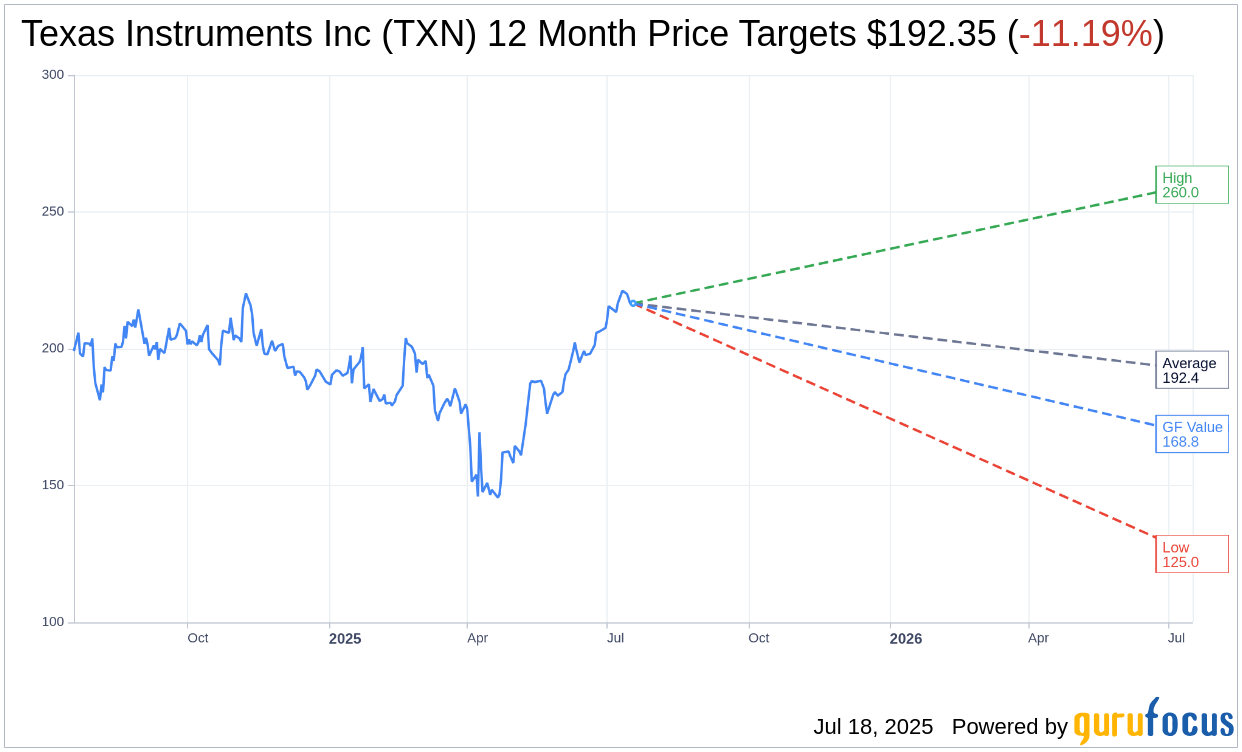

Wall Street Analysts Forecast

Wall Street's one-year price target projections for Texas Instruments Inc (TXN, Financial) from 32 analysts reveal an average target of $192.35. Price predictions range from a high of $260.00 to a low of $125.00. This average target implies a potential downside of 11.19% from the current share price of $216.59. More comprehensive analysis and estimates can be accessed on the Texas Instruments Inc (TXN) Forecast page.

The consensus recommendation from 41 brokerage firms places Texas Instruments Inc (TXN, Financial) at an average rating of 2.7, which correlates with a "Hold" status on the investment scale. This scale ranges from 1, suggesting a "Strong Buy," to 5, indicating a "Sell."

GuruFocus Valuation Insights

GuruFocus estimates show the one-year GF Value for Texas Instruments Inc (TXN, Financial) to be $168.85. This figure suggests a potential downside of 22.04% from its prevailing price of $216.59. The GF Value represents GuruFocus' assessment of the stock's fair trading value, taking into account historical trading multiples, business growth trajectories, and future performance projections. For further detailed insights, visit the Texas Instruments Inc (TXN) Summary page.

Also check out: (Free Trial)